Gold GLD ETF Breaks Out, TLT Breaks Down

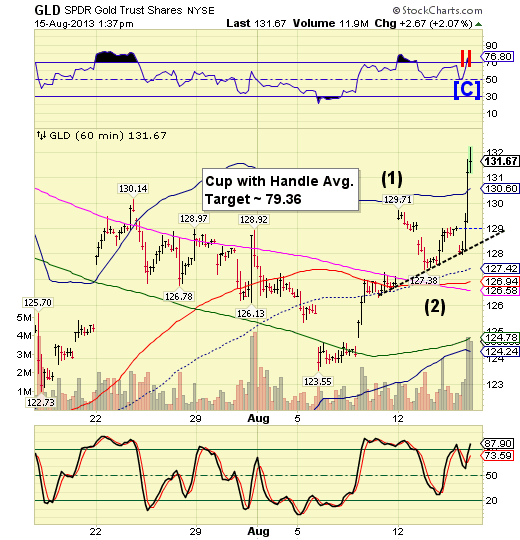

Commodities / Gold and Silver 2013 Aug 16, 2013 - 07:31 AM GMT GLD broke out this afternoon, creating a temporary “safe haven” for investors fleeing stocks. See the next chart.

GLD broke out this afternoon, creating a temporary “safe haven” for investors fleeing stocks. See the next chart.

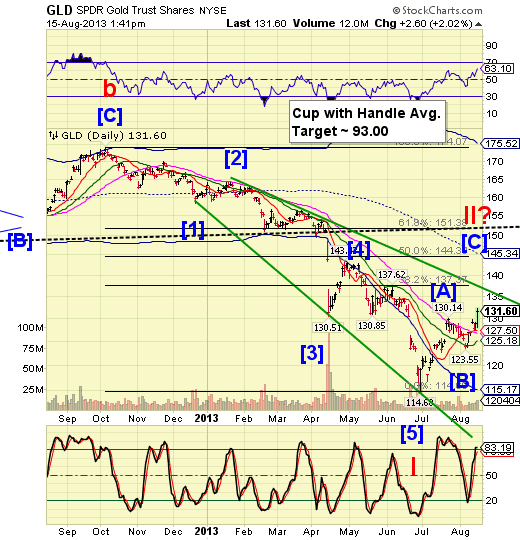

I had been suspecting that GLD/Gold could move higher in a counter-trend retracement. Today we finally have the confirmation. The normal counter-trend move would be back to mid-Cycle resistance at 145.34, which is declining on a daily basis. That suggests the 50% retracement at 144.36 may be the most likely target for this move.

Earlier I had suggested it could go all the way back to the Cup with Handle/Head & Shoulders line at the 61.8% retracement level. This would be my alternate target, assuming the decline in SPX is severe.

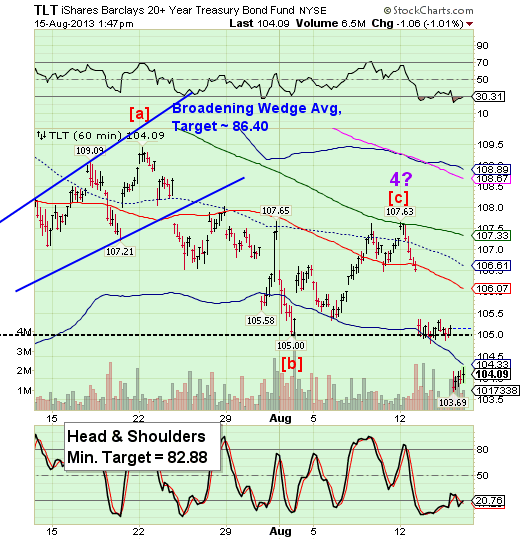

TLT, on the other hand, has diverged by breaking through its Head & Shoulders neckline at 105.00. GLD and TLT have had nearly identical moves for the past 6 months until now. The yield on the Long Bond is targeted to rise to 4.5% in the very near future, with TLT Declining down to 82.00 to 86.00. This will have a severe impact on the government funding its deficits going forward. As the old debt rolls over, we may see the interest component of the deficit possibly doubling, This will, in turn, make the government more aggressive in its collection activities. Plan on being audited if your income is over $80,000.00. Forget about incomes over $250,000. They are already targets.

I recommend having a year’s income or more in cash. They’ll come after bank accounts, pensions and IRAs, so consider a strategy to cash out and go “off grid” with as much as you possibly can.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.