Is the Stock Market Top In?

Stock-Markets / Stock Markets 2013 Aug 07, 2013 - 05:56 AM GMTBy: Graham_Summers

I keep hearing that whenever “stocks are rising” it’s a good thing.

I completely disagree. If a market move is warranted by earnings and fundamentals, then yes, a sharp move higher is great. But if the market is rallying based on false hopes, or even worse, is in a bubble, then it’s actually very bad for stocks to move higher because it means the ensuing collapse will be even more violent (a la 2000 and 2008).

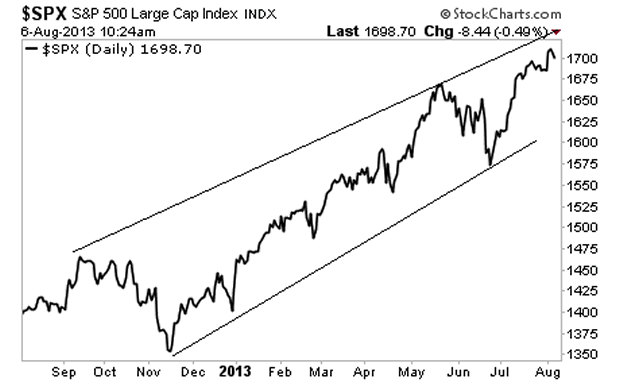

With that in mind, this market has essentially moved up almost non-stop since December 2012. This entire move has occurred against worsening economic fundamentals.

While the cheerleaders on TV applaud this move, it’s important to consider the “big picture” for the economy and market as a whole. Here’s the big picture:

1) Earnings, the primary driver or prices, are falling. If you exclude financials earnings for the last quarter, earnings are down 2.9% year over year.

2) Economic activity, the other driver of stock prices, has fallen too, leaving stocks diverging sharply to the upside.

3) The “smart” money is fleeing the market en masse (institutions, wealthy private investors, etc.).

4) The problems in Europe have not gone away. They’ve been shuffled under the carpet until Germany’s elections. But Spain, Portugal, and even Italy are rapidly descending into financial chaos and insolvency.

5) Japan massive experiment with monetary policy is proving to be a disaster with industrial production falling while costs of living are rising. Japan is skirting on the verge of financial collapse.

6) China is experiencing a hard landing, if not economic crash. If you look at their electricity consumption their GDP growth is barely 2.9%. Yet the entire world continues to believe the People’s Republic will produce 7% growth ad infinitum. Good luck with that.

Folks, there is no other way to put this… the markets are in a massive bubble. And when it bursts, things will get ugly very FAST.

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.