Greenland Offers Exploration Resources Investor Profit Potential

Commodities / Resources Investing Aug 10, 2013 - 06:31 AM GMTBy: Richard_Mills

It’s time to talk about Greenland, security of resource supply and excellent early exploration results. Why Greenland? Well Greenland’s becoming the new frontier for those in the mining industry who explore for, find, and develop (to a certain point) the world’s future mines. Explorers are there now and coming in ever increasing numbers. They’re searching for a wide range of commodities including base and precious metals, rare earth elements and gemstones.

It’s time to talk about Greenland, security of resource supply and excellent early exploration results. Why Greenland? Well Greenland’s becoming the new frontier for those in the mining industry who explore for, find, and develop (to a certain point) the world’s future mines. Explorers are there now and coming in ever increasing numbers. They’re searching for a wide range of commodities including base and precious metals, rare earth elements and gemstones.

The number of active Exploration Licenses has increased more than six fold since 2002. Part of the reason for this rapid increase is that Greenland’s home rule government is anxious to see its resource sector expand - tax and other revenue from mining accrue directly to government coffers. Mining companies, and their investors, like Greenland because it is part of the Kingdom of Denmark, a safe, stable democracy with a transparent regulatory system and ready access to the EU.

As competition from the developing world pushes up the price of energy, metals, minerals and other raw materials, finding new sources of supply is at a premium.

As competition from the developing world pushes up the price of energy, metals, minerals and other raw materials, finding new sources of supply is at a premium.

Greenland represents a vast and largely untapped resource.

A unique frontier

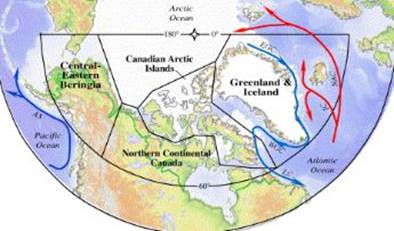

Greenland is the largest island on Earth and its geological development spans a period of nearly 4 billion years, from the earliest Archean to the Quaternary.

Although the central portion of Greenland is covered by a large ice sheet left over from the last ice age, the ice-free zone around the ice cap is up to 300 kms wide and covers an area of 410,000 km² (area of Germany is 357,000 km). The scouring forces of the glaciers have left behind large areas of clean exposed rock for geologists to prospect while the melting snow and ice from the inland icecap creates potential for hydro-electric power generation.

These non ice covered coastal areas - geological terrain that is simply an extension of the Canadian Shield - expose numerous mineral belts that are highly prospective for gold, nickel, platinum group elements (PGE), copper, lead, zinc, molybdenum, tantalum and niobium, iron ore, several forms of industrial minerals, diamonds, rubies and rare earth elements (REEs).

North American Nickel

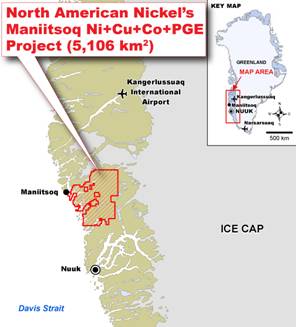

North American Nickel TSX.V – NAN is a resource development company that's exploring for sulphide nickel/copper (with cobalt/PGE) deposits in Greenland at their Maniitsoq Project (named for the nearest large town).

NAN has met with some success at Maniitsoq such that in May/June 2013, it was able to raise over $7 million to finance follow-up drilling. Market conditions have been challenging, and NAN’s ability to raise a large sum of money on a grassroots exploration project is encouraging, and a very strong indicator of the potential investors see in the property.

In July of 2013 NAN announced that it had been notified by the Greenland Bureau of Minerals and Petroleum that its application to expand its exploration area by 123 square kilometers has been approved - the total exploration area of the project is now 5,106 square kilometers.

West Greenland Current

The southwest region of Greenland, where NAN’s Maniitsoq project is located, has a relatively mild climate with sea travel, and deep sea shipping possible year round.

The southwest region of Greenland, where NAN’s Maniitsoq project is located, has a relatively mild climate with sea travel, and deep sea shipping possible year round.

The East Greenland Current flows south along

Greenland’s east coast.

The current mixes with the warmer Irminger and Norwegian currents, at the southern extremity of Greenland (Cape Farewell).

A branch turns to form the West Greenland Current, which flows north along the west coast of Greenland into the Davis Strait, where it joins the Labrador Current.

The West Greenland Current (WGC), a combination of warm North Atlantic waters, keeps the southern west coast free of ice.

Greenland doesn’t have a highway system to speak of, people live in towns on the coast or further up the fjords, so they mostly travel by boat, planes and helicopters. Travel by sea is possible throughout the year from Nanortalik, in the South, to Sisimiut in the north west; these ports have a year round shipping season.

Travel from Sisimiut to sites further north doesn’t start till May, at the earliest, because of ice, although climate change is playing a role here with sea ice disappearing at an advanced rate.

Travel from Sisimiut to sites further north doesn’t start till May, at the earliest, because of ice, although climate change is playing a role here with sea ice disappearing at an advanced rate.

In Greenland, if you are working in the southwest part of the country, you are never far from year round open deep sea water, meaning a sea port, or the possible future site of a rough loading dock, tie up for a couple of barges and deep water anchorage for a freighter.

This is a huge advantage, let’s call it like it is, exploration is exploration, sure one area might be more expensive then another but so what? The main consideration factor is what are you going to do if you actually find something and this is the advantage sea borne freight has over road transport – cost.

Access to the sea puts the world’s smelters, end users, middlemen etc at your fingertips. But sea transport also lowers your upfront development costs and capex/opex when it comes time to build and run your mine.

If you are in the interior of Canada’s north you need to road transport your product, usually across vast distances, to get it to a railhead or port, sometimes utilizing both a railway and ocean freighter to get it to a smelter. Of course the reverse order applies when you are doing exploration and development. The more complicated, the more time consuming, the greater the distances, the more players, or pieces if you will that are involved makes it that much more expensive.

Transport distances in Greenland from your project site to open water are usually very short, we’re talking maybe tens of kilometers with some projects much closer versus road transport measuring hundreds of kilometers in Canada’s north.

Greenland Norite Belt

Last year North American Nickel attracted worldwide attention when it was announced by the Geological Survey of Denmark and Greenland (GEUS) that the Maniitsoq structure represents the remains of the oldest-known meteorite impact site in the world. The meteorite impact is said to be three billion years old and may have consequences for nickel exploration.

Last year North American Nickel attracted worldwide attention when it was announced by the Geological Survey of Denmark and Greenland (GEUS) that the Maniitsoq structure represents the remains of the oldest-known meteorite impact site in the world. The meteorite impact is said to be three billion years old and may have consequences for nickel exploration.

NAN was originally attracted to the Maniitsoq area because it was historically known to have numerous high-grade nickel occurrences concentrated in a belt of rocks known as the Greenland Norite Belt (GNB).

Most of the occurrences are hosted in a rock called norite, which is what gave the belt its name. The norite rocks are believed to have been part of a magma conduit system through which large volumes of nickel-rich ultramafic magma flowed from the mantle up into the crust. As the hot magma traveled through the crust it melted and assimilated the country rock. This changed the chemistry of the magma and triggered production of a nickel-rich sulphide liquid, which eventually settled out of the magma and formed deposits of nickel sulphides.

Many of the world’s giant nickel deposits, including Norilsk and Voisey’s Bay, are believed to have formed in this manner. Since the news of the meteorite, there has been speculation that the giant impact may have been responsible for initiating the magma conduit system at Maniitsoq.

Exploration to date

Historically the Maniitsoq area has been challenging to explore because the terrain is quite rugged (Maniitsoq means “place of rugged / uneven terrain”).

In the 1960’s and 70’s Danish explorers identified a 70km long belt of high-grade nickel sulphide occurrences at Maniitsoq but they had difficulty following the mineralization in the subsurface. Two major mining companies explored the belt for nickel in the 1990’s but left without drilling.

In the spring of 2011, NAN evaluated the historical data from the GNB and came to the conclusion that modern helicopter time domain electromagnetic (TEM) technology could potentially detect and follow the nickel sulphide mineralization in the subsurface. NAN applied for and was granted a large, exclusive mineral exploration licence covering much of the GNB and conducted a test helicopter TEM survey. The survey detected numerous anomalies some of which corresponded to known mineralization which had not responded to previous types of airborne geophysics used at the site.

The successful test survey in 2011 gave NAN the confidence to return in 2012 and perform more extensive helicopter TEM surveys and drill nine holes totaling 1,551 meters. Three of the holes intersected high grade nickel sulphide mineralization at two locations known as Imiak Hill and Spotty Hill.

The two locations are approximately 1.25 km apart. The best intersection at Spotty Hill was 123.94 meters long and averaged 0.81% Ni, 0.21% Cu and 0.26 g/t PGM (Pt+Pd+Au) including a 24.20 m section assaying 1.75% Ni, 0.34% Cu and 0.52 g/t PGM. The best intersection at Imiak Hill was 26.98 m averaging 0.98% Ni and 0.44% Cu including a 16.64 m section assaying 1.36% Ni and 0.52% Cu.

NAN had selected samples of mineralized drill core from both locations to be analyzed at SGS Canada Inc.’s Lakefield facility using the QEMSCAN system. The objectives of the study were to identify and quantify the nickel, copper and cobalt-bearing minerals within the samples and to determine the liberation and association characteristics of the nickel and copper sulphides. The results showed that, for the samples submitted, >95% of the nickel is hosted in pentlandite and that there is potential for high nickel recovery.

Following the study NAN’s Chief Geologist, John Pattison, said that: “At this early stage of exploration it is very helpful for management and investors to know that, based on the mineralogical characteristics of the samples analyzed, there is potential for high nickel recoveries from both the Imiak and Spotty Hill zones.”

Given the good results to date, NAN is investing in further exploring this territory with a larger, follow-up drill program, which is currently in progress.

Conclusion

Increasingly we will see falling average grades being mined, mines becoming deeper, more remote and with increased political risk. Extraction of metals from the mined ore will become increasingly more complex and expensive.

These problems are not evident at North American Nickel’s Maniitsoq Project in Greenland.

Every country needs to secure supplies of needed commodities at competitive prices yet supply is increasingly constrained and demand is growing. Barring a total global economic collapse or a dramatic reduction in the world’s human population it doesn’t seem to this author demand is going to collapse anytime soon.

Junior resource companies, the same ones who today are so oversold and undervalued, are the present owners of the world’s future commodities supply and, most important for investors seeking outsized returns, they act like leveraged exposure (with price gains many times that of the underlying commodity) to the specific commodity(s) investors want exposure to.

For contrarians like myself it’s an exciting time to be an investor in the junior resource market.

Is there at least one junior resource company with an exceptional management team operating in a politically safe jurisdiction exploring a quality green field exploration project that is a potential takeover target on your radar screen?

If not, maybe one should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.