Gold - 'Never Mind', Quantitative Easing Is A Time Bomb

Commodities / Gold and Silver Stocks 2013 Jul 23, 2013 - 03:30 PM GMTBy: Submissions

John Ing writes: "Never mind" was how Gilda Radner's character, Emily Litella ended her rants on Saturday Night Live. Ben Bernanke should have said "never mind" after threatening the Fed might take the punch bowl away. Within days, following a panic in the markets he later recanted fearing that the hangover could be worse. The threat of the end of easy money was enough to knock a third off the gold price including a collapse of $150 in only two trading days in April. The prospect of higher rates caused big losses just after the Dow and Standard & Poors reached new highs. While the Fed's addiction to cheap money eased some of the pain from the financial crises, surprisingly not enough money was printed to sustain global growth. Instead trillions flowed into riskier investments inflating a string of asset bubbles in the financial world, destabilizing normalized markets as investors chased stocks and bonds in the search for higher returns.

John Ing writes: "Never mind" was how Gilda Radner's character, Emily Litella ended her rants on Saturday Night Live. Ben Bernanke should have said "never mind" after threatening the Fed might take the punch bowl away. Within days, following a panic in the markets he later recanted fearing that the hangover could be worse. The threat of the end of easy money was enough to knock a third off the gold price including a collapse of $150 in only two trading days in April. The prospect of higher rates caused big losses just after the Dow and Standard & Poors reached new highs. While the Fed's addiction to cheap money eased some of the pain from the financial crises, surprisingly not enough money was printed to sustain global growth. Instead trillions flowed into riskier investments inflating a string of asset bubbles in the financial world, destabilizing normalized markets as investors chased stocks and bonds in the search for higher returns.

But gold's collapse was different and in our opinion, more technical than fundamental. The orchestrated dumping of 400 tonnes on Comex in April was symptomatic of the casino-like atmosphere created by quantitative easing. Most telling was the collapse sparked a wave of record buying of physical gold around the globe, especially in China. Bar premiums went to double digit levels as gold went from weaker hands such as the ETFs to stronger ones like the central banks and Chinese housewives. We believe gold's secular bull market that began in 2000 is intact as investors will once again seek insurance against the unresolved economic and political risks, providing a solid foundation for record gold prices.

Quantitative Easing Is A Time Bomb

And while everyone danced around the punch bowl, the main problems were postponed and unresolved. The fix of easy money is like a drug, having less of an impact as time moves on. Zero interest rates are a money illusion that can't save the economy from mounting public and private sector debt, postponing the day of reckoning. And, unknown are the consequences of a lower dose of the Fed's medicine (aka tapering) which is likely to bring a wave of bad debts and financial failings much bigger than 2008. Just a hint of the needed brakes caused a rush for the exits, raising the risks of a further slowdown in an already anemic pace of growth, a jobless recovery.

Overshadowing all this is the phenomenal increase in sovereign debt which has been rising faster than GDP and painfully obvious is that the more money, the less bang for the buck. For example in late 2008, quantitative easing (QEI) was Ben Bernanke's grand experiment with almost $800 billion of bond-buying and yet unemployment was stuck at 10 percent. The Fed created trillions of dollars in response to the financial crisis and subsequent recession. Then a second round of bond buying, QE2 of about $600 billion followed in 2010 but also did not have much impact although Standards & Poors did lower America's credit rating. And of course, QE3 saw the Fed purchase $40 billion a month, which was doubled to $85 billion a month for an indefinite period. Noteworthy was each successive intervention had diminished returns yet, trillions later, unemployment is stuck at 7.6 percent while the Fed's balance sheet has exploded over $3.4 trillion, and still climbing.

In essence the market hopes were pinned on an untried growth model which has not worked. And while the perceived absence of inflation clearly enables the central bank to keep the pedal to the metal, trillions have fed asset inflation bubbles from stock markets to oil and condos. Meanwhile producer costs have ratcheted ever higher for both energy and commodities.

Quantitative easing operates primarily through two channels. In the first channel, the central bank purchases government paper bringing down interest rates, making it cheaper for debtors but penalizing savers. However, the artificially low cost of debt instead of reviving the economy, forced savers and investors into higher yielding yet riskier assets. The Bank for International Settlement (BIS) recently warned, "it seems less and less likely that central banks cannot repair the balance sheets of households and financial institutions". The second channel is a consequence of the first, where exchange rates drop as a result of the money printing. Quantitative easing was to lower the dollar and help exports, however, much of the money spilt into other currencies sparking currency battles. And now central banks are intervening in a defacto currency war whilst the Fed eyes an overdue exit. Not only was the Fed's monetary experiment unprecedented but its exit is uncharted and unknown. To be sure, the punch bowl was only just refilled, not taken away and yet another building block for higher gold prices.

Debt Keeps Getting Higher and Higher

In less than five years President Obama added trillions to the national debt currently at $17 trillion or 103 percent of GDP. In 2001, the national debt was some $6 trillion. Too much government spending was financed with too much debt. With America's public spending stuck at 25 percent of GDP, the most since World War II, the Federal Reserve was forced to finance consumption. And the US federal debt burden would surge further if costs for entitlements like social security, Medicare and Obamacare are included. America's debt is greater than the entire Eurozone and UK combined debt. Unresolved is another battle this fall over raising America's borrowing limit which was postponed temporarily until September by raiding billions from Fannie Mae's piggy bank. Unresolved too and not passed is President Obama's budget. Even Jack Lew, the new US Treasury Secretary said, "The bottom line is that the debt limit and the fact that we don't have a solution for the debt is also the reason for the crisis". Future generations are left with a debt they cannot pay and to be sure, this spending and public profligacy is unsustainable.

The amount of debt is one thing but the cost of interest payments is another. Markets mistakenly believe that the real problem is not the level of America's debt since servicing costs appear manageable. How short-sighted. History shows that the average interest cost on a five year Treasury note is almost 6 percent. Today, the burden of servicing America's debt is just 0.9 percent of GDP, the lowest level in 50 years. However with rates returning to the norm, then the US debt burden could cost a whopping $600 billion a year or more than the annual cost of any federal program except Social Security. Another building block for higher gold prices.

So what should policymakers do? After Mr. Bernanke's musings, the world's central bankers lost control over rates in the biggest global bond sell-off in history. The Bank of Japan, after ushering a Japanese-style quantitative easing program caused a reversal of the "carry trade" which encouraged investors to sell offshore holdings resulting in a collapse of their market. After billions of losses, what happens when rates actually do rise and QE ends? Of course, interest rates would rise and so too the cost of debt.

Looks Like An Exit, But Is It An Exit?

But we were told that quantitative easing would allow the economy to grow and buy time for needed structural changes. The pattern is familiar. Ever since the Fed began easing there was a promise of change. Reforms were to complement the Fed's zero interest rate policy. Dodd-Frank hasn't fixed the "too big to fail" problem. Obamacare has been postponed and a majority of states have opted out. The Volcker rule was relegated to the scrap heap. Gone are comprehensive tax reforms mired in a still yet to be passed budget and tax reform instead has become a "war on wealth". Gone is the call for austerity with policymakers pointing to sky high stock prices as evidence that austerity is not needed. Gone also, is the emphasis on fiscal policy as a solution and in its place, rhetoric and promises. The trillions of savings bought time and unfortunately made it too easy for politicians to delay action. More likely is that the Fed's new "tapering" policy will be a "rebranding" exercise of QE to make it look, sound like an exit, but it won't be an exit - just more of the same and another building block for higher gold prices.

Amidst this, Europe's pain continues. Despite a hiatus, new growth sources disappeared. The numbers are grim. Unemployment remains at near record levels as Europe pays for past excesses. Political turmoil has plagued the Eurozone, yet again. Portugal's government is in tatters while Greece and Italy's finances worsen. Europe still hasn't got its act together and despite rhetoric, remains more of a political union than economic union. Over a year ago, the EU planned to unify their banking systems which has become more of a goal than reality since each of the 17 members are clinging to their provincial rules. Germany rightly worries that it faces almost unlimited liabilities if the banks pool their assets and liabilities. At yearend, Greece's non-performing loans were 24 percent of loans, in Portugal 10 percent, Ireland at 15 percent and Spain at 11 percent. Major schisms between Hollande and Merkel have emerged which can't be glossed over in advance of the German elections this fall. And having admitted that they botched the bailout of Greece, the IMF and EU are proposing to use the Cyprus bank "bail-in" template ensuring states will exact pain from both creditors and taxpayers. Taxpayers have become bailout weary so the bail-in provisions are the only way of dealing with the next round of bankruptcies. Particularly odious, is that this confiscation of wealth from bondholders and savers shifts the credit risk again from the government to the private sector, which lays another building block for higher gold prices.

As a consequence of the inflation of both money and credit, the world has some $209 trillion in financial assets consisting of about 75 percent or $156 trillion of debt, exposing the global financial system to trillions of paper losses when rates rise. The health of the global financial system is ultimately tied to the health of the countries and the penchant to increase sovereign debt as a panacea for our problems has again made the banking system vulnerable. The banking system thus remains at the center of mounting concerns over the Fed-induced worries whether "tapering" will trigger a debt crisis. The irony was that the collapse of Cyprus' banks was caused by their loading up on cheap Greek bonds, taking advantage of cheap loans from the European banking system.

An Owl Market - To Who?

Indeed with the Fed financing forty percent of all debt issuances, it has become the market and thus any exit is fraught with liquidity risks - a typical "owl" market - "too who" does the Fed sell the mountain of debt to? Of concern is that despite trillions of handouts, the global banking system remains heavily undercapitalized, even under Basel III. Higher interest rates and more bailouts will make this sector riskier exacerbating vulnerabilities. Today, banks have limited ability to absorb losses of higher interest rates or even another round of bad loans. When the swamp drains even the ugly frogs are exposed. We also believe the health of the sovereigns will become a concern again and the prospect of higher rates and an eventual end to quantitative easing will cause a flight from the US dollar, the currency of a heavily indebted sovereign and much weaker than Europe. Although possessing the world's reserve currency, the Fed's balance sheet is at a record $3.47 trillion and the country has again exceeded its debt limit, further debasing its currency. Washington must relive the debt limit this fall which raises the risk of a run on the Treasury causing turmoil in the financial markets and damage to the economy. Déjà vu? The largesse and patience of lenders cannot continue forever, and another building block for higher gold prices.

Then there are derivatives, the main tools of the shadow banking system which were supposed to act as insurance against the debt default by a company or a sovereign government but morphed into "weapons of mass destruction" causing the subprime crisis and the financial meltdown of 2008. Dodd-Frank was supposed to fix the system, but its rules were so complex that many parts have not been enacted including tightening restrictions on the use of derivatives. Since sovereign health remains a concern, the biggest risk in our view remains the largely unregulated $600 trillion derivative market at ten times the size of the world's economy. While the derivative community says that the derivatives are matched, recent data shows that the interest rate and currency swaps are more leveraged than in 2008 and an Italian inquiry is looking into the usage of derivatives alarmed at the potential losses of billions following the restructuring of contracts last year. And of course, derivatives remain a big source of profits for the banks which have become bigger after the bail-outs and yet those same players are considered safer today despite JP Morgan managing to lose $570 million in one trade. Does anyone learn? Never mind.

Is Gold's 12 Year Bull Run Over?

Currently the bandwagon for gold is empty. Although the price drop was sharper than expected, the price collapse pales in comparison to the drop in Apple or Facebook or even recently, the Japanese market. Yet gold receives more media attention than Mayor Ford receives in a week.

The Commodity Exchange (Comex) is owned by the CME group, the world's largest futures market where investors and commercials buy or sell commodities for future delivery. The price and size of the commodity contracts are linked to the physical commodity, in name only, since only a small portion of the commodity is actually held in the Comex warehouses. Indeed commodities no longer are consumption based but driven by the financialisaton of our markets where low rates and excess liquidity are bigger influences.

We believe the gold market like other markets has been manipulated by the financial engineers of today. In fact, in any month, less than five percent of the open interest is actually delivered against contracts while the majority is rolled over into the following month. At times, there is a growing "short" position but surprisingly, Comex physical inventories are being drawn down and curiously, as the gold price went lower, so did withdrawals from Comex warehouses. The other price determinate is the London gold fixing where the price of gold is set twice each day by the five members of the London Bullion Market Association. Many of those members are also big traders in the futures market. Not surprisingly something like three million ounces worth $3 billion or more than 10 times the annual supply of gold is traded daily. Unlike the LIBOR lending rate, which was overhauled by regulators who found that the members manipulated interest rates in their favour, the London gold fixing mechanism remains untouched and open to abuse. Something similar might be happening in the gold market.

Paper or Fiat Gold vs Physical Gold

With almost a thirty percent drop in bullion, physical ownership has become increasingly desirable as ownership becomes nine tenths of the law. The gold market has seen a shift away from paper or fiat gold (futures, contracts and ETFs) to the physical market. Paper gold has counterparty risk, while physical gold is tangible and always fungible. Unlike paper gold and fiat money, the supply of physical gold is limited. ABN Amro, the Dutch state-owned bank recently defaulted, offering cash instead of gold to their customers holding gold at the bank. We believe that the squeeze will continue as more and more central banks repatriate their gold and sop up what physical supplies are out there. There is even a school of thought that the April collapse was orchestrated by certain central banks and bullion funds in need of physical gold. After all, some 700 tonnes of gold from the ETFs somehow found a home among those needing physical gold.

The ownership issue even raised questions over the gold stored in Comex warehouses which is actually a tally of the individual holdings of Comex members. Amazingly those holdings are not audited, just like the gold in Fort Knox. The Comex legal beagles recently issued a disclaimer, "The information in this report is taken from sources believed to be reliable, however, the Commodity Exchange Inc disclaims all liability whatsoever with regard to its accountancy or completeness. This report is produced for information purposes only". Today that disclaimer seems not as boiler plate. No wonder then that physical gold trades at a premium to paper gold, there is simply a growing shortage of physical gold.

We believe there is a structural change happening to the market, akin to a classic short squeeze. We note the lack of physical gold backing those contracts as the net position of Comex stocks have plummeted to lows. Comex short positions skyrocketed on bets that the price would fall further according to the Commitment of Traders Report. Traders are taking advantage of the financial arbitrage utilizing cheap financing to leverage, purchase or sell forward, exposing themselves to huge risk changes. Given the large number of short positions, we expect that the next few months will force some of those shorts to cover their positions, underpinning the gold price as the eventual unwind will take gold to new highs.

Where is the Gold?

We also believe the fundamentals of the gold market are changing and ironically, while the world central banks were big sellers in the eighties, they are now big buyers, in particular the creditor nations like China, Korea, Russia, and Kyrgyz Republic. Nineteen central banks bought gold last year. Gold is slowly moving from the indebted West to the East, particularly since China is sitting with foreign exchange reserves of $3.5 trillion and in need of an outlet other than the dollar. Chinese physical demand in the first six months has exceeded the entire amount taken on the Shanghai Gold Exchange last year and more than double that country's annual production.

The global central banks are loading up on gold because they too are worried about the supply of physical gold and the safety of their reserves. At one time, central banks lent gold to the bullion banks to help hedge programs of the gold miners. Of course that turned into a disaster when the gold price moved upward, resulting in Barrick taking a $5 billion beating. However when Barrick reversed its position it caused a rush for gold, and for some central banks, the gold they had thought they had did not return. In addition, during the European crisis, some members' gold was loaned out as collateral, but the actual physical location of the gold became a mystery and that gold too is missing. As a result

Germany requested the repatriation of its gold held at other central banks but were told it could take up to seven years for delivery. And following the Cypriot debacle a few months ago, when savers' assets were seized there was an inevitable a rush for physical gold and all of a sudden, investors are talking of "allocated gold" and "unallocated gold". The bottom line is that while there appears to be a lot of gold, no one knows how much physical gold resides in any vault.

Gold's 34 percent correction is in line with the 2008 price correction that saw gold recoup all its losses, posting record highs in 2011. Gold miners fell a whopping 76 percent and 52 percent in one month alone, but soared 95 percent to new highs. We also recall the seventies when gold went from $35 an ounce in 1971 to almost $200 an ounce but fell back nearly 50 percent to $104 an ounce. The bandwagon emptied and gold's bull market was declared over. Of course, gold rallied eight times to close at $850 an ounce in January 1980. Gold always posts new highs.

Some say that interest rates are set to rise and gold would not do well in those conditions. Looking more closely, gold does well when there are negative interest rates, as there is now. Even, with the recent increase in interest rates, rates are still negative which is good for gold. Still others point to the fear that central banks would sell their gold when they got into trouble. That is untrue since gold sales were suspended a couple of years ago and even during the European crisis, gold was used as collateral for loans. Ironically, Canada, among the strongest industrial countries was an exception selling a paltry 615 ounces in May leaving our nation with 101,820 ounces. The last major sale was the UK government's disposal of 395 tonnes over 17 auctions at an average price of $275 per ounce, raising $3.5 billion. Today, that gold is worth $15.8 billion.

We further believe that gold's pullback was not due to the absence of inflation or that gold's role as a hedge against inflation is over. Although we have asset inflation in stock prices as well as other commodities and to be sure, in services like the high inflation period of the seventies, everyone misses that gold's twelve year run to $1,900 an ounce came when inflation was moribund or almost non-existent.

Still many have declared gold's glory days over, but few remember that for thousands of years, gold has been money, a store of value and barometer of investor anxiety. To be sure today, there is a lot of anxiety over the Fed's exit from ultra-loose policies. Yesterday's problems are today's. Gold's role as a hedge against debased currencies has not gone away just because of a bout of profit taking, particularly during the money printing episodes so prevalent today. For twelve years, gold has provided protection against this money printing.

We thus believe, gold's correction was normal. The world's stock markets have been among the biggest beneficiaries of the US Federal Reserve's ultra-loose monetary policy. That golden era is ending. A new era was sown with the seeds of easy money. We thus believe we are at the end of gold's correction and bullion's bull market is only half over. While gold is an ancient currency, it underpins the world economy - it has become the default currency, independent of governments. We continue to expect gold to reach $2,000 an ounce this year and ultimately $10,000 an ounce. Near term we expect gold's technical bounce to $1,350 and then find meaningful resistance at $1550 from which the "johnnies come lately" will declare a new bull market. Gold's obituary is premature and the so called money illusion called quantitative easing ensures new highs.

Recommendations

The once popular gold ETFs suffered its biggest losses, losing more than $54 billion in value this year. Assets in the SPDR Gold Trust, the biggest, fell below 1,000 tonnes for the first time since February 2009. The gold miners did worst, losing half of their value in reaction to the collapse in gold and the fallout from their overpriced and overbuilt acquisitions that were bought recklessly in the golden heydays. In recent weeks the gold miners have recorded mega writedowns of more than $19 billion of their assets led by the senior companies Barrick, Newmont, Newcrest in Australia, and AngloGold Ashanti.

The industry has been forced to write down billions after spending almost $250 billion on acquisitions in the past decade. While gold has dropped 24 percent so far this year, the stocks have done even worse losing more than half of their value. The lower price of gold will also force writedowns of reserves since many like Barrick used $1500 to value their reserves. The miners have become leveraged bets on gold and the market is afraid of revenue leverage not the upside, but the downside. The industry is set to shrink itself and Barrick axed 100 office jobs in Toronto. In addition, gold miners are reassessing projects with a lower price deck. Kinross is expected to take a $720 million charge in the second quarter after it shelved Fruta del Norte in Ecuador. The industry has long talked about growth but now the new industry mantra is profitability. The industry is going to have to boost margins, cut back exploration and rid themselves of high cost assets. The major players have scaled back projects and exploration, taking big writedowns. Many are embroiled in negotiations with hostile governments who are pushing for either higher returns or in fact ownership of those deposits. As such many miners are starved for cash. So far there have been six CEOs replaced and where changing the coach might work in hockey, the track record to date is not so good for the mining industry.

Our view is that the gold market is tightening and that the gold mining companies are the only new source of new unallocated supply. Mining stocks are leveraged bets on the gold price. As such, we do not expect the gold stocks' non-performance to last long. The in-situ reserves of the gold miners are trading at less than $250 an ounce - too cheap. The markets are wrong footed at this time. The fundamentals have not changed and the realities of the gold market are that this bull market is only a calf.

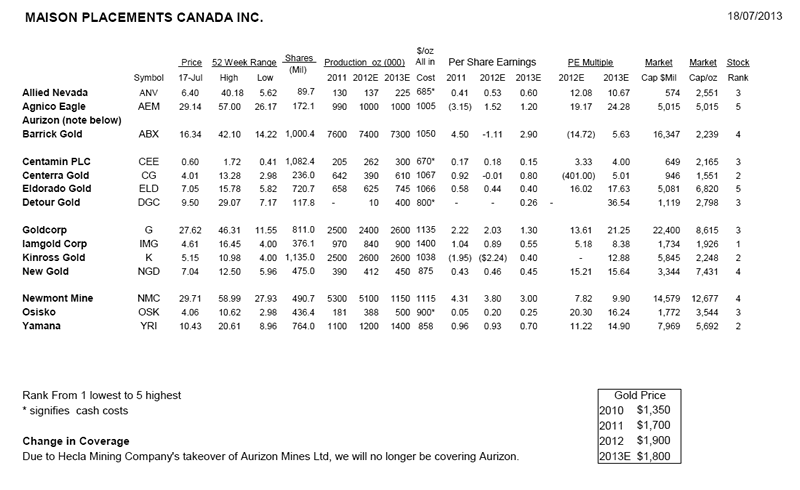

But not all gold companies are created equal. Some are undervalued. There is an ever dwindling supply of gold deposits, and in fact in the last five years, there has been a reduction in the discovery of deposits of more than five million ounces. Indeed, there have been only six discoveries in the past three years of that size. In addition the huge capital required to develop those deposits have resulted in a financing problem for even the mid-tier companies. We believe that gold stocks offer compelling value here, particularly since they have discounted and at long last recognized many of the problems outlined earlier. We continue to recommend the midcap like Agnico Eagle and Eldorado. Barrick is even a trade here.

Agnico-Eagle Mines Ltd

Agnico-Eagle's quarter was in line with the Street's expectations and importantly all-in costs remain less than $1000 an ounce. Nonetheless, Agnico-Eagle's shares are trading at net asset value (NAV). Agnico has taken advantage of the collapse by spending $50 million to buy stakes in four junior mining companies with interesting exploration upside. Rather than blow the bundle on a single takeover, as its competitors, Agnico is making strategic investments looking to build a portfolio of future producers. The LaRonde mine in Quebec remains the flagship with Goldex and La India in Mexico will make contributions this year. Agnico has operations in Quebec, Mexico, Finland and Nunavut. We like the shares here.

Barrick Gold Corp.

Barrick is facing a fresh wave of analysts' downgrades on concerns that the albatross Pascua Lama will sink the company. Barrick has lost almost half of its value, following a stunning $5.5 billion writedown for Pascua Lama. The cost of Barrick's Pascua Lama has escalated following the court decision that caused the suspension of the project and the total price tag could reach $10 billion. In addition the panic selling of gold has caused a reassessment of Barrick's other assets. Further writedowns of the African mines are expected. Barrick has since wrote down $3.8 billion of its Equinox Minerals which it acquired for $7.5 billion. The Lumwana Mine in Zambia continues to lose money and is a disappointment. Barrick has reduced its capital expenditures by $1.4 billion to $1.8 billion yet, investors are concerned that with a debt load in excess of $13 billion and having spent $5 billion at Pascua Lama that Barrick is caught between a rock and a hard place. We believe that Pascua Lama should be shelved, and that the 18 million ounces of proven and probable reserves will stay in the ground and not disappear.

Not only is Barrick facing operating problems but its shareholders have criticized the company for feathering their nest with $200,000 a year director fees, and a whopping payment to co-chairman, John Thornton. That investors are focusing on what is normally overlooked is a reflection of how far the world's biggest gold miner has fallen. However, we believe that Barrick's misfortunes are overdone and over-exaggerated. Barrick still has a treasury of $2 billion in cash and an undrawn credit line of $2 billion. The debt bullet repayments are not due until 2016, so Barrick has flexibility. Even if Barrick should halt construction at Pascua Lama, they will owe Silver Wheaton some $625 million. Barrick has already paid some of that with silver deliveries and could repay a good portion with output from its other mines or in fact take advantage of the drop in silver price and make delivery with silver open market purchases. The bottom line is that with 60 percent of Barrick's production from only five mines, Barrick has options. Asset sales are thus likely. In addition, Barrick has already begun reducing costs selling assets and could slow down work at higher cost mines. Further Barrick could monetize some of its assets and in fact why not a royalty scheme, which would show investors some money. In essence, there is flexibility. We believe that Barrick is a trade down here.

Goldcorp Inc.

Goldcorp has a great balance sheet with almost $2 billion in cash, however its multi-billion cornerstone Peñasquito poly-metallic mine in Mexico has become Goldcorp's Pascua Lama with another disappointing quarter (water and low grades this time). And now a legal dispute over ownership of part of the open pit has surfaced. Peñasquito continues to underperform and is a candidate for writedowns. In addition, newly open Pueblo Viejo mine, which it shares with Barrick, also faced a revised deal, after the government pushed for a bigger stake. While the main deal was kept intact, Goldcorp and Barrick will have to accelerate payments to the government, further reducing the margins on that project. Goldcorp has some big plans to expand production by 2017, but with those big plans come big capex. We expect Goldcorp like others to pare down its portfolio including highly prospective Eleonore in Quebec which is scheduled to

start up in 2014. Other projects that could be deferred including Cerro Negro in Argentina and 70 percent El Morro in Chile. Goldcorp should produce about 2.6 million ounces this year at a total cash cost of $1100 per ounce. We prefer Barrick here.

IAMGold Corporation

IAMgold's results have been a disaster as costs rise. Despite a capital constrained environment, IAMGold persists in the development of Côté Lake despite the $1 billion expenditure. IAMGold's focus on costs, is also limited because they are not the operator of some of its mines and thus have no control over costs. IAMgold should also sell Niobec and concentrate on gold mining. We would avoid the stock here.

Kinross Gold Corp

As expected Kinross has walked away from the Fruta del Norte project in Ecuador because the company could not come to an agreement with the Ecuadorian government over on extension of its contract. Consequently Kinross intends to write-off $720 million in the quarter. Kinross acquired Fruta del Norte in a $1.2 billion takeover of Aurelian in 2008 but Kinross was unsuccessful in getting the contract extended after five years of negotiations. Instead, Kinross plans to proceed with a full feasibility study at the problem prone Tasiast open pit mine in Mauritania but at a more modest 38,000 tonnes per day mill which could produce 800,000 ounces or so. We believe that Tasiast is an albatross and the revised mine plan is still questionable given that Kinross expects to spend $2.7 billion more to develop the project. While management insists that a final construction decision has not been made, Kinross plans to spend $624 million this year. After writing off $5.5 billion, mostly due to Tasiast, we believe Paul Rollinson's decision to prune expenses should include Tasiast. Sell.

Newmont Mining Corp

Newmont's results were disappointing as its costs creep up. Newmont has cut back its spending because all-in costs are between $1100 to $1200 an ounce. Still, Newmont is spending half a billion dollars in Africa, South America and North America so we believe there is still room to cut back, particularly since its guidance is for another flat year. The $4.8 billion Minas Congo project in Peru is stillborn and Newmont faces a problem of ageing mines and rising costs. Newmont should think of merging with another entity to prune costs and maximize the value of its assets.

Yamana Gold Inc.

Yamana owns seven operating mines in Mexico, South America and reported a drop in earnings due to higher costs. Yamana's all-in costs are low at $900 an ounce producing 1.4 million gold equivalent, principally ounces from flagship El Penon. Yamana's heavy copper exposure will hurt overall costs as well as higher cost Jacobina and Ernesto/Pau-a-Pique. Although Yamana commissions three new Brazilian mines this year, Yamana might shelve the stalled Cerro Morro project a gold/silver project in Argentina (bought for almost $400 million) because of the government's desire to increase revenues. We prefer Agnico-Eagle at this time.

| Company Name | Trading Symbol | *Exchange | Disclosure code | Rating |

| Barrick | ABX | T | 1 | 4 |

| Centamin | CEE | T | 1 | 3 |

| Centerra | CG | T | 1 | 2 |

| Detour | DGC | T | 1 | 3 |

| Eldorado | ELD | T | 1 | 5 |

Disclosure Key: 1=The Analyst, Associate or member of their household owns the securities of the subject issuer. 2=Maison Placements Canada Inc. and/or affiliated companies beneficially own more than 1% of any class of common equity of the issuers. 3=<Employee name> who is an officer or director of Maison Placements Canada Inc. or it's affiliated companies serves as a director or advisory Board Member of the issuer. 4=In the previous 12 months a Maison Analyst received compensation from the subject company. 5=Maison Placements Canada Inc. has managed co-managed or participated in an offering of securities by the issuer in the past 12 months. 6=Maison Placements Canada Inc. has received compensation for investment banking and related services from the issuer in the past 12 months. 7=Maison is making a market in an equity or equity related security of the subject issuer. 8=The analyst has recently paid a visit to review the material operations of the issuer. 9=The analyst has received payment or reimbursement from the issuer regarding a recent visit. T-Toronto; V-TSX Venture; NQ-NASDAQ; NY-New York Stock Exchange

by John Ing

http://www.maisonplacements.com/

Disclosures Rating Structure

Analysts at Maison use two main rating structures: a performance rating and a number rating system.

Performance Rating: Out perform: The target price is more than 25% over the most recent closing price. Market Perform: The target price is more than 15% but less than 25% of the most recent closing price. Under Perform: The target price is less than 15% over the most recent closing price.

Number Rating: Our number rating system is a range from 1 to 5. (1=Strong Sell; 2=Sell; 3=Hold; 4=Buy; 5=Strong Buy) With 5 considered among the best performers among its peers and 1 is the worst performing stock lagging its peer group. A 3 would be market perform in line with the TSX market. NR

is no rating given that the company is either a new issue/ waiting to clear or we do not have an opinion.

Analyst’s Certification: As to each company covered in this report, each analyst certifies that the views expressed accurately reflect the analyst’s personal views about the subject securities or issuers. Each analyst has not, and will not receive, directly or indirectly compensation in exchange for expressing specific recommendations in this report.

Analyst’s Compensation: The compensation of the analyst who prepared this research report is based upon in part; the overall revenues and profitability of Maison Placements Canada Inc. Analysts are compensated on a salary and bonus system. Some factors affecting compensation include the productivity and quality of research, support to institutional, investment bankers, net revenues to the equity and investment banking revenue as well as compensation levels for analysts at competing brokerage dealers.

Analyst Stock Holdings: Equity research analysts and members of their households are permitted to invest in securities covered by them. No Maison analyst, or employee is permitted to effect a trade in the security of an issuer whereby there is an outstanding recommendation for a period of thirty calendar days before and five calendar days after the issuance of the research report.

Dissemination of Research: Maison disseminates its hard copy research material to their clients using the postage service and couriers. Samples of our

research material are available on our web site. Electronic formats are available upon request.

General Disclosures: This report is approved by Maison Placements Canada Inc. (“Maison”) which is a Canadian investment dealer and a participating organization of the Toronto Stock Exchange and TSX Venture Exchange and is regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

The information contained in this report has been compiled by Maison from sources believed to be reliable, but no representation or warranty, express or implied, is made by Maison, its affiliates or any other person as to its accuracy, completeness or correctness. All estimates, opinions and other information contained in this report constitute Maison’s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility or liability.

Maison and its affiliates may have an investment banking or other relationship with the company that is the subject of this report and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. Accordingly, Maison or their affiliates may at any time have a long or short position in any such securities, related securities or in options, futures, or other derivative instruments based thereon.

This report is provided for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities discussed herein in any

jurisdiction where such offer or solicitation would be prohibited. As a result, the securities discussed in this report may not be eligible for sale in some jurisdictions. This report is not, and under no circumstances should be construed as, a solicitation to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction.

This material is prepared for general circulation to clients and does not have regard to the investment objective, financial situation or particular needs of any particular person. Investors should obtain advice on their own individual circumstances before making an investment decision. To the fullest extent permitted by law, neither Maison, its affiliates nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of the information contained in this report.

For more information, please visit our website: www.maisonplacements.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.