Crude Oil Shortage Meme Struggles On, And On

Commodities / Crude Oil Jul 30, 2013 - 03:46 PM GMTBy: Andrew_McKillop

GOLD CORE SAYS

GOLD CORE SAYS

What looks suspiciously like disguised advertising for the site, Gold Core has published a three-part report in its Market Update series on “why gold must rise”. Key arguments used by Gold Core include the parlous state of world financial markets, and what Gold Core calls a “selloff of all asset classes: stocks, bonds, commodities, and of course, silver and gold”. We didn't yet notice the selloff in stocks, and although the commodities sector has been mauled, oil prices are still at extreme, well-supported, heavily-manipulated highs. The world's green energy sector is in several ways comparable – resulting from the same basic cause of overvalued assets sucking in vast amounts of investor capital, needing a continuation of overvalued assets – or price collapse.

Gold Core gives a rundown on major financial crises since 1980, which it says run “like clockwork over the last thirty years”, roughly every 7 years, it says. It then comes along to what it says is the clincher. It says: “But today there is an additional factor: the world faces a severe energy shortage that caps real growth prospects”.

It means an oil crisis. No other form of energy. Simple facts like the following are not allowed even a bit part role in the Gold Core oil crisis story - oil only supplies about 32 percent of world energy today – in constant decline since that 1980 benchmark year Gold Core uses to set its financial crisis clock.

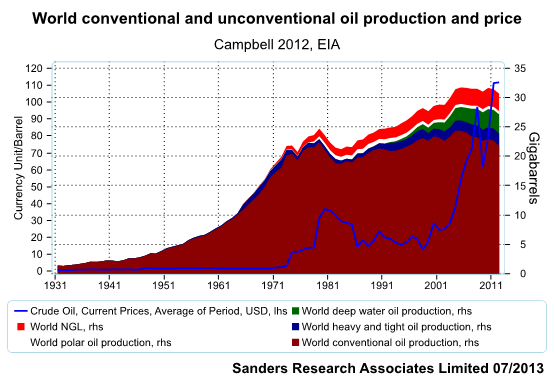

The claim for an imminent or underlying oil crisis is shown in this Gold Core chart from Sanders Associates:

http://www.goldcore.com/sites/...

IN A ZERO SUM GAME SOMEBODY HAS TO BE THE LOSER

One of the losers is easy to identify: OPEC. To be sure, its total oil revenues of $1260 billion ($1.26 trillion) in 2012 are impressive – more than two and a half times WalMart's turnover – but we should make a comparison of this with world GNP, about $65 trillion. If oil, supplying a bit less than one third of world energy, costs around 5 percent of GNP is this a crisis?

If it was, it will be less of a crisis when oil prices fall to their right level of $80 per barrel.

Market exuberance, as it is called, will of course ensure the price is pushed a lot lower than this “during the crisis”. The only surprise is this oil price adjustment does not need the tailwind (or hurricane) of a 2008-2009 economic crash sequence, but can be spread over the next 4 to 5 years, to 2017 or 2018.

Oil prices will decline.

Other losers can be aligned and counted. Overpriced oil dragged in and swelled the oil-and-gas sector to extremes of at least $250 billion-a-year exploration and development spending on a regular basis. In turn, this rationalized and justified over-investment in all kinds of allied, and competing energy sources and systems, running from energy saving to biofuels. Set against this, many developed countries including the US, Japan and all EU28 countries have official or semi-official targets for compressing their total energy demand by as much as 33 percent by 2035. Both China and India are not so far behind in this new no-energy policy quest. Oil will of course be especially hit.

Overinvestment in the gas sector has produced dramatic results, especially in the US where in 2005 the talk of the town was The Coming Gas Cliff or an uncontrolled and radical decline in gas supply with of course spiraling prices. Books written at the time on this scary theme are now on offer from Amazon at typical prices, for used copies, from 10 US cents (postage extra). What happened was that gas cliff fear, the lure of extreme high gas prices, and the now-ripe arrival of fracking technology combined to create the US shale gas boom. The US is now No 1 gas producer in the world and 37 percent of current output is by hydraulic fracturing. Prices collapsed.

Through 2005-2009 the pace of worldwide exploration for deep offshore stranded gas (gas only) resources went into high gear, and was crowned by success. Entirely new world-class producers have emerged and will emerge, for example Australia, Mozambique and Tanzania, all of them able to reach their markets through the linked boom in LNG tankers and terminals investment. The list of minor new and emerging export-capable producers of stranded gas is long. Russia and Qatar will no longer call the shots for world gas prices, which will decline.

Surprising, even very surprising to some, other major losers from the accelerating and massive global energy shift, transition or transformation include coal and nuclear. Both have either resource or technology advantages – but so many handicaps their future is clouded. For coal however, the sure and certain increase in in-situ coalbed methane extraction (currently supplying about 15 percent of US natural gas) will ensure a second coming for coal. World non-extractible deep coal resources according to China's University of Petroleum are probably around 200 trillion tons. Present world physical coal consumption is about 6 billion tons-a-year. You said coal shortage ?

In a recent article ('Saudi Prince Sounds The Alarm On Fracking'), I noted that in Saudi decider circles the oil minister al-Naimi brushes aside the US shale oil boom, for the moment, but is already alarmed about the shale as boom. He can also get worried about the stranded gas boom – with a major ramp in global supplies from 2017 – and the coming in situ coalbed methane production boom which is possible from about 2025. Cheap and clean natural gas is the silver bullet for saving oil in any road, rail or marine transport application. These end-uses account for over one-third of current oil demand.

HYPE WALLAHS OUT

Dangling the prospect of a vintage-type Peak Oil crisis, which begets a financial crisis, which begets a ramp in gold prices may seem nicely logical to some Gold Core readers.

In the real world this is unlikely and getting more so, which in no way prevents gold prices from rising, to at least $1500 per ounce. Prices above that level are surely more than possible, due again to “market and trading exuberance” but a full blown crisis like the 2008-2009 sequence will not only collapse oil prices, but seriously trim investor appetite for gold. In the austerity economy, gold has an attractive place – under the mattress – hoarded until the good times come back, if they come back.

The logic for the crisis sequence from Gold Core is that world oil output did not rise by a large extent since 2000 in spite of a huge rise in the price of oil. Funnily enough, exactly the same happened to gold, but Gold Core doesn't mention this. World oil production has been unable to climb, it says, but the ramp in oil prices helped more than somewhat in dampening oil appetite.

The following Gold Core argument is that due to rising oil prices we are at the limit of what the world economy can bear – but these rises have firstly helped triggered the energy revolution, and secondly have made oil saving a profitable business. The certain “erosion” of oil prices in 2013 will only underline how much times have changed, because oil demand will in no way boom, in fact anything above a 1%-a-year rise in oil demand is a jamboree event.

The only help for oil boomers, apart from upward price manipulation by the big manipulators like Barclays, JP Morgan, Goldman Sachs & Co, is that the Middle East will fall apart into mayhem and mass killings. Without that tailwind from the djihadists and the generals, oil prices are set to fall.

This is the reality. Economics from Gold Core, which explain nothing, will change nothing.

By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2013 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.