Gold And Silver – Contrary To Popular Belief, Paper Is The Bellwether For Near-Term Precious Metals

Commodities / Gold and Silver 2013 Aug 03, 2013 - 05:23 PM GMTBy: Michael_Noonan

For all of the disdain directed toward the paper futures markets in gold and silver from the Precious Metals, [PM], community, those markets continue to set the tone for pricing. Why is that?

For all of the disdain directed toward the paper futures markets in gold and silver from the Precious Metals, [PM], community, those markets continue to set the tone for pricing. Why is that?

People by the tens of thousands lining up to buy gold and silver, waiting for hours in lines; record sales for gold and silver coins growing month by month; central banks have over- leased their gold holdings, [add also the gold holdings of its customers, against their knowledge]; banks no longer delivering physical gold; banks with allocated gold accounts held by the uber-wealthy not able to make good in delivering gold to rightful holders; German bank demanding gold back from New York and London, told "unable" for the next seven years, not weeks, not months, years; India banning gold imports, and now Pakistan. There are many rumors that COMEX/LMBA have little to no gold and silver available to deliver. The paper markets are garbage, worthless, a joke.

The list goes on and on. So does the pricing viability of the paper markets. You know, the ones nobody believe in but almost all still follow. Why is that?

The best answer? Laws and rules do not apply to the New World Order, [NWO], nor to the central banking arms of that shadow-ruling group. They operate their Ponzi schemes with impunity. When is the last time you heard of any banker going to jail for the massive fraud committed in the mortgage scandal, or the rampant bank scandals using derivatives that dwarf their holdings but remain hidden, abetted by central bankers loaning out fiat by the trillions to prop up every single existing bank, all underwater but not allowed to fail?

Charles Keating was one, back in the late 1980s, but that was before the NWO began to operate more openly in their undaunted zeal to rule the world, enslaving it financially with fiat, with the Rothschild formula growing in influence like a tapeworm devouring its host. The Rothschild's understood money and loaning it out at interest. Their formula was to lend only to kings and countries, demanding repayment in gold and silver, or control over a nation unable to repay. Eventually, none are able to repay, and the NWO take over. If ever anyone could roll over in his gave, convulsing with laughter, it is Mayer Amschel of the red shield sign.

The Rothschild's also well understood that the surest way to destroy a nation is to debauch its currency, a-la Vladimir Ilyich Lenin. This is how the NWO finally took over the United States when it was forced into bankruptcy back in 1933, via the bank "holiday" declared by Socialist FDR so the Federal Reserve could take official control over the entire system. [The privately owned Federal Reserve being the NWO financial tentacle.]

How does this relate to gold and silver and paper pricing? The NWO is in full control of the entire Western banking system, economy, and governments. There is absolutely no way that controlling group is about to walk away and cede control of its financial system, developed over centuries, to anyone. Not to China, not to Russia, and no other country really matters. Accommodations will develop between the rising ruling East and the fast declining West, but the NWO will remain in control in the West. Think Big Brother and NSA, and you get the picture.

The Golden Rule: He Who Has The Gold Rules, may be undergoing a new test, if all of the gold has been transferred to the East, as widely reported. Almost all opinions are that the West will somehow financially collapse, in this process, and it certainly seems to be inescapable to some degree, but no one knows how or to what extent.

Everyone now knows how the NWO operates, or should. Note Greece and the destruction of that country. Greece was told to take on unsustainable new debt, in order to deal with all the debt it could already not sustain, and for those loans, "Greece, you must give up your gold, and by the way, we now tell you how to run our country, for you are now bankrupt, according to plan."

Cyprus. "Our poor banking system is in trouble," cried the NWO. "We cannot allow that. Steal the money needed from the masses dumb enough to deposit [loan] into our greedy hands. Make them pay!" ... a corrupted version of Marie Antoinette's "Let them eat cake." All according to NWO plan.

Is Edward Snowden a traitor? Absolutely, according to the Obama Reich. How does the NWO's political arm, USA, work? Kill the messenger, and get the message buried. Make the people believe Snowden betrayed his country and do not focus on the FACTS that the US is spying on all its citizens, betraying them [and apparently citizens from around the world], STASI-style. There is no outrage from the public, at least none that will stop the NWO from its mission of total submission.

When one is out of work, receiving minimum wage, working part-time, receiving welfare, benefits, or food stamps, etc, that population is not going to question the hand that feeds them, [all according to plan].

The point? If you get the people to focus on the wrong questions, you never have to worry about giving the right answers. That is how the NWO functions, and these are examples of how expectations for the collapse of gold and silver may be vastly misplaced, at least in terms of timing. We know for certain that all of our purchases of the physical over the past two years are underwater, [earlier purchases are not], but in the same way a homeowner may be underwater. It only matters if you have to sell while in that status.

This is the mainstay attitude of those PM buyers and holders smart enough to acquire both gold and silver. Fiats have an unbroken track record of failing throughout all of history. Gold also has an unbroken track record of being a store of value for over 5,000 years. Yes, there have been hiccups along the way, and we are in one now. It is what it is, but what it is is also an incredible buying opportunity at "fire sale" prices.

No one knows how long it will take for a final bottom to occur in PMs. The focus of this article is on things other than gold and silver, yet closely related in important ways for their ultimate impact. When will fiat inflation come? It is already here, just masked by an ongoing series of more lies and deceptions by NWO governments, and that includes the US.

The bigger question everyone else so interested wants to know is when will PM price "inflation" show up? Actually, gold never has inflation problems. Its counter-measure in fiat currencies always does. For us, the surest signs of problems will show up in those NWO paper markets, aka COMEX and LMBA. They are the bellwether to watch, for as long as price is captured in these so-called markets, the price of physical gold and silver remains captured within them, regardless of anyone's opinion of the paper markets.

Why is that?

It should not be, but it is.

Looking at the "faux" paper markets, they are like any other chart of any other market, they go up, down, and move sideways. Like any market, it takes time to turn a trend. From a down trend, a market usually goes sideways, allowing for smart money to cover shorts and establish longs. We will not pass on the merits of smart money already accumulating positions, albeit in the physical market, not in paper, and that could create an exception to a sideways move and lead to a V-Bottom, where price explodes to the upside.

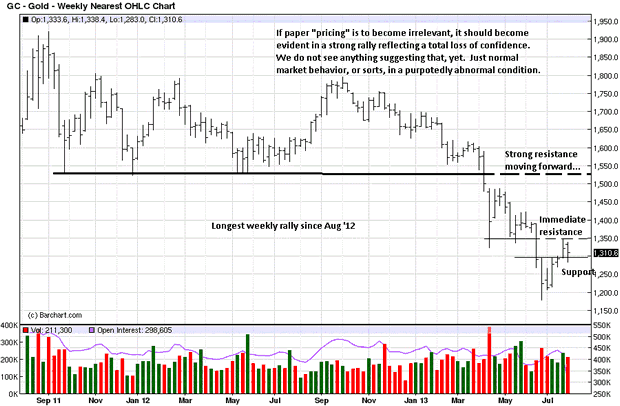

In either event, a look at the charts of the paper-tracked PM market shows the following:

Around the mid-1980s, there was a commercial by Wendys featuring the little old lady, Clara Peller. Her catch-phrase line was, "Where's the beef?" Where is the substance of anything? It is why we listed several aspects for the unprecedented demand for gold in the second opening paragraph, yet, the question remains, "Where's the beef?" We see none in the charts.

Weekly trend remains down. There was evidence of a potential upside breakout rally, two weeks ago, but no follow-through. It is possible last week was a supporting retest, but that will have to be confirmed by higher prices in the week coming, or gold will continue to languish in its paper malaise.

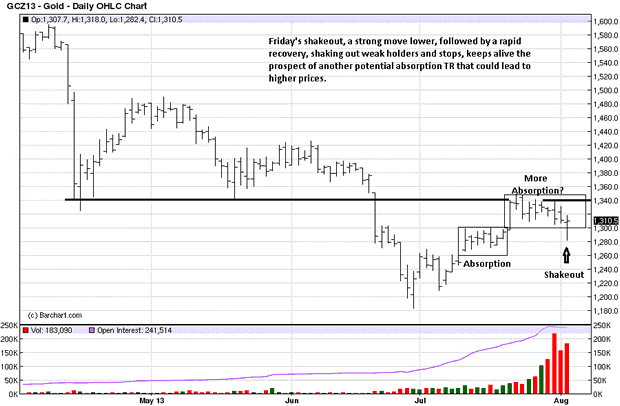

The daily shows what is needed, more clearly than the weekly. We gave back profit gained from the breakout rally, a few weeks ago, during Friday's shakeout, which triggered a protective stop just under 1300. A re-entry at 1310 was taken because of the structure of a strong close after a strong sell-off that failed.

If paper prices are to continue higher, there should be more evidence of absorption in the coming week. If not, this market remains weak.

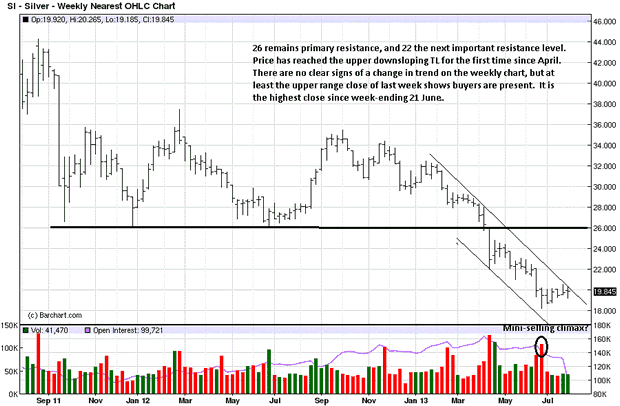

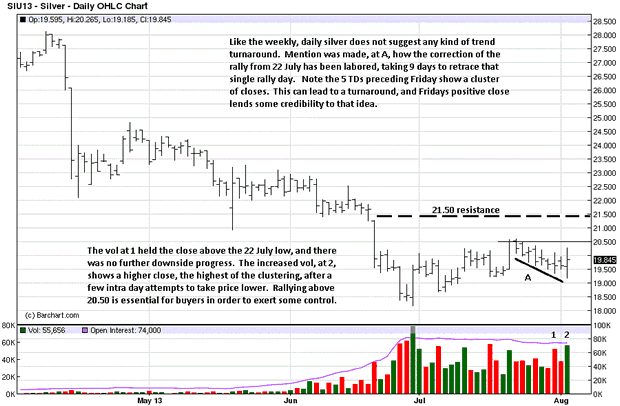

This is a totally different market. Unlike the labored retest in gold, note how labored the rally effort has been since the week-ending 21 July wide-range decline. It could be a reflection of the manipulation of the paper market, which makes a degree of sense, for the natural law of supply and demand has been missing during the JPMorgan take-down.

Any argument for a silver recovery remains a fragile one until that market shows demand in the form of strong rally bars on increased volume. We also took a hit in silver on the Friday shakeout, triggering a stop-loss, but re-entered again, near the close.

These positions are probes, expecting a rally to continue, and they require flexibility, for as price swings show, anything can, and will happen.

Charts do not lie. There may be lies and deceit within them, but the chart structure shows the truth of whether or not those lies and deceits are working. If you were to take all of the PM pundits, along with the sky-high predictions of where the price of gold and silver are to be, and stack them all against a few charts, based on results, who/which has been more accurate? All pundits have been way off, as to timing, and continue to be. Why is that?

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.