Gold Stocks Correcting in Typical Post-Bottom Fashion

Commodities / Gold and Silver Stocks 2013 Aug 06, 2013 - 12:07 PM GMTBy: Jordan_Roy_Byrne

In our last editorial we presented the bulletproof evidence that the gold stocks had put in a major bottom. We included a historical chart that was supplemented by a major reversal at a Fibonacci strong target and on record weekly volume. At the end of that piece we noted that the sector could correct before it would accelerate to the upside. Looking at historical rallies from major bottoms we noticed that there tends to be a consolidation or correction around the 50-day moving average. The sector is two weeks into that correction. Don't worry bulls, this is exactly what happens following the initial rebound.

In our last editorial we presented the bulletproof evidence that the gold stocks had put in a major bottom. We included a historical chart that was supplemented by a major reversal at a Fibonacci strong target and on record weekly volume. At the end of that piece we noted that the sector could correct before it would accelerate to the upside. Looking at historical rallies from major bottoms we noticed that there tends to be a consolidation or correction around the 50-day moving average. The sector is two weeks into that correction. Don't worry bulls, this is exactly what happens following the initial rebound.

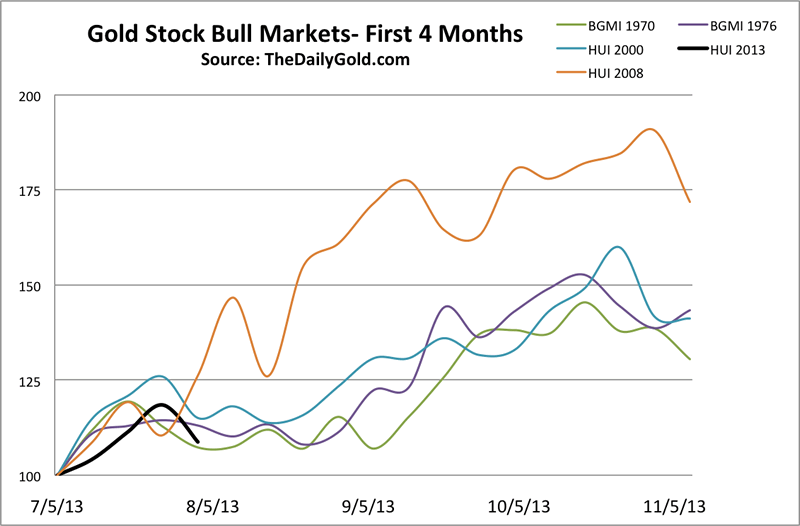

The chart below shows the progression of gold stock recoveries in comparable periods (1970, 1976, 2000, 2008 and 2013). The current recovery is in black. Note that each recovery didn't truly accelerate until after the middle of August. (That is using the current time scale). Thus, don't be impatient. It could be a few more weeks before the sector begins its next leg higher.

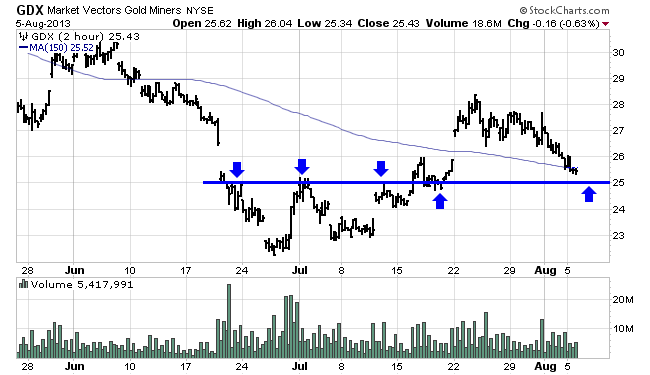

While it may take a few weeks for the next impulsive advance to begin, that doesn't mean one should wait to participate. Gold stocks have declined for six consecutive days and are nearing what should be strong support at GDX $25. Take a look at the chart below.

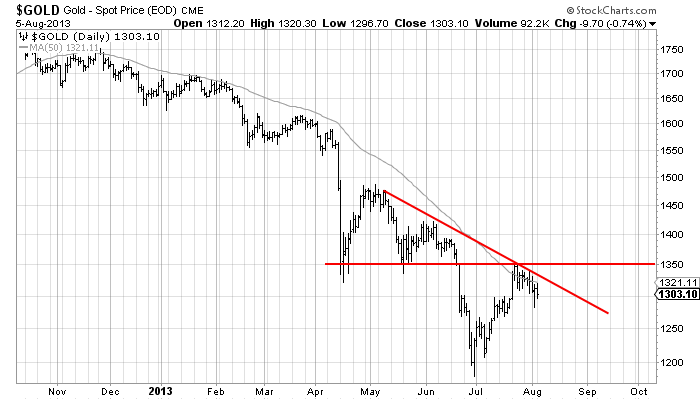

As far as Gold, its correction began when it reached $1350, which was formerly support. Gold is facing some trendline resistance as well as lateral resistance at $1350. If and when it breaks $1350 it will have very little resistance on the way to $1500. Gold should continue to consolidate for several more weeks. The big move will occur after it breaks $1350.

In our last piece we concluded:

Those who missed the initial pop could use the correction or consolidation to capitalize on the next and much larger leg higher. The bottom line is if we do see a correction or consolidation, don't let it frighten you or cause you to question the major bottom. History argues that it is an excellent buying opportunity.

To conclude, the gold stocks are two weeks into their correction. These corrections or consolidations typically last four weeks. The gold stocks have declined six days in a row and are very close to what should be strong support at GDX $25. We could see a bounce over the next few days followed by a brief consolidation.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2013 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.