Saudi Oil Clout And The Fate Of Egypt

Politics / Crude Oil Aug 15, 2013 - 05:20 PM GMTBy: Andrew_McKillop

OIL SHOCK FOR SOME – FOOD SHORTAGE FOR EGYPTIANS

OIL SHOCK FOR SOME – FOOD SHORTAGE FOR EGYPTIANS

Since August 14 Egypt's continuing existence as a unified state is unsure. The country may be plunged into a long and deadly civil war on the 1990s Algerian model (see my article: 'Algerian scenario for Egypt?” http://www.marketoracle.co.uk/Article41630.html). Since the army-led overthrow of Mohamed Morsi, July 3, showing their outright support for the coup, the Arab Gulf states rushed to supply aid to Egypt. World media announced from July 18 that the United Arab Emirates was first in line, transferring $3 billion to Egypt's central bank shortly before another $2 billion came in from Saudi Arabia and Kuwait promised $4 billion. In total Gulf Arab oil producers promised aid packages, including food and fuel, worth $12 billion after President Mohamed Morsi's ouster, throwing a lifeline to Egypt struggling to maintain food supplies for the Arab world's most populous nation, and world's No 1 importer of wheat.

Mohamed Abu Shadi, a 62-year-old former police general who became Egypt's minister of supplies following the army coup said in a VOA interview, July 17, that: “The biggest mistake the deposed President Mohamed Morsi made was stopping wheat imports”. He said that Egypt's stocks of wheat were enough to last until November 25, but due to the gifts from Gulf Arab states another 480 000 tonnes had been purchased immediately after Morsi was deposed, stretching Egypt's wheat stocks to last “until the end of the year”.

Although it grows its own wheat, Egypt still needs huge quantities of foreign wheat with higher gluten content to make flour suitable for subsidized bread, and for years has been the world's biggest importer.

Bread, as much as politics has long been a sensitive issue in Egypt. Mubarak faced unrest in 2008 when the rising price of wheat caused shortages. Similar problems in the 1970s provoked riots against former President Anwar Sadat and helped make way for his October 1981 assassination, the responsibility for which is disputed, claimed or denied by the military, Sadat's rivals, the Muslim Bortherhood – and others.

Helping seal the fate of Morsi, he had bet on Egypt's national harvest of wheat coming in big this year, and in anticipation froze international purchases for months, from February onward. Bread price rises therefore led food inflation until his overthrow. Immediately after, bread prices dropped alongside diesel fuel and gasoline prices, and other key consumer items. The Gulf Arabs had purchased street sympathy for their own-version Islamist cause, opposed to the Muslim Brotherhood of Egypt.

OIL SHORTAGE FOR OTHERS

One of Wikileaks' most celebrated revelations, in 2011, was a confidential mail from a US diplomat in KSA (Kingdom of Saudi Arabia) stating that he had been convinced by a Saudi oil expert named Sadad al-Husseini using data from as far back as 2005 that the nation's oil reserves are overstated by nearly 40%. The diplomat was certain that KSA could not “keep a lid on oil prices”. With little surprise this not-so-original revelation has resurfaced in recent weeks as oil prices have soared well above $100 a barrel – now also propelled by the Egyptian crisis.

To be sure, there was no need to consult Wikileaks or the State Dept to hear the revelation – for at least a decade Matthew Simmons, author of books including Twilight in the Desert: The Coming Saudi Oil Shock published in 2005 had worked the theme of Saudi exaggeration or lying about its oil reserves. Simmons main argument was that over and above the political uncertainty of reliance on Middle Eastern oil, the reserve decline rates for conventional or first-generation oil in the region should raise our awareness of the physical unreliability of Middle East oil.

Due to the huge dominance of KSA in Middle East oil and Arab world politics, KSA's decisions on how and when it uses its Oil Weapon concerns the rest of the region – and the world. . KSA's recoverable oil reserves could range from 250 – 350 billion barrels (250-350 Gb), and its production at about 10 million barrels-a-day (Mbd) is 3.65 Gb-a-year. The Financial Times reported June 11 that KSA is presently producing “nearly 9.7 Mbd”.

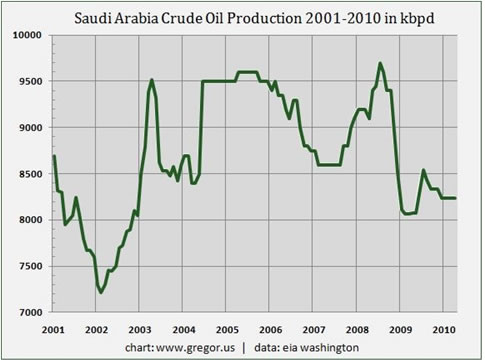

Much more important for Saudi Oil Diplomacy, it has a huge range of “discretionary production”, depending on how near or far it is from peak output capacity – estimated by many as around 12 Mbd. The present chart from Gregor Macdonald explains KSA's ability to “open and close the tap”. Its probable present discretionary potential is around 2.5 Mbd, and may be higher.

ABLE AND UNWILLING TO PREVENT PRICE RISES

Despite the US shale oil and gas revolutions, Canadian tarsand oil, extensive new oil finds in Africa and rising output from Iraq, the spectre of oil shortage can be, and is used to work oil markets upwards. This has a totally predictable impact on political sentiment and behavior in major consumer nations – who remain highly sensitive to the subjects of oil supply shortages, blockades, cutoffs and higher oil prices. KSA has the highly-powerful role of being able to allay – or intensify importer country anxiety.

Currying favour with the Gulf Arab states, especially KSA is a long-running State Department theme, as well as the foreign ministries of other major importer countries. Whatever the merits of the Saudi oil decline “analysis”, from Wikileaks or Matt Simmons before his death in 2010, the same can be applied almost word-for-word to joint-No 1 or close No 2 world oil producer Russia.

This underlines that anything concerning world oil and oil prices concerns the Dominant Pair which produce a combined total of about 25% of world total oil output. The major difference is critical - in Russia's case much more than KSA, the role of conventional oil reserves versus “assisted recovery” tapping secondary or tertiary reserves utilising steam-assist, water flood, chemicals, compressed gases and other means to enhance and increase recovery from “tight” source rocks or declining conventional reserves makes Russia much less able to “open and close the tap”. Its discretionary oil production capacity is likely not much above 1 Mbd.

In reality neither Russia nor KSA have any strong interest is seeing oil prices decline – and will reap major windfall gains whenever oil prices spike. Neither could under present economic and political conditions live with oil prices far below $75 a barrel. With totally predictable timing, KSA has announced over recent weeks that it will either maintain highest-possible production, or increase it.

For as long as this does not prevent oil prices rising, KSA will “almost regrettably” enjoy especially large windfall revenue gains. Russia ditto.

MANAGED POLITICAL CRISES – MANAGED OIL OUTPUT

For as long Egypt's probable civil war stays on the front pages, with its linked threat of Suez Canal closure and possible enhanced or increased Al Qaeda action using Egypt as a sanctuary, oil prices can easily be maintained high. KSA can therefore “open the tap”, underline its Swing Producer, and reap the windfall oil revenues which flow.

Given that the Kingdom's powerful but hidden role in the Egyptian crisis needs constant bolstering, the news and views or opinions and spin on the subject of KSA's oil production intentions and policies will be given professional and intensive media attention. are likely going to get huge airtime – as the Egyptian crisis deepens. The role of KSA oil politics will return in force, this time given an extra layer of intrigue on its intentions and policies due to Saudi billionaire investor, prince Alwaleed bin Talal, a nephew of King Abdullah warning on July 28 that global demand for the kingdom's oil is constantly and clearly dropping, urging revenue diversification and investment in nuclear and solar energy to cover domestic and local energy consumption. See also my article: http://beforeitsnews.com/energy/2013/07/saudi-royal-sounds-alarm-on-fracking-2450748.html.

This obscures the extent of Saudi political meddling in Egypt, but explains why its action has been and will stay intensive, to the point that Saudi use of the Oil Weapon or political and diplomatic lever may be moved up one or more notches in coming weeks. Its national Wahabite “philosophy” or religious ideology is radically opposed Egypt's Muslim Brotherhood, which for decades has been in both open and covert struggle with “the Wahabites”.The Brotherhood, which has rivaled Saudi, Qatari and other Gulf Arab state action inside Syria favouring Sunni factions, including djihadists linked to Al Qaeda, has been massively weakened by the Egyptian army coup deposing Brotherhood-linked Morsi.

Despite weak global oil demand, Saudi action to not increase output or to cut back would give a home run for oil bulls working major markets. As the oil price rose, Western leaders will act predictably to comfort and bolster Saudi policy on Egypt.

Russia, to be sure, is also watching the action KSA will take, as well as Iran, Iraq and Venezuela – the other leading OPEC producers. Any Saudi action to cut back on production – for example with the pretext of oilfield maintenance or equipment breakdowns – will almost certainly result in raised production from the other main producers and cause the worst outcome for Saudi's oil diplomacy: falling prices.

KSA's discretionary or spare capacity has proven crucial in meeting recent supply shortages. It raised output during the 2011 civil war in Libya, and in 2012 raised production to a 30-year high slightly above 10 Mbd as US-led sanctions reduced exports from Iran. Saudi action, and posturing in Egypt today can however have unintended political consequences. The crisis-atmosphere has already led to further tightening by Saudi Aramco on the sale of its crude, ensuring only end-users obtain it to restrict their ability to resell barrels.

Overall, due to the total opacity of oil market trading – shown by increasing action by regulators in Europe and the US to rein in abuses – oil prices effectively tell us little or nothing about fundamentals and everything about speculation. Middle East supply risk is rising and KSA will exploit this to its own ends – political leverage and windfall revenue gains – and can be tempted to intensify any shortage that can be linked or related to the Egyptian crisis.

By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2013 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.