U.S. Economy Set to Continue Grinding Higher

Economics / US Economy Aug 15, 2013 - 10:09 AM GMTBy: DailyWealth

Dr. David Eifrig writes: For the past year, I've been carefully watching for signs of trouble...

Dr. David Eifrig writes: For the past year, I've been carefully watching for signs of trouble...

The two biggest potential sources of trouble – the two big concerns I hear from investors – are:

1. The U.S. economy is "running off the rails"... It's about to enter a recession... or worse, a depression.

2. The U.S. economy is about to overheat, triggering major inflation... which will destroy the value of their savings.

But folks who follow my research have been able to rest easy at night... They know what I'm about to show you today...

First, the financial news service Bloomberg's Consumer Comfort Index is now at post-recession highs. This 1,000-person telephone interview on the economy, personal finances, and purchasing behavior is showing signs of coming off a multiyear negative territory, as the chart below shows.

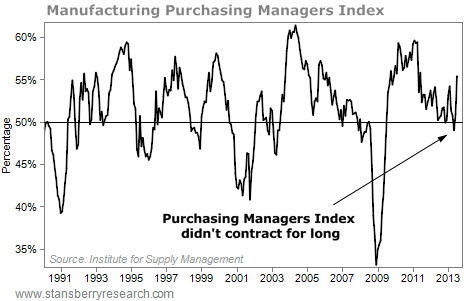

In the manufacturing sector, things have turned back up. As the following chart shows, purchasing managers in the manufacturing industry are buying more raw goods and supplies... a sign of expansion for the sector.

Any time the numbers are above 50, that means manufacturing is growing. New orders are also expanding again after also dropping below the 50 mark in the spring.

Finally, the service sector, which is nearly 80% of the U.S. economy, is also showing signs of improvement. The managers making new orders are on the front line of the economy. They make real purchases for future business plans. When the index sits above 50, this is a positive sign for the overall health of the U.S.

As the chart shows below, we've bounced back up from the neutral 50 level where it appeared we were heading this spring.

In sum, these three charts say the American economy will continue "grinding" higher. We're not headed into a recession... And we have yet to see inflation.

Today, I'm still comfortable recommending investments like municipal bonds, blue-chip stocks, and real estate.

The "gloom and doom" headlines would have you believe we're on the cusp of a major crisis. But the facts show that's simply not the case.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

P.S. If you want to build a safe, secure, income-producing portfolio – that can profit in both recessionary and inflationary environments – I encourage you to check out Retirement Millionaire. Right now, it costs just $39 for a year's subscription. We keep the costs low to make sure we can get useful, fact-based investment insight into as many folks' hands as possible. And if you don't like it after four months, you can get all your money back. Learn more here (without watching a long promotional video).

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.