Experts Predict 30-Day Window for Gold Price

Commodities / Gold and Silver 2013 Aug 01, 2013 - 04:55 PM GMTBy: Money_Morning

Mary Anne & Pamela Aden: We've been studying the resource markets - and gold in particular - for over 30 years. And have seen almost every cycle the yellow metal has gone through.

Mary Anne & Pamela Aden: We've been studying the resource markets - and gold in particular - for over 30 years. And have seen almost every cycle the yellow metal has gone through.

One thing is certain in our opinion: International investors, central banks and corporations are all looking to buy gold... And these slow summer months are likely providing the best price.

Asian investors, especially in China and India, are buying coins and bullion like mad. Sales are up 22% annually in China and 52% in India.

Gold analyst Jim Willie put it best when he said: "The migration of gold from West to East is the grand story of the decade." They know, as our dear friend Richard Russell recently reminded us, that gold and international power still go hand in hand.

Beyond the obvious demand, history is also on gold's side. Gold's movements are in line with historic trends, never mind what the no-nothing, hand-wringing Cassandras are saying.

In fact, we believe this is a unique moment in history to get gold on the cheap, and take advantage of before the end of summer.

Of course, the ongoing "tapering talk" from the Fed pushed gold down sharply. That's because if the Fed stops stimulating the economy, an inflationary outcome is unlikely, especially if it's combined with higher interest rates that boost the value of the dollar. That's bad for gold.

What's more, there may be darker forces at work as well. There's a distinct possibility the gold market was manipulated [Editor's Note: here's who did it].

Yet the bottom line is that nothing material changed to justify a $700 drop in gold prices from over $1,903 in 2011 to almost $1,200 earlier this month.

In fact, this 36% fall is clearly the steepest in gold's 12-year bull market. The worst dip prior to this was an almost 30% decline in 2008.

Gold's Eight-Year Cycle: On track

But looking at gold's full bull market rise from 2001 to 2011, gold gained over 660%, so a 36% decline isn't bad from that perspective.

The fact is, if you got into the bull market early, even up until mid-2010, you're fine. But if you bought any time after mid-2010, you are break-even to down.

But even if you're down, it's just a matter of time before we see higher gold prices, so it's imperative you keep a core position.

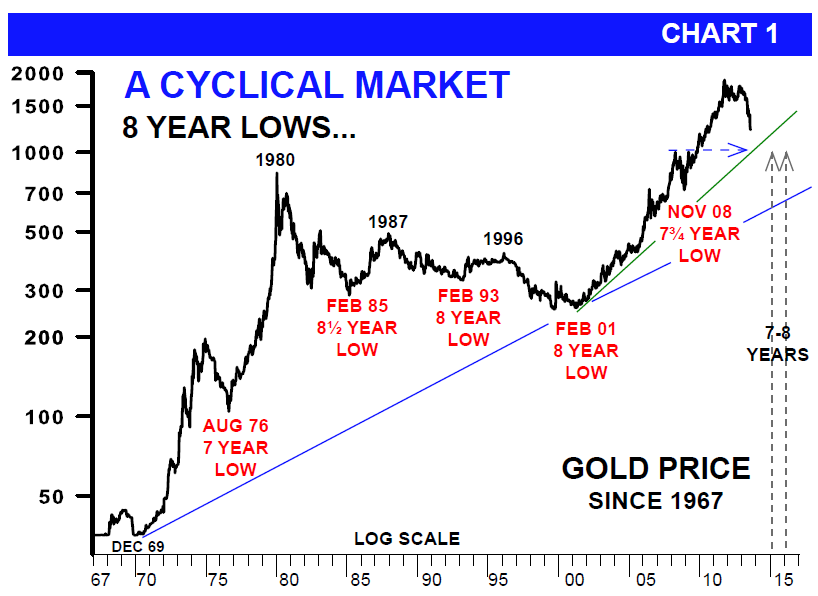

Gold hits a consistent low area nearly every eight years. You can see below, it's been pretty reliable by several months.

February 2001 saw an eight-year low, following a modest gold rise in 1996.Gold then rose sharply until it fell to the next low in November 2008, which was just three months shy of the eight-year mark.

That brings us to today...

gold is now almost five years closer to the next major eight-year low. This doesn't mean gold is going down until then. It's simply saying that 2015 or early 2016 is a likely time period for the next key low in gold.

There are always important major increases between the lows.

During major bull markets, gold tends to stay above the high reached prior to the eight-year low area. In today's case, this means gold should stay above the $1,000 high of 2008, where the blue horizontal line and the 2001 uptrend meet.

For now, so far, so good. Gold held above the $1,200 level and it's now showing the first signs of renewed strength by staying above $1,275. And since gold is currently rising from an extremely oversold area, there's a good chance it will break through its next important resistance at $1,350.

If so, it'll be a good sign the decline is over and the price is indeed headed higher.

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, named 2010 Letter of the Year by MarketWatch. Mary Anne and Pamela provide specific recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com.

Source :http://moneymorning.com/2013/08/01/experts-predict-30-day-window-for-gold/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.