Today's "Gold Convergence" is Your Best Buy Signal Yet

Commodities / Gold and Silver 2013 Aug 14, 2013 - 02:39 PM GMTBy: Money_Morning

Peter Krauth writes: We've been recommending gold shares for months now, ever since prices collapsed in April. But timing's getting critical, because now the market is telling you gold is set to surge...

Peter Krauth writes: We've been recommending gold shares for months now, ever since prices collapsed in April. But timing's getting critical, because now the market is telling you gold is set to surge...

The first piece of evidence hit my radar on August 1st, moments after Barrick Gold released its $8.7 billion "news." (More on that in a minute.)

The Commitment of Traders report - perhaps the best leading indicator for gold prices - delivered the second piece of evidence: a staggering 70% spike in "red flag" futures trading. And the third and fourth pieces of evidence just arrived.

But before we look at each of these events in detail, here's what you need to know:

Any one of these indicators is bullish on its own. So when all four signals flash at once, please don't wait.

A "Gold Convergence" like this hasn't happened in 12 years...

Indicator No. 1: A True Bottom

Calling market bottoms - and tops, for that matter - is typically a 50/50 proposition... unless, of course, the market hands you an overwhelming element of proof, just like it did on August 1st...

On August 1, the world's largest gold miner, Barrick Gold (NYSE:ABX) said it was writing down $8.7 billion on a single project, Pascua-Lama, located on the border between Chile and Argentina.

Barrick's market cap is just twice the hit it's taking on Pascua-Lama.

What's more, on that same day the company announced it was cutting its quarterly dividend, and would defer expansions and divest certain assets to reduce costs. Things could hardly look worse for a gold miner.

But the amazing thing is, in the wake of all this awful news, Barrick's stock hardly budged.

And that can only mean one thing...the bad news is already priced in. Price action in a number of other large gold miners has been similar.

Indicator No. 2: Record Short Positions

One of the best indicators of the direction of the gold price is the Commitment of Traders (COT) report for gold. Because they tend to move in herds, speculators are almost always wrong at extremes.

According to recent COT reports, speculators are so bearish on the gold price, their short positions are 70% higher than they have ever been throughout this 12-year secular gold bull market.

Given the massive leverage many futures contracts are traded on - up to 16 to 1 - just a 6.4% rally in the gold price would obliterate all the capital of those fully leveraged contracts.

Just a small percent rise in the gold price can lead to a massive short covering, which would feed on itself, pushing gold still higher and faster.

Short covering rallies can lead to violent upside surges.

And right now, gold hasn't been this hated since its bull market began in 2001. After the extreme bearish sentiment of 2008, gold rallied 70% in a little over one year.

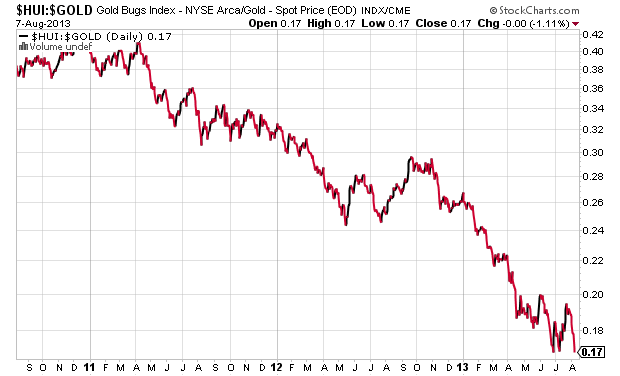

Indicator No. 3: Gold Stocks-to-Gold Ratio

The Gold Stocks-to-Gold Ratio (HUI) is flashing its best bullish signal in 12 years. By comparing the HUI to the gold price, you get a sense whether gold stocks are pricey or not relative to gold.

The last time we saw this ratio at current levels was back in late 2000, at the very beginning of this secular gold bull market. From that bottom, gold stocks catapulted by over 430%.

Even the crash in 2008 only saw this ratio temporarily dip below 0.25. From that point, gold stocks shot over 150% higher in the following year. So if gold can rise a bit from here, gold stocks could leverage that substantially just by returning to their long-term average.

But there's more...

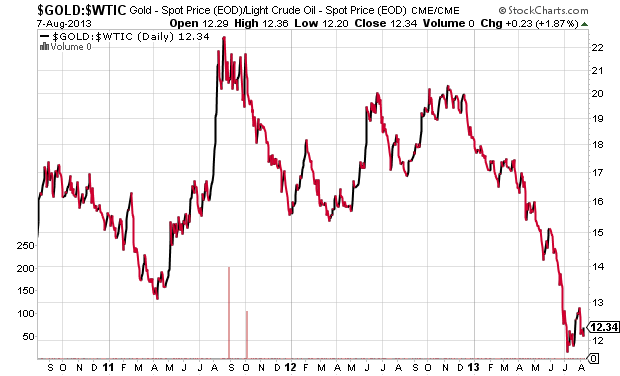

Indicator No. 4: Gold-to-Oil Ratio

The Gold-to-Oil Ratio is also very bullish right now. This ratio plots the value of gold to oil, and gives us a strong indication of how these two valuable commodities are priced relative to each other.

In the past year, this ratio has fallen nearly in half, from 20 to 12. That's been mostly thanks to a dramatic fall in the price of gold.

In order to get back to a more normal gold-to-oil ratio, gold can rise, oil can fall, or a combination of the two can take place. I believe there's some room for oil to fall, but given gold's drop so far, I think it has a lot more room to climb.

As gold and gold stocks return to more normal levels, I expect to see both of them considerably higher from here. Sentiment and these three valuation metrics say the odds are definitely in gold's favor.

If you want to take advantage of the coming higher gold stock prices, the best choice is to buy SPDR Gold Shares (NYSE:GLD). For more leverage and more risk, you can raise the stakes by choosing the Market Vectors Gold Miners ETF (NYSE:GDX), a proxy for the HUI.

For more crucial evidence that global indicators point to a strong rally in gold prices, check out Money Morning's Special Report: "Shocking New Gold Chart" here.

Source :http://moneymorning.com/2013/08/14/todays-gold-convergence-is-your-best-buy-signal-yet/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.