Massive Stock Market Wave B Top Appears Complete

Stock-Markets / Stock Markets 2013 Aug 03, 2013 - 12:48 PM GMT It might be good to look at the big picture, since we are very close to the high in what may be the all-time largest correction in history. It’s been a difficult process to sort out the waves, since the pattern is somewhat irregular and sloppy. Here are the highlights of the analysis:

It might be good to look at the big picture, since we are very close to the high in what may be the all-time largest correction in history. It’s been a difficult process to sort out the waves, since the pattern is somewhat irregular and sloppy. Here are the highlights of the analysis:

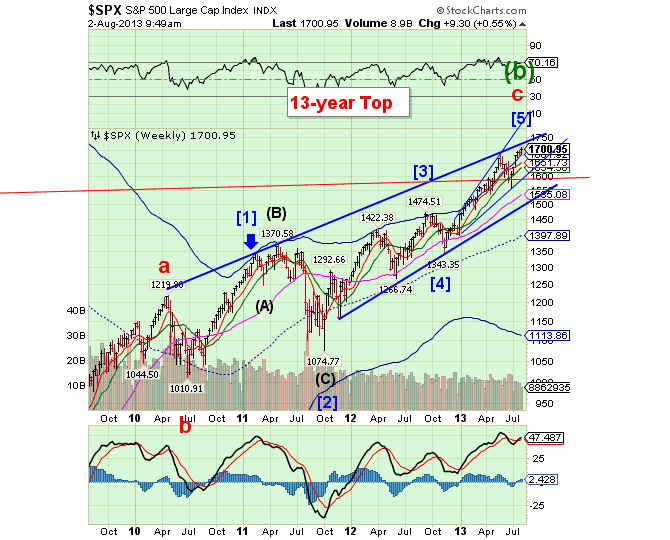

From the March 2009 low to the April 2010 high was a 5-wave (impulsive) move. That means that the total correction that follows Wave b, the decline into the 2010 low must also be five waves. That is why the high in February 2011 looked like an easy call.

However, the new high May 2, 2011 threw off that call. The best analysis is that it was an Intermediate Wave (B). The 5-waves down that followed that high was an Intermediate Wave (C) of Primary [2].

The 1474.51 high (400 points from the 1074.77 low) was Primary Wave [3]. However, I labeled it a Wave [C] instead. I was out of form there, since a zig zag cannot follow an impulse. But it seemed to fit the time frame from the March 2009 low (1290 days).

The move to the Dec 18, 2012 high was definitely a zig zag, which suggested a probable Wave (2) correction. Instead, it was the beginning of an Expanding Ending Diagonal, with all the waves being zig zags. We finally have an ending pattern. That pattern is now complete, or nearly so. Primary Wave [5] is 365 points long, while Primary Wave [3] is 400 points in length. Primary Wave [1] is 334 points, but if you count the Wave (B) extension, it is 360 points in length. That gives us near equality between Waves [1] and [5].

It appears that SPX may have made its final move yesterday. If so, we may watch two levels in the next day or two. The first is the 13-year Top trendline, which comes across SPX at 1696.00. The second is the small Broadening Wedge trendline at 1680.00. Once they are crossed, the decline should be underway.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.