Why QE Money Printing Hasn't Stimulated the U.S. Economy

Economics / Quantitative Easing Aug 02, 2013 - 10:56 AM GMTBy: Clif_Droke

After the Fed's latest 2-day policy meeting it announced on Wednesday that it would continue its $85 billion per month asset purchase program. The major indices fluctuated from positive to negative throughout the day, as is typical of a Fed meeting day, before closing basically unchanged.

After the Fed's latest 2-day policy meeting it announced on Wednesday that it would continue its $85 billion per month asset purchase program. The major indices fluctuated from positive to negative throughout the day, as is typical of a Fed meeting day, before closing basically unchanged.

Many investors wonder why the Fed's QE3 program hasn't boosted the economy more than it has. After all, $85 billion in monthly asset purchases would be, in a normal economy, inflationary. This isn't a normal economy, however, and as we've argued many times in past commentaries the deflationary long-term cycles which are down through 2014 is one reason why inflation remains subdued despite the Fed's best efforts.

There's another reason why QE3 hasn't stimulated the economy to the extent that Keynesians would like to see. It's just possible, as one respected economist has suggested, that quantitative easing was never meant to be stimulative to begin with.

Scott Grannis, a former chief economist at Western Asset Management and editor of the popular Calafia Beach Pundit blog, recently wrote that the primary objective of QE was to satisfy the world's massive demand for money in the wake of the 2008 credit crash. With the very real prospect of runaway deflation following the 2008 crisis, the Fed had no choice but to provide as much liquidity to the financial system as it possible could. This, after all, is the prime object of the central banks as Grannis points out.

Cash is king in a deflationary environment, and following the credit crisis the demand for money exploded as investors liquidated stocks and commodities in a frantic bid to raise cash. "Strong demand for T-bills began early in 2008," observed Grannis. "From late 2007 through mid-2008, the Fed sold almost its entire holdings of T-bills--about one-third of the Monetary Base--in an attempt to satisfy the world's demand for safe assets. But it wasn't enough."

That's when bank reserves came to the rescue. Reserves have since expanded to record levels and although banks are starting to lend again, most of that surplus money remains unused. As Grannis puts it, "Bank reserves are the new T-bills, and that's why banks have been content to accumulate $1.9 trillion of 'excess' bank reserves (reserves that are sitting idle at the Fed, and not being used to support increased lending) since late 2008.

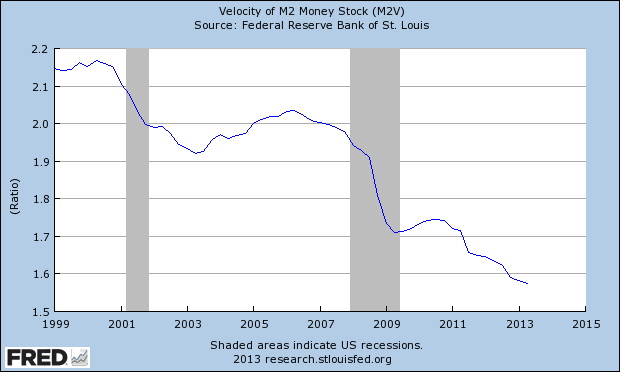

Notwithstanding the massive increase in bank reserves, money supply as measured by M2 hasn't shown an inflationary increase. Velocity of M2 is in decline and while a record amount of liquidity now exists, little of that money is seeing the light of day. See graph below.

Indeed, the world currently holds 25% more money relative to total spending compared to six years ago, according to Grannis. He observes that QE did nothing more than provide banks with the ability to support the public voracious appetite to hold more money. The excess money created by the Fed, in other words, has been absorbed in a global savings glut fueled by fear and uncertainty over the future. This is why QE hasn't resulted in the major inflation that many predicted.

True economic inflation, which is characterized by dramatically rising prices, wages and rising interest rates, only happens when the supply of money outstrips the supply of money. So far that hasn't happened due to the world's continued high demand for money. The Fed simply hasn't been able to churn out enough money supply to exceed the public's clamor for it. This in itself is a testament to the deflationary undercurrents due to the Kress cycles.

U.S. Economy

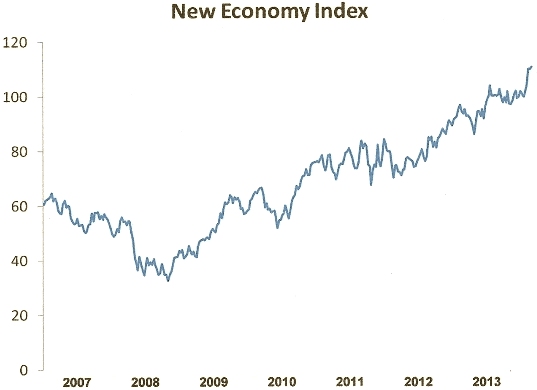

For those who say the U.S. economic recovery isn't real, the New Economy Index (NEI) argues otherwise. The NEI is a stock price composite of the leading retail, business transportation and employment agency stocks. It's currently at a 6-year high, having long since surpassed its previous all-time high from 2007. Until the uptrend in the NEI is broken, we can assume the economic outlook is still positive despite the bumps appearing on the road from time to time (see section below).

Gold

On the economic front, June existing home sales in the U.S. fell to 5.08 million on an annualized basis compared to the median forecast of 5.26 million, and 5.14 million in May. This could be the end of the housing rebound or perhaps only a temporary aberration. In either case, the fact that mortgage rates are increasing hasn't helped matters for prospective home buyers. Gold could also benefit from the uncertainty surrounding the recent spike in interest rates.

"Physical demand has been robust in Asia as evidenced by the persistent premiums," observed Sharps Pixley. "The dwindling Comex gold inventory has raised concerns of default by the Comex. Gold traders are increasingly covering their shorts as physical gold delivery is getting a little harder each day."

CFTC data shows that during the week of July 16, net short positions in gold among speculators fell 10.82 percent to 121,305 contracts while the net combined positions surged to 47.72 percent.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets. Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you're buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the "smart money" pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you'll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.