If the U.S. Economy is Recovering… Why Is Nominal GDP in a Recession?

Economics / Recession 2013 Aug 05, 2013 - 06:57 PM GMTBy: Graham_Summers

The financial world is abuzz with the unexpected jump higher in our manufacturing and non-ISM(s). The world seems to think these two jumps are the result of the US economy suddenly getting back on track.

The financial world is abuzz with the unexpected jump higher in our manufacturing and non-ISM(s). The world seems to think these two jumps are the result of the US economy suddenly getting back on track.

The whole thing smacks of political games. Is it really coincidence that the scandal-ridden Obama administration suddenly decided to focus on the economy (again) and the official economic data starts improving the next week?

Or is this an attempt to draw attention from the fact that even the mainstream financial media has caught on that the US’s employment, GDP, and inflation numbers are a joke (hence the sudden importance of ISM and non-manufacturing ISM data)?

Regardless, we cannot help but wonder where this incredible growth is occurring. Most of the growth in corporate profits over the last year have come from financials which are notorious for generating “earnings” through various accounting gimmicks.

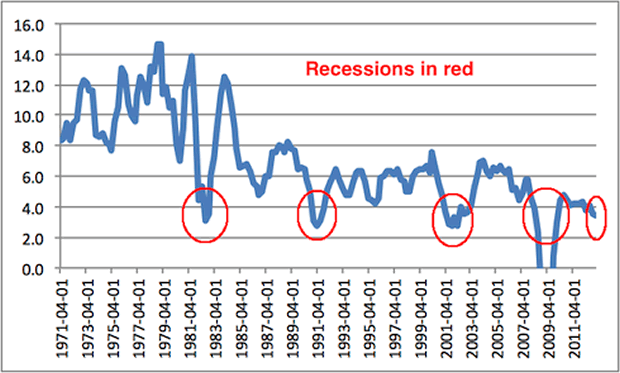

Indeed, when you remove financials from the picture, earnings for the S&P 500 are DOWN 2.9% for the second quarter of 2013. We also see that when you remove the Fed’s absurd GDP “deflator” (the way in which it accounts for inflation in its GDP numbers) that the US is clearly back in recession.

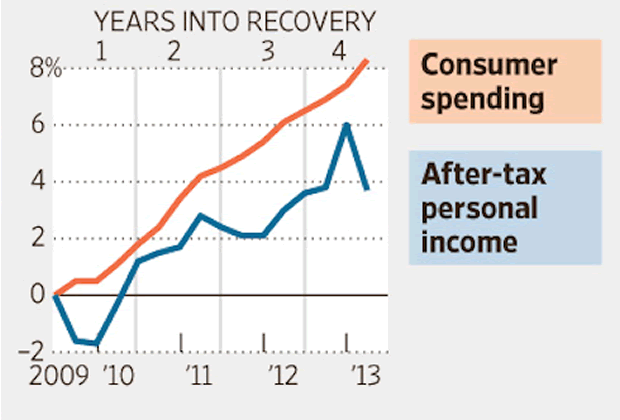

So, somehow the US economy is roaring back in a big way? Hard to see. Over 70% of the economy is consumer spending. And spending is driven by incomes. And incomes are… falling.

What could go wrong?

The Great Crisis, the one to which 2008 was just a warm up, is approaching. The time to prepare for it is BEFORE the US stock market bubble bursts.

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.