US Interest Rate Cuts Ineffective If Banks Do Not Lend

Economics / Credit Crisis 2008 Mar 31, 2008 - 07:31 AM GMTBy: Mick_Phoenix

Welcome to the Weekly Report. Click on the link for my update on Moral Hazard written for Livecharts earlier this week. Stress continues to increase across all markets, a fact that should make all investors stop and think about the root cause.

Welcome to the Weekly Report. Click on the link for my update on Moral Hazard written for Livecharts earlier this week. Stress continues to increase across all markets, a fact that should make all investors stop and think about the root cause.

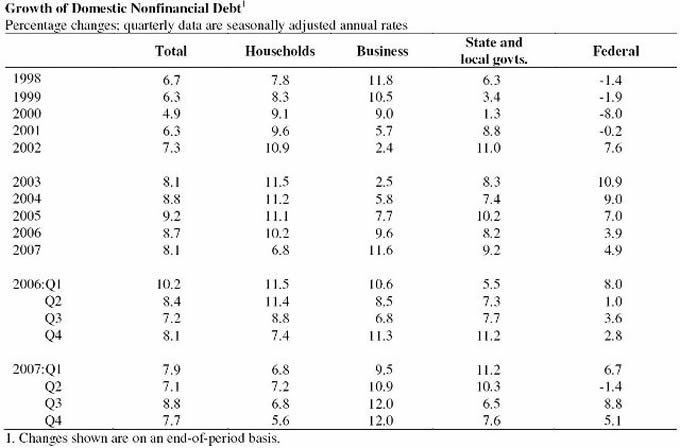

First up, we dig into the Flow of Funds Accounts of the United States for Q4 '07. Specifically I want to look at the growth of Domestic Non-Financial Debt:

Remember this is a growth chart, the amounts are still rising. Without using a chart, you can see a bell curve in household debt, State and Local Govt debt and Federal Debt. Inverse to this is Business debt. There are some disturbing patterns here that bode ill for the future.

The growth in household debt is slowing rapidly, almost halving since Q1 '06 to Q4 '07. I somehow doubt Q1 '08 will show an improvement. It is clear that for consumers the debt crisis did not begin in the summer of '07 but in Q3 '06. Anyone who tries to label the MBS credit crunch as a Minsky event, an unforeseen happening that surprised the Markets, didn't look deep enough. This disinflation in the growth of consumer debt is different than the expansion we saw during the last recession. There is no support coming for the economy from a continued and increasing expansion of consumer debt. This is a consumer led recession that has ramifications for the whole system of funding used by local and national government. Without an increasing flow of taxes raised through spending, Municipal, State and National funding will be increasingly reliant on raising debt through bond issuance.

Indeed the process had already started, as can be seen by the rise in Local/State and Federal Debt to cover the shortfall in funding. As we all know the Municipal Bond (MB) Market looks like the Somme in 1916, cratered and deadly to all participants.

The figures for Q3 and 4 '07 show the sudden difficulty in raising debt experienced and the acceleration of the problem. This makes sense if viewed from MB buyer's point of view. If the MBs are issued using future tax/income flows as the underlying asset it is no wonder that, after a quick glance at slowing consumer debt, the underlying asset is no longer seen as such a secure basis for borrowing. It is exactly the same calculation used when buyers deserted the lower (and now top) rated MBS tranches, a lack of confidence in the underlying asset to perform at its historical level of return.

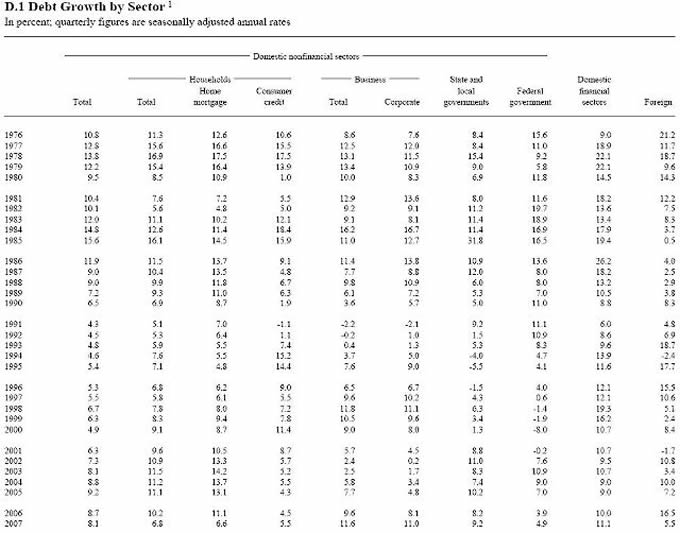

Business lending looks solid at first glance but if we take a longer term view, a pattern becomes evident:

Notice the pattern? Business debt grows until hard times arrive. It is likely that falling rates (yields) become attractive and business debt is increased or rolled over on better terms. As I have shown before it is this short-sighted view that often becomes the undoing of Business. Whilst falling yields are attractive to borrowers they are the precursor of a contraction in economic performance. The Fed allows rates to drop for a reason; it is to attempt to stimulate economic growth. That stimulation is required as conditions weaken:

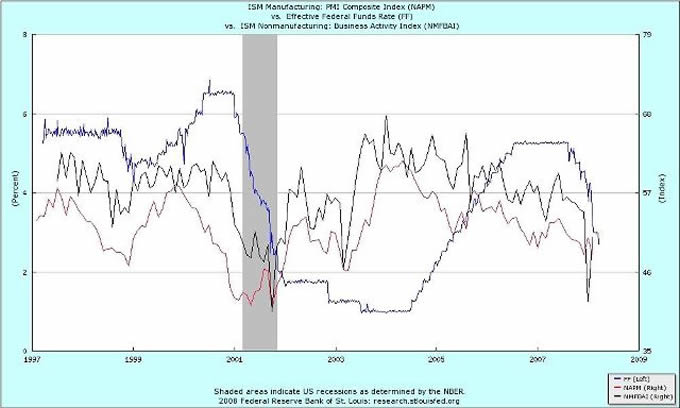

We can see this in practise above, as conditions shown by the ISM readings for manufacturing (red) and non-manufacturing (black) business are interest rate sensitive (effective Fed Fund Rates- blue). Rates climbing above 5% are not conducive to a healthy business environment. Even periods of stable rates above 5% do little to help business; it demonstrates that business planning is not aided by "stability" but by low, accommodating rates. As we can see, the Fed did not pursue a new paradigm this time around. Business conditions had to show marked deterioration before the Fed cut.

Here is the conundrum for the Fed. Previous accommodating drops in rates helped to re-invigorate business after deterioration, helping employment, expansion of credit and consumerism. This time the Fed faces a problem not seen since the depression (except in Japan 1990 - present).

Lowering rates is ineffective if Banks do not lend. It is clear that Banks either are not willing or are unable to extend credit facilities to all sectors of the economy, including to each other. The Fed has attempted to address this with a series of new measures, designed to alleviate the pressures on Bank capital reserves. Banks are grateful for this but will not take new positions in credit markets. The Fed support is being used to repair and rebuild bank balance sheets by deleveraging, using cheap Fed assets and funds to roll their own positions, whilst keeping income streams high on current lending. If the Banks decide its time to clear the decks of liabilities, this process could take much longer than most expect.

Without access to lower commercial rates, businesses could find themselves unable to use credit to roll over existing debt or to use new credit for "expansion". This would be comparable to the conditions seen in Japan in the last 2 decades.

How tight are current Bank credit conditions? Put it this way, if the Fed has to enact '30s legislation to save a broker and then set up a discount window for other Primary Brokers it is clear that Banks are unwilling to help out.

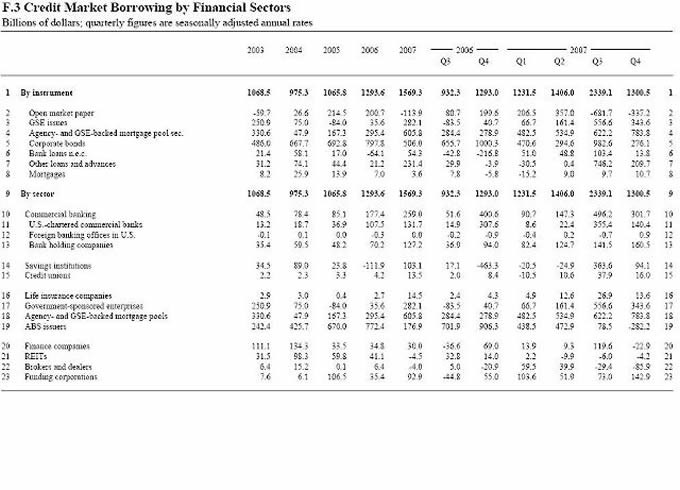

Here we see the massive drop in borrowing, except for two sectors:

Apologies if it is a bit small, here is the link to the Fed Fed Z. 1. Credit market borrowing in the Financial Sector is down from $2339.1Bn in Q3 to $1300.5Bn in Q4 '07. That's some disinflationary rate, 55.5% quarter on quarter! No wonder Banks and Primary Brokers were happy to take "liquidity injections" from SWF's and Middle/ Far East investors.

The only expansions of note were in Agency and GSE backed mortgage pool securities and Funding Corporations.

Conditions will not improve until

To read the rest of the Weekly Report, click here.

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.