Bernanke the Candyman as Detroit Declares Bankruptcy

Interest-Rates / Quantitative Easing Jul 31, 2013 - 12:28 PM GMTBy: John_Mauldin

By Grant Williams

By Grant Williams

Who can take tomorrow

Dip it in a dream

Separate the sorrow

And collect up all the cream?

The candyman, the candyman can

The candyman can 'cause he mixes it with love

And makes the world taste good.

And the world tastes good 'cause the candyman thinks it should.

– "The Candyman", Willy Wonka and the Chocolate Factory

In 1964, Roald Dahl penned what is arguably his most famous book. It tells the story of a poor boy who, thanks to the discovery of a golden ticket concealed in a bar of chocolate, wins his way into a magical factory run by a mysterious oddball named Willy Wonka.

The book, Charlie and the Chocolate Factory, was a smash hit; and inevitably the book was turned into a screenplay, which spawned a 1971 movie in which the word Charlie was replaced in the title with the name of the character the movie's producers felt was far more important to the narrative: Willy Wonka. And so it was that one of cinema's great transformations from written page to silver screen took place, and in the process one of its finest characters was born.

Gene Wilder's Willy Wonka is the only portrayal officially recognised and endorsed by Things That Make You Go Hmmm.... Accept no imitations.

As much respect and admiration as I have for the extraordinary talents of Johnny Depp, just ... no, sorry. There is only one Willy Wonka, and it's Gene Wilder.

Now that I've clarified my position on that particular issue, let's proceed.

I am sure that, somehow, there may be readers who haven't either read the book OR seen the movie; and so for them I include a short synopsis of the story. Please be apprised that it contains spoilers that, well, give away the entire plot and the ending, to be honest. If you have read the book or seen the movie, it may be worth reacquainting yourself with the plot before we dive in any deeper:

Mr. Willy Wonka, the eccentric owner of the greatest chocolate factory in the world, has decided to open the doors of his factory to five lucky children and their parents. In order to choose who will enter the factory, Mr. Wonka devises a plan to hide five golden tickets beneath the wrappers of his famous chocolate bars. The search for the five golden tickets is fast and furious....

Charlie Bucket, the unsuspecting hero of the book, defies all odds in claiming the fifth and final ticket. A poor but virtuous boy, Charlie lives in a tiny house with his parents, Mr. and Mrs. Bucket, and all four of his grandparents.

In the factory, Charlie and Grandpa Joe marvel at the unbelievable sights, sounds, and especially smells of the factory. Whereas they are grateful toward and respectful of Mr. Wonka and his factory, the other four children succumb to their own character flaws. Accordingly, they are ejected from the factory in mysterious and painful fashions.

During each child’s fiasco, Mr. Wonka alienates the parents with his nonchalant reaction to the child’s seeming demise. He remains steadfast in his belief that everything will work out in the end....

After each child’s trial, the Oompa-Loompas beat drums and sing a moralizing song about the downfalls of greedy, spoiled children. When only Charlie remains, Willy Wonka turns to him and congratulates him for winning. The entire day has been another contest, the prize for which is the entire chocolate factory, which Charlie has just won. Charlie, Grandpa Joe, and Mr. Wonka enter a great glass elevator, which explodes through the roof of the factory. (Source: iSL Collective)

In the movie's first act, Bill, the owner of the sweetshop, sings a song written by Anthony Newly and Leslie Bricusse, called "The Candyman", which praises the wonderful world created by Wonka and espouses the pure joy of living in a place where everything is deliciously sweet; miracles, dreams, and rainbows are ubiquitous; and any sorrow is separated and discarded in favour (yes, there's a u in favour — deal with it!) of cream ... pure cream.

As Bill hands out free candy to a group of wide-eyed kids, you can see in their eyes the pure joy that only comes of living in a world where everything is wonderful and nothing bad ever happens.

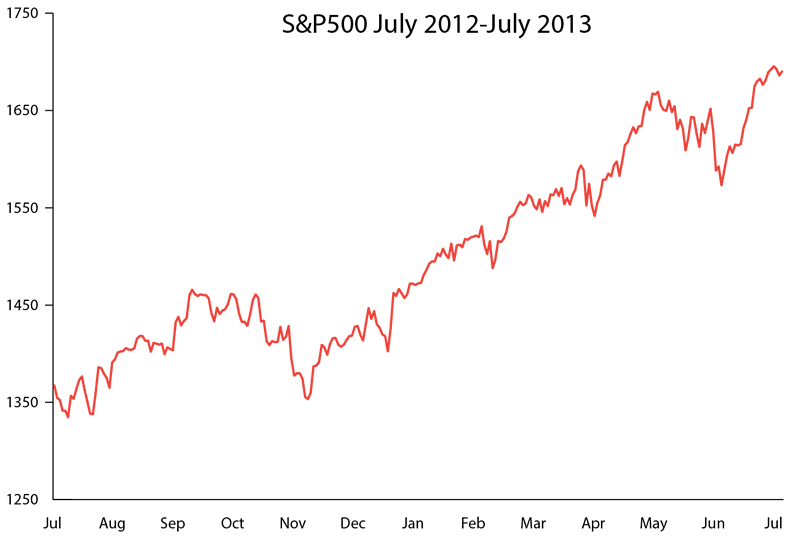

Ladies and gentlemen, I give you ... the S&P 500.

Source: Bloomberg

Yes, the US equity markets have bought firmly into the idea that everything is right in the world and that nothing will ever be allowed to go wrong. A prime example of this attitude emerged last Thursday, when we were greeted with two irreconcilable headlines on the same day:

Detroit declares bankruptcy, becoming largest city in U.S. history to go belly up

That was courtesy of the New York Post, and the opening paragraph — in true New York Post style — went straight to the meat of the story:

(NY Post): Detroit on Thursday became the largest city in U.S. history to file for bankruptcy, as the state-appointed emergency manager filed for Chapter 9 protection.

In paragraph 10 of the article, the Post went on to disclose the size of the hole on Detroit's balance sheet:

Detroit's budget deficit is believed to be more than $380 million. [State-appointed bankruptcy expert Kevin] Orr has said long-term debt was more than $14 billion and could be between $17 billion and $20 billion.

Wait ... what?

"... more than $14 billion and could be between $17 billion and $20 billion."

Sadly, this is the world we live in — where a state-appointed bankruptcy expert talks about a possible discrepancy of $6 billion in a city's accounts and the figure is relegated to paragraph 10. Unicorns and rainbows. (Jefferson County, AL, the biggest previous municipal bankruptcy, totaled only $4 billion.)

Meanwhile, gracing Reuters on the same day was this little beauty:

Dow, S&P 500 end at all-time highs on earnings, Bernanke

The first paragraph of that story read as follows:

(Reuters): The Dow and the S&P 500 closed at record highs on Thursday after Morgan Stanley and others reported better-than-expected earnings and Federal Reserve Chairman Ben Bernanke's comments further reassured markets.

A little higher up in the story than the Detroit balance sheet shortfall in the New York Post piece (in paragraph 6, for those of you keeping score at home) was this expansion on the headline:

(Reuters): Bernanke, speaking before the Senate banking committee, reiterated comments he made on Wednesday to the House Financial Services Committee. He stressed that the timeline for winding down the Fed's stimulus program was not set in stone.

"We got no negative surprises from the Fed chairman today, so the market liked that," said Bucky Hellwig, senior vice president of BB&T Wealth Management in Birmingham, Alabama.

Ladies and gentlemen, I give you Ben Bernanke — the Candyman. (Or perhaps that should be the Bendyman? Quite suitable, given the extent of his flexibility, don't you think?)

As Bucky Hellwig points out, the market likes it when there are no negative surprises from the Fed chairman — the corollary of which is that the market HATES it when the Candyman threatens to stop with the sugar — last month's Taper Tantrum being the obvious and most recent example.

But in its adherence to whatever is being handed out by Bernanke, the market is failing to pay attention to signals that would ordinarily call for caution. That is the danger of getting kids hooked on candy: rationality tends to fall by the wayside and behaviour becomes harder and harder to understand until, ultimately, a sugar crash occurs….

To continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore – please click here.

© 2013 Mauldin Economics. All Rights Reserved.

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.MauldinEconomics.com.

Please write to subscribers@mauldineconomics.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.MauldinEconomics.com.

To subscribe to John Mauldin's e-letter, please click here: http://www.mauldineconomics.com/subscribe

To change your email address, please click here: http://www.mauldineconomics.com/change-address

Outside the Box and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA, SIPC, through which securities may be offered . MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at http://www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs may or may not have investments in any funds cited above as well as economic interest. John Mauldin can be reached at 800-829-7273.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.