Return Persistence & Future Stock Performance: Are Momentum Strategies Effective?

InvestorEducation / Sector Analysis Mar 31, 2008 - 12:00 AM GMTBy: Joseph_Dancy

Return persistence – the tendency for stocks to trend in the same direction – has been the topic of a number of academic studies. Many academics, and a number of portfolio managers, adhere to the theory that the market is reasonably efficient. As such, historical stock prices should reflect the sum of public knowledge and should have little predictive value of future stock price movements. Many value managers adhere to this theory. The fact that some studies show that stocks tend to trend on one direction is therefore puzzling to these researchers.

Return persistence – the tendency for stocks to trend in the same direction – has been the topic of a number of academic studies. Many academics, and a number of portfolio managers, adhere to the theory that the market is reasonably efficient. As such, historical stock prices should reflect the sum of public knowledge and should have little predictive value of future stock price movements. Many value managers adhere to this theory. The fact that some studies show that stocks tend to trend on one direction is therefore puzzling to these researchers.

The latest comprehensive study of this issue by Elroy Dimson, Paul Marsh and Mike Staunton of the London Business School examined 108 years of market data. They looked at markets in 16 different countries to determine if a stock's historical return has any predictive basis when looking at future stock returns.

Return Persistence. The study found extensive evidence that was statistically significant, across time periods and markets, that returns are persistent – that is a stock that has performed extremely well in the last year has an increased probability of performing well in the future. Conversely, stocks that have performed poorly have an increased probability of underperforming the market going forward.

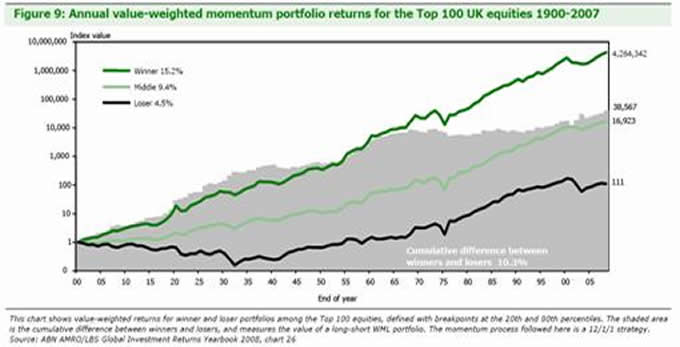

Strategies which utilized this persistence, called ‘momentum' investing or ‘relative strength' or ‘trend following' by some, generated excess returns that were striking. Over 108 years, taking the largest stocks, those that performed in the top 20% in the previous year, outperformed those in the bottom 20% by 10.3% per year in the U.K. markets. Over time such incremental returns compound – delivering substantial excess returns for long term investors.

Over shorter periods the excess returns of momentum investing remained significant. Over the 1956 to 2007 period the top 20% outperformed the lowest performing 20% by 10.8% per year. The impact of this strategy was present not only in the U.K. markets but every market they studied, including U.S. markets.

Small Cap Sector. Significantly, at least from our standpoint, is that the excess returns attributed to persistence was larger for small cap stocks than large cap stocks. While the best performing U.K. portfolios weighted by company size had an annual return of 18.3% for the 1956-2007 period, using an equally weighted portfolio in which smaller companies had the same impact as larger ones resulted in an annual returns of 25.6% - generating much higher excess returns. The average market return during these periods was 13.5%. The inefficiencies of the smaller cap sector apparently compounds the momentum effect.

It is also significant that when they studied the best performing 10% of the portfolio in the prior year versus the lowest 10%, the momentum effect was also greater then using the 20% cutoff. The better the previous year performance, the more likely the significant out-performance would continue.

While most active managers do not expressly focus on this issue they either adopt a momentum based strategy or reject the premise by default. Pure value based managers reject the momentum effect, while hedge funds using pure technical analysis buying purely on price action clearly adopt the theory.

The authors conclude that practices like letting winners run and cutting losers short implicitly incorporate a momentum bias in the management style – and the performance of these managers should benefit from such a strategy. The performance improvement should be significant. This is especially true of small cap portfolios according to the data.

In the 1956 to 2007 period the non-market related difference in return, referred to as ‘alpha', was roughly 11 percent per year – an incredibly high value considering the fact that many active managers have difficulty generating positive alpha.

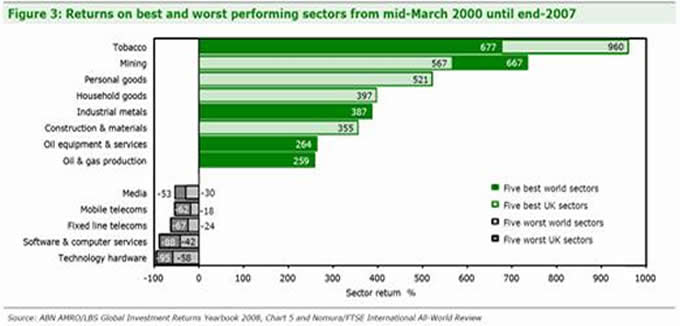

Best Performing Sectors. Another interesting output of the study was the finding that since 2000 certain sectors have performed incredibly well in the global markets.

On a global basis most of these sectors are in the commodity sectors – mining, metals, and energy, as well as the tobacco sector.

One of the authors of the study noted that finding an attractive sector is especially important for an investor, and he claims this explains why some investors like Warren Buffett have done so well. A well performing sector, with a strategy to buy well performing stocks, historically has generated substantial excess returns.

The researchers conclude: “The momentum effect, both in the UK and globally, has been pervasive and persistent. Though costly to implement on a standalone basis, all investors need to be acutely aware of momentum. Even if they do not set out to exploit it, momentum is likely to be an important determinant of their investment performance.”

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2008 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.