Why Everything You've Heard about China's Yaun Currency is Wrong!

Currencies / China Currency Yuan Jul 26, 2013 - 01:28 PM GMTBy: Money_Morning

Robert Hsu writes: Nearly everything you've heard about China's currency, the yuan, is dead wrong. It's not undervalued and it's not undercutting the U.S. dollar as the financial press and politicians like to point out. I'll show you why.

Robert Hsu writes: Nearly everything you've heard about China's currency, the yuan, is dead wrong. It's not undervalued and it's not undercutting the U.S. dollar as the financial press and politicians like to point out. I'll show you why.

You likely heard that China recently reported it had grown just 7.5 percent in the second quarter of 2013, the lowest level in over three years.

What you likely don't know is, more than half of that growth came from wasteful infrastructure and property investments, such as this: http://www.ibtimes.com/worlds-largest-building-new-century-global-center-opens-chengdu-china-1330585.

China uses government investments as the main channel to pump money into its economy. The resulting monetary growth makes the Fed's quantitative easing seem like child's play.

Another thing - a very important thing - you likely haven't heard is on a purchasing power parity basis, the Chinese Yuan is overvalued - not undervalued - versus the U.S Dollar.

The Yuan used to be a cheap currency before 2008, but this changed after the Chinese government responded to the global recession with massive stimulus investment spending. Driven by the greatest construction spree in history, Chinese banks lent out trillions and the country's money supply grew three times as fast as the U.S.

Chinese Currency is Strong

Unlike the Fed, the Chinese central bank can order commercial banks to lend money and directly pump liquidity into its economy.

For five years, Chinese banks recklessly lent money to local governments and other state-owned enterprises, enriching government officials, bankers and state-owned enterprise managers in the process.

$3 Trillion in Funny Money

Investment lending, corruption and spending spiraled out of control. China spent $3 trillion on investments, and the funny money caused real estate prices to triple and inflation to skyrocket.

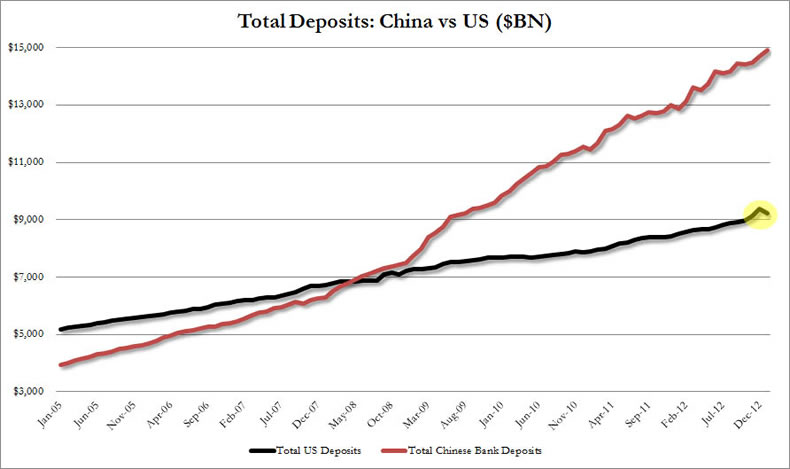

Even though the U.S economy is about twice the size of China's, the Asian giant's M2 money stock is 70% greater than the U.S.

Just in Q1 of this year, credit expanded by $1 trillion in China, equivalent to an entire year's Fed quantitative easing. Yet despite excessive money creation, the Chinese Yuan rose 9% against the dollar since 2008, making the Yuan more overvalued.

Inflation: China Style

China's monetary excess fueled its investment bubbles and inflation, both were worsened by the fact that newly created Yuan is not freely traded and largely trapped in the country.

The Yuan lost over 60% of its purchasing power in the past five years. To prevent purchasing power from eroding, Chinese investors bought all sorts of real assets, from fine wine, jade, real estate to gold,

If you want to see evidence of the Yuan's over-valuation, just go to any major high-end department store in New York or Los Angeles, where you will see droves of Chinese tourists stocking up on Louis Vuitton and Coach bags faster than canned goods before a zombie attack in the movie World War Z.

According to the U.S. Office of Travel and Tourism Industries, Chinese tourists spend an average of $2,932 per visit to California, compared with $1,883 for other overseas visitors because the Chinese know that their Yuan, when converted into cheap U.S dollars, goes a lot further here.

Because of rampant inflation, just about anything that is high quality in China costs more there than in the U.S.

In Shanghai, where my money management company has an office, the cost of office rents, laptops, clothing, sneakers, cellphones, talented professionals, cars, wine, coffee, etc. is usually 20% to 200% higher than in Los Angeles. This is true even for branded goods, such as Nike sneakers and HP laptops that are made in China.

You can buy cheaper unbranded goods produced by local Chinese companies, as most of the less affluent locals do, but the quality is usually shoddy. For instance, Chinese branded AA batteries for my electric toothbrush usually last only a few days, while Duracell batteries usually last for months.

Politics Trump Economics

Although the Yuan is overvalued, I wouldn't bet against it just yet. Because of currency control, Dollar-Yuan exchange rates are driven by politics rather than economics. Political pressure from Washington prevents the Yuan from losing ground against the dollar for now.

Long term, though, contrary to what many U.S politicians claim, a Yuan that loses purchasing power will depreciate against the U.S dollar.

That's why investments, not exports, drive China's economic growth. The most recent data shows Chinese exports are down 3.1% year-over-year while total GDP rose by 7.5%, mostly from investment growth.

Investments make up a greater percentage of Chinese GDP growth than exports and domestic consumption combined.

Unlike the previous Chinese administration that engineered this monetary bubble, new Chinese premier Li Keqiang recognizes the growing risks posed by this credit bubble.

A few weeks ago, Beijing forced banks to curtail investment lending and caused a liquidity crunch in China. Cutting back on investment spending will cause GDP growth to slow even more, but it beats massive inflation and debt default.

Investors need to prepare for a slower growing China.

Avoid investing in resource countries that rely on Chinese commodity purchases for economic growth, such as Canada, Brazil and Australia. You should also watch out for any potential fall-out from the coming China bubble deflation.

The world's No. 2 economy will remain an important force and should be on everyone's radar screen.

But for now, when it comes to investments, focus on the world's No. 1 economy right here at home. The Fed's easy money policy won't end anytime soon and robust earnings will drive stocks higher.

Robert also guides you to the right way to look at investing for retirement here. It's to look beyond wealth preservation and to actively manage your portfolio.

Source :http://moneymorning.com/2013/07/26/most-everything...

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.