As The Crisis Deepens, Gold Flows East

Commodities / Gold and Silver 2013 Jul 30, 2013 - 12:57 PM GMTBy: GoldCore

Today’s AM fix was USD 1,322.25, EUR 996.65 and GBP 864.05 per ounce.

Today’s AM fix was USD 1,322.25, EUR 996.65 and GBP 864.05 per ounce.

Yesterday’s AM fix was USD 1,330.75, EUR 1001.24 and GBP 864.79 per ounce.

Gold fell $3.60 or 0.27% yesterday and closed at $1,329.40/oz. Silver fell $0.19 or 0.45% and closed at $19.84.

Gold is remaining steady ahead of the key U.S. Fed policy meeting later today. Mixed economic data from the U.S. has left no clues as to when the Fed will taper its stimulus program. Gold bullion prices reached a five week high of $1,347.69/oz last week.

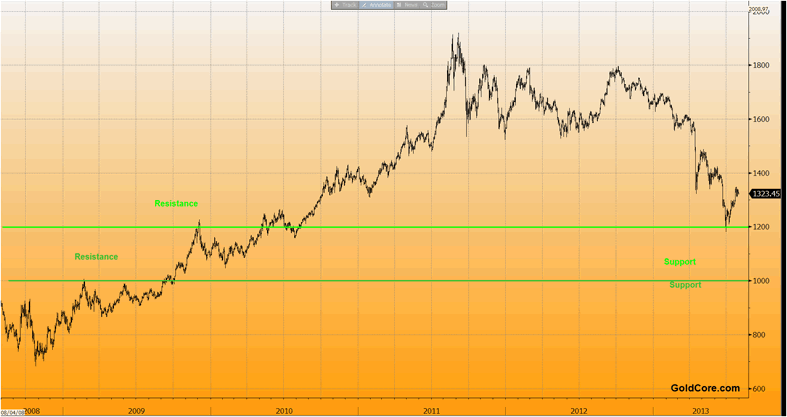

Support & Resistance Chart, 5 Year - (GoldCore)

In yesterday’s Market Update we began this 3 part series with a look at the global ‘power play’ currently in full swing where Organisation for Economic and Co-operation and Development (OECD) members are working assiduously to reduce their dependency on fossil fuels. The growth rates achieved by China and its rapidly industrializing neighbours has in part been made possible by the efficiencies achieved by OECD members. There is no doubt about that and as Sanders quite rightly points out, ‘The first major player to successfully make the switch to renewables will be the technology provider of choice to everyone else.’

Against this backdrop gold is emerging as a key component of China’s future economic plans. There is no official figure from the Chinese authorities that gives an exact statement of how much gold they hold but as we wrote back in February, ‘China's gold imports from Hong Kong doubled to a new record in 2012.’ What is notable about this statistic is that the doubling in demand in 2012 is solely private demand and does not take into account official Chinese Central Bank purchases.

Chinese citizens were banned from owning gold bullion by Chairman Mao in 1950 and this prohibition continued until 2003. The current demand is coming off a very small base? and with a population of over 1.3 billion, the Hong Kong import figures may well be breached again in 2013.

Heading into today’s second Insight installment from As The Crisis Deepens, Gold Flows East’ the headline signifies that the stakes are high. In the shadow of this game, gold looks like a solid investment.

In A Zero Sum Game, Someone Has To Be The Loser

What is at stake is illustrated by the difference in oil consumption between Asia and the West. The former, exemplified by China and India, is still increasing its consumption growth. The latter, basically the OECD, has been using less oil each year since the crisis began in 2008. This is unsustainable. The OECD’s deepening recession is evidenced by its falling oil use while the fragility of the export dependent and imported energy dependent East’s growth prospects suggests that its real growth rate is about to peak or already has.

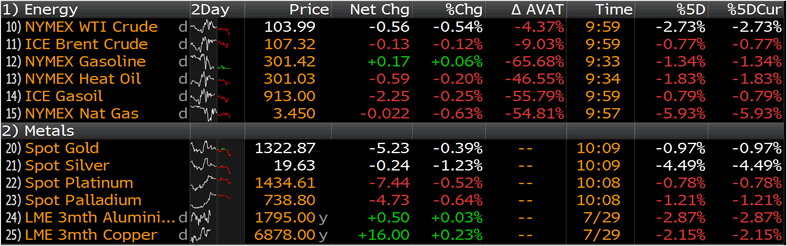

Energy & Metals: 2 Day Price Average - (Bloomberg)

Complicating matters is the zero interest rate policy and quantitative easing now being pursued across the OECD.

This has further exacerbated a forty year growth of income and wealth disparities that is displaying its tangible face in huge unemployment and underemployment rates and widening hunger as the unemployed fall out of the social safety nets that we have become accustomed to depending on to alleviate the human cost of recession.

These in any event are being reeled in everywhere even while taxes and user fees multiply and rise. The reality of ZIRP and QE is that they are starving the real business of investment incentives and destroying the consumption base on both of which growth depends.

This is a subsidy of the core of the money system, the largest international financial institutions. Subsidy it may be, but it is proving an effective if cruel way of reducing oil consumption. It has also preserved for the time being the capital structure of the industrial world by inflating the nominal value of the world equity and bond markets.

In the U.S., at least, this has received considerable help via stock buy backs. Nothing could illustrate the real outlook better when you think about it: if business prospects are so good why are so many corporations returning cash to their shareholders via buy backs, while an overwhelming proportion of insider trades are sales?

Unfortunately, business prospects are not good at all.

They couldn’t be when you consider that the marginal sources of petroleum and petroleum substitutes have very low net energy yields relative to conventional oil (or for that matter to conventional gas). At the margin, as I and many others have pointed out in the past, this means that the marginal unit of energy consumed in the process of powering economic activity is costing society at large exponentially more energy to produce that marginal energy for consumption. This is at odds with continued growth in the world population as well as with trends in finance.

To download a copy of 'As The Crisis Deepens, Gold Flows East,’ please click here.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.