Deciphering Bernanke - Horse, Pig, Helmet, Man, Woman

Politics / US Federal Reserve Bank Jul 23, 2013 - 03:46 PM GMTBy: John_Mauldin

Grant Williams writes: Arthur Evans died in July of 1941 at the age of 90.

Grant Williams writes: Arthur Evans died in July of 1941 at the age of 90.

A rather ordinary name disguised an extraordinary life during which the famed archaeologist made many notable discoveries, including the unearthing of the Minoan Palace at Knossos, the site of a famous Greek mythological tale.

Legend has it that this huge palace complex which comprised hundreds of rooms linked by a labyrinth of passages, was home to the fearsome Minotaur, the half-man, half-bull who devoured seven young Athenian men and seven maidens every seven years until he was killed by Theseus with the sword of his father, King Aegeus.

Of course, this being Greek mythology, an unequivocally happy ending just wouldn't do, so the tale finishes with Theseus's neglecting to raise a white sail upon his return as a sign to his father that he has been successful in his quest, and Aegeus's promptly committing suicide by throwing himself into the sea that today bears his name.

Of course, this being Greek mythology, an unequivocally happy ending just wouldn't do, so the tale finishes with Theseus's neglecting to raise a white sail upon his return as a sign to his father that he has been successful in his quest, and Aegeus's promptly committing suicide by throwing himself into the sea that today bears his name.

What is it with Greeks and a dearth of happy endings? Actually, scratch that question. We'll get back to it later.

Where were we? Ah yes, Arthur Evans.

During his excavation at Knossos, Evans would also discover a series of tablets dating back to the Bronze Age that bore a riddle in the form of a set of mysterious inscriptions destined to baffle the world for the next half a century — haunting Evans to his grave.

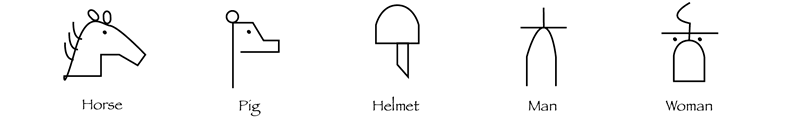

The inscriptions were like nothing ever seen previously: although they contained a set of pictograms that were fairly easy to decipher, there was also a set of cryptic characters that would consume some of the smartest minds of a generation until, 52 years after their discovery, an Englishman called Michael Ventris would at last be credited with solving the riddle of the language that Evans had, for reasons known to only himself, named Linear Script Class B — or Linear B for short.

In the years that intervened between Evans's discovery and Ventris's solution, an American college professor named Alice Kober would devote her life to the unraveling of Linear B; but, though her work undoubtedly laid the groundwork for Ventris's discovery, it was the Englishman who received the acclaim. Such is the way in matters like these, unfortunately.

The pictograms contained in Linear B were simple in construction — let's face it, even I could have figured this little lot out:

... but the rest of the inscriptions were baffling.

In fact, after 40 years of studying them, Evans had managed to decipher just a single word: total. This word appeared at the bottom of what were clearly accounts and inventories, but the wider meanings of the components of those accounts were shrouded in mystery.

Ventris didn't come across Kober's life's work until two years after her death at age 43. Then, using an all-important "key" derived from her exhaustive research, he finally unlocked the code and solved the riddle. By then, of course, it was too late for Evans and too late for Kober.

It may well be that, in 40 years or so, historians will uncover the recent comments and testimony of Ben Bernanke and his fellow Fed governors and spend a lifetime parsing them to detect any semblance of sense contained therein. Unfortunately, we who would invest or do business are forced to try and decipher them in the here and now, and that causes enormous problems.

Lately, Fedspeak Nonlinear B has plummeted to new depths of indecipherability as frantic Fed governors, terrified by the extent of the reaction to the slightest hint that the Free Money Express is pulling into the station, have scrambled to fine-tune the effects their hieroglyphics have had on markets.

Bernanke himself has been the "key" to solving the latest riddle, but so far the Da Benci Code has remained an enigma. Take for example this week's Humphrey Hawkins testimony — his last before he retires in January 2014.

The closest we have to a "key" these days is something called the "Hilsenrath Stone", which was uncovered a few years ago based on word-frequency patterns in Bernanke's speech. Using the Hilsenrath Stone, we can readily discern the specific bits of language that Bernanke himself thought were important, and by extension we may be able to decipher the wider code.

To continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore – please click here.

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2013 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.