Rampant Stock Market Manipulation

Stock-Markets / Stock Markets 2013 Aug 14, 2013 - 04:04 PM GMTBy: PhilStockWorld

We're right on that line again.

We're right on that line again.

1,688 on the S&P is a 1.25% retrace off the top and, failing to hold that, we're looking at another 1.25% drop to 1,667 and below that, we're back at 1,645, 1,622 and back to 1,600, which is our Must Hold line for this bull run to sustain itself.

Now 1,600 is a lot of 1.25%s away, so no reason to panic and we're certainly not panicking about a tiny little pullback (see Dave Fry's SPX chart) of a 350-point run (25%) since November and we're exactly where we expected we'd end up way back in March of 2009, when we called the bottom and begain using 800 on the S&P as a base for our 5% Rule calculations.

1,600 on the S&P is a 100% gain in what's about to be 4.5 years on Sept 9th. That's 177 points a year, 15(ish) points a month of gains for 54 consecutive months. That trend has certainly been our friend and, with all this free money sloshing around, there's no reason to expect it to stop – we're just looking for a pullback to test 1,600 and we've been looking for it since May. We got it in June but it reversed too quickly so we didn't feel good about the July rally and so, we're looking for a proper drop and just a little consolidation at the 1,600 line and THEN (assuming it holds), we can feel good about cheerleading the next leg up – to 1760.

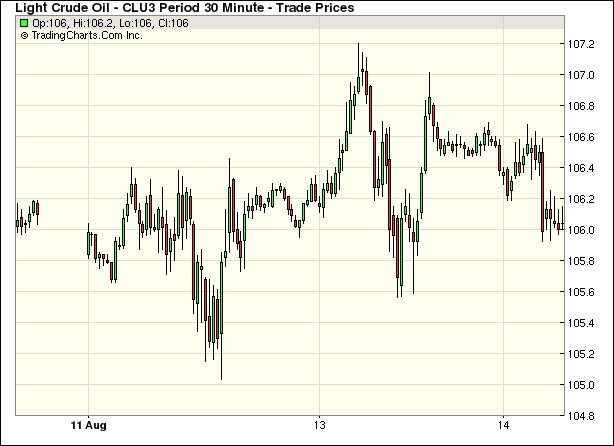

Another chart we're watching closely is, of course, oil and, as we keep telling you and our Congresspeople, you can see the scam unfolding as yesterday's pump and dump allowed them to move 58,000 fake orders out of September and shift them to now create fake demand for October (now 281,000 contracts), November (162,000 contracts) and December (219,000 contracts) for a total of 662Mb worth of fake orders in those three months, along with the remaining 185Mb worth of fake orders that are still open in September.

I say FAKE, because almost ALL of them will be shited (not closed, shifted) to fake demand in the next 3 months over the next…

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.