Gold and Silver Remain Overbought

Commodities / Gold & Silver Mar 30, 2008 - 10:45 PM GMTBy: Joe_Nicholson

“Notice two important indicators may be showing short term support ahead in gold. Silver may be putting in an internal fourth wave.” ~ Precious Points: What Goes Up…, March 22, 2008

If last week's update said gold could go to $800 and silver to $15 without technically damaging their bull markets, then some might assume the positive price action last week in precious metals must be super-bullish and that it's time to pile back in. But that's clearly not the case, as shown in the weekly gold chart below.

Periods of decline in gold characteristically find resistance at the 5-week moving average, just as it is typically support during advances. In this case, it took a rally of nearly 60 points from the recent lows to reach this level, and short term traders may have taken advantage of the move, but the crucial level proved to be resistance on Thursday, which was further confirmed by Friday's decline. Now with a potential negative crossover in the MACD possible for next week, gold could face increased selling pressure if it cannot clear the 5-week sma in short order.

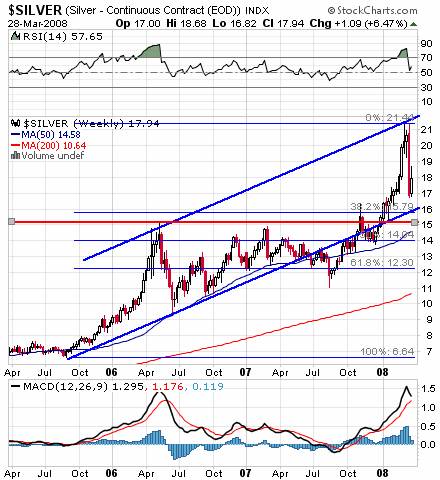

The chart of silver above may seem complicated, but it's actually fairly simple. First notice silver has described an ascending channel from late 2006 and has recently tested both extremes. The lower limit of that channel now coincides with a .382 retrace of the advance from late 2006, creating a strong band of support between $16.25 and $17.25. Silver could even decline to the red horizontal line at about $15 and still be in a valid wave 4 retracement, with new highs ahead.

Though precious metals seemed to fly in the face of the many pundits who jumped on the bandwagon last week after the declines to announce the end of the bull market, it is still too early to say decisively that we've seen the end of this correction, even if there are advances early next week. But we are even further from confirming the opinion of those who expect catastrophic declines in these metals to pre-bull market levels.

Last weekend, TTC members were given the chart above suggesting mining stocks could be set to continue outperforming the broader market, despite the previous week's commodity selloff. After dropping to attractive valuations, mining stocks were one of the top performers last week and unless there is a significant decline in metals prices next week, that trend could continue, particularly if both stocks and metals rally.

But frankly, though it seems unlikely to happen, have no illusions about the fact gold and silver could be decimated virtually overnight if the Treasury were to announce some currency intervention program or if the ECB were to soften its tone against inflation. There's also risk the dollar could move higher even without such bold and explicit declarations. And, with precious metals already vulnerable, and the U.S. Federal Reserve banking on inflation pressures to subside, getting aggressively long the metals here does not seem the prudent move. The entire economy and all markets appear to be in a holding pattern, at a crossroads, and a path will soon be chosen. The long term prospects for precious metals continue to be favorable, but a little patience now could prevent a lot of frustration later. And, if gold is on its way to $1200 and beyond, waiting until it clears and holds $960 to get long will significantly reduce your risk while hardly limiting your profit potential!

TTC will close soon to new membership.

We originally thought we would close the doors to new retail in June or July , but I've decided to move that up closer to May 31 , Memorial Day weekend. The opportunity to join the TTC community of traders is slipping away from retail investors. If you're really serious about trading learn more about what TTC has to offer and how to join now .

So, do you want to learn how to trade short term time frames? Would you like access to next week's charts posted in the weekly forum right now? Ten to twenty big picture charts are posted every weekend. If you feel the resources at TTC could help make you a better trader, don't forget that TTC will be closing its doors to new retail members on May 31, 2008 . Institutional traders have become a major part of our membership and we're looking forward to making them our focus.

TTC is not like other forums, and if you're a retail trader/investor looking to improve your trading, you've never seen anything like our proprietary targets, indicators, real-time chat, and open educational discussions. But the only way to get in is to join before the lockout starts - once the doors close to retail members, we'll use a waiting list to accept new members from time to time, perhaps as often as quarterly, but only as often as we're able to accommodate them. Don't get locked out later, join now.

Have a profitable and safe week trading, and remember:

"Unbiased Elliott Wave works!"

by Joe Nicholson (oroborean)

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts,, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

Joe Nicholson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.