Gold Stocks Sector: A Small Fish in a Big Pond

Commodities / Gold and Silver Stocks 2013 Jul 23, 2013 - 10:33 AM GMTBy: Casey_Research

By Andrey Dashkov, Research Analyst:

By Andrey Dashkov, Research Analyst:

Earlier in July, Jeff Clark showed in his article A Rare Anomaly in the Gold Market that the gold sector is dramatically undervalued based on its price-to-book ratio. In this article, I would like to expand on his analysis and provide some additional context.

In that article, we found only 31 primary gold producers with a market cap over $1 billion. This seemed rather small when one considers just how many stocks trade around the world, so we wanted to compare this to other industries.

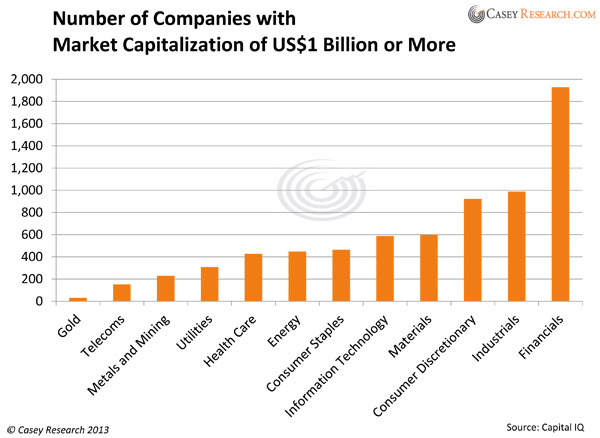

The charts below are built from a database of 6,830 companies. They're grouped by industry, and all have a market capitalization of US$1 billion or more. They trade on various stock exchanges.

Here's how the number of gold producers compares to other sectors.

Primary gold producers are clearly a tiny group when compared to the number of companies in other industries at this MCap.

Gold producers with a $1 billion MCap or more are a small subset of the Metals and Mining group, a sector that comprises 229 companies, which in turn is a part of the Materials category that consists of 600 stocks, including companies producing chemicals, construction materials, containers, forest products, etc.

What's staggering is that there are three times as many companies in the Financials group as there are stocks in the whole Materials category. Further, there are 470 real estate companies with +$1 billion MCap within the Financials group. Primary gold producers would be just 6.5% of that subset.

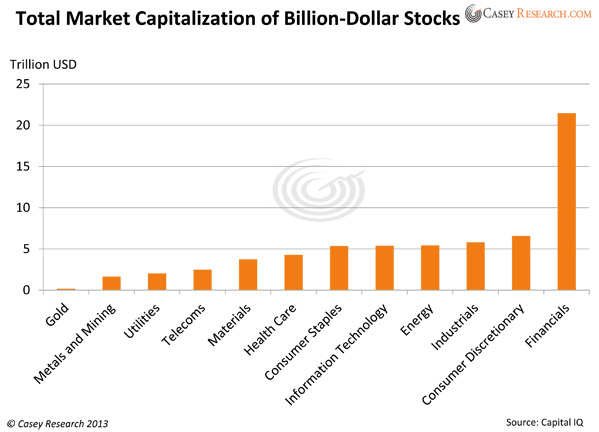

What about the market value of the different sectors? They also vary widely, though the Financials group dwarfs them all.

By market capitalization, billion-dollar gold stocks represent only 12.5% of the total MCap of the Metals and Mining subcategory, which in turn is about 43% of the total Materials group. Billion-dollar gold stocks have a market cap just 0.9% the size of those in the Financials group.

The conclusion we can draw from these two charts is rather obvious: gold stocks are a tiny constellation in a big universe. That's important, because it shows just how very crowded his little area could get when the larger universe of investors turns to the gold sector. If they invest in the bigger companies, there won't be that many to choose from, which could swell stock prices.

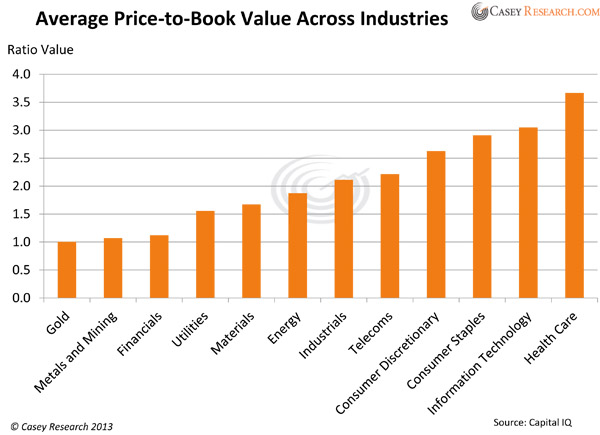

In the meantime, gold stocks remain deeply undervalued. Let me build on Jeff's argument that gold stocks are cheap on an historical basis and compare them to other industries' price-to-book values as of July 17.

The gold industry remains the most undervalued sector available to stock investors today. Its latest price-to-book value is 1, the only industry at that level. It is slightly higher than what we reported in the beginning of July because gold has risen slightly since then, and so did many gold miners' share prices. But they remain very cheap, as further evidenced by the Metals and Mining group having a higher P/BV, implying that non-precious metals producers are valued more than precious metals producers, a rare anomaly.

How long will gold stocks continue to be so undervalued? As Louis James wrote last week, we don't try to time or predict the bottom. Those who've made fantastic amounts of money speculating in this sector didn't even try. They made money buying when valuations were ridiculously low… and simply waiting to be right.

That's exactly what we recommend, too—because when investors do return to the gold sector, it won't take much capital for this small minnow to become a much bigger fish.

| Not all companies will be equally attractive when investors return, but there are a number of precious metals producers that we're convinced will outperform in a big way, based on important factors—especially their price to tangible book value. They're revealed in the latest issue of BIG GOLD. |

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.