The End of QE - What Ben Bernanke Is Really Saying

Interest-Rates / Quantitative Easing Jul 22, 2013 - 03:27 PM GMTBy: Raul_I_Meijer

Ever wonder what Bernanke is saying? Well, it boils down to this: at the same time that Jimmy Carter says the US doesn't have a functioning democracy, Ben Bernanke says the US doesn't have a functioning economy.

Ever wonder what Bernanke is saying? Well, it boils down to this: at the same time that Jimmy Carter says the US doesn't have a functioning democracy, Ben Bernanke says the US doesn't have a functioning economy.

Unfortunately, people understand what Carter says, though they may not agree with him, but they do not understand what Bernanke says, and that has nothing to do with agreeing with him or not. Moe likely it has something to do with the illusionary oracle qualities once attributed to his predecessor Alan Greenspan, whenever no-one had a clue what he was saying. In reality, Ben Bernanke will turn out to be the biggest scourge on American society since the same Alan Greenspan, but that's not how he's seen; instead, just like Greenspan, he's idolized. What's wrong with this picture is that Bernanke's words and actions are interpreted in the press exclusively by people who live in the part of society that stands to profit from them, let's call it "the financial world". That they are but a very small part of society easily gets lost in translation.

Greenspan was and still is mostly regarded as a miracle worker of super-human intelligence, even though he ran the US straight into the recession/depression/crisis we've now been witnessing since about the day when Bernanke took over the Fed, February 1 2006. Greenspan set the American economy firmly on the road to ruin through his support of the Glass-Steagall repeal and various tax-cuts, as well as his insistence that the newly blossoming derivatives trade needed little or no regulation. Certainly in hindsight, it should be obvious that Alan Greenspan served the interests of Wall Street, not Main Street.

All Ben Bernanke has done since succeeding the Oracle is continue where the former left off. Not that you would know it from the picture the media paint of him. Or the president, for that matter. Just about everyone agrees that he saved the US from something like a Great Recession II. In reality, what Bernanke has done over the past 6.5 years is being a prominent player in aiding and abetting Wall Street banks in hiding their losses through the violation of accounting standards, declaring them Too-Big-To-Fail, and then handing them trillions of dollars in public funds, most recently through QE programs, thus enabling them, the very same banks that would no longer exist without public funds, to once again play the casinos and come up with near record profits and bonuses.

This is the great little scheme that is presented to you through the media as "saving the US economy". It has done no such thing. It has been, and still is, enormously harmful to the economy. But as long as you continue to believe that what's good for Wall Street is also good for Main Street, the trick will continue to be played on you; Ben Bernanke is giving free money (well, actually, credit) away to those whose interests he represents, the banks, and taking it from those he doesn't, you. What Bernanke has saved is bankers' bonuses, not the economy. And if there is a direct correlation between the two, it's not the one you're being tempted to think it is. Which is how you should interpret Bernanke's insistence before Congress on July 17 that "We're very focused on Main Street": it may be true, but not in the way he wants you to believe it is.

Here's how Bernanke said the US doesn't have a functioning economy: by choosing to continue QE, he would reveal how weak the US financial system is. He already has, obviously, first by starting up QE in the first place, and again by his recent backpedaling on the conditions for tapering. The worst wet dream of the big banks is that they wouldn't get their black jack chips for free anymore, and they manage to convince everyone that the real economy would go down if they can no longer play. Regardless of the details: if it needs free money, the financial system can't stand on its own two legs.

By choosing to halt QE, on the other hand, Bernanke would reveal how weak the financial system is just as much. The slight rise in available credit that has allowed Americans to add yet more debt towards home and automobile purchases, giving the economy a fleetingly rosy glow in the process, would be over in a heartbeat. The banks would sit on their QE free excess reserve giveaways parked at the Fed even more than they already do. And then use it as security for more leveraged high-risk wagers. That's where the money is, not in consumer loans. Don't worry, says Ben, we'll keep interest rates low for the foreseeable future. Hossanah, sings the entire choir. But interest rates for whom? Only the big banks, that's for whom. Rates on the street, not so much: he has no control over those.

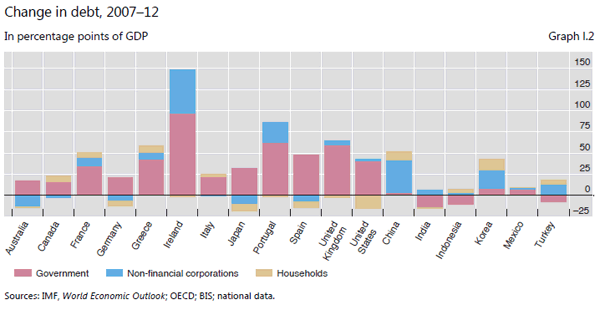

Here's an example of Bernanke's effect on Main Street: debt has been rising, not falling, since debt plunged the markets into that deep dark pit. A graph I picked up here at Zero Hedge:

The US may not look like the worst horse in the slaughterhouse, but in absolute numbers it probably is. Debt has risen by some 40% of GDP, and that does not yet include financial corporations and the Fed.

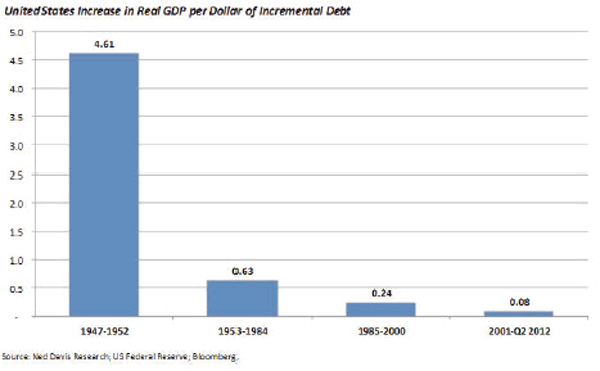

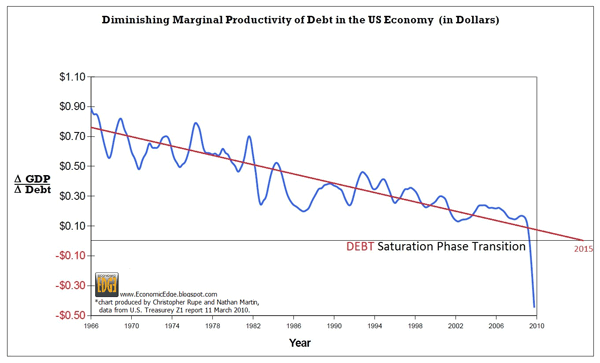

Is the new and additional debt at least put to good use for American society? The answer is a resounding "no". Just take a look at the diminishing productivity of debt in the US. Which, as is evident from these two graphs, will soon turn into negative territory, if it isn't already there.

The huge amounts of debt the Fed (and government) policies are adding will result in hardly any GDP growth. What does seem to be there in growth or recovery, moreover, comes from individuals taking on additional debt for home and automobile purchases. Bernanke, even if he would be trying to help Main Street, would be pushing on a string regardless. And I have no qualms about suggesting that he knows all this, which leads to one possible conclusion only: he is not trying. If he were, he'd adopt totally different policies. QE is not helping Main Street; it's killing it. Not today perhaps, but we should broaden our view beyond today, and consider what happens tomorrow.

Here's another example of how Bernanke is killing Main Street, courtesy of Chris Turner at Zero Hedge:

Savers And The 'Real' $10.8 Trillion Cost Of ZIRP

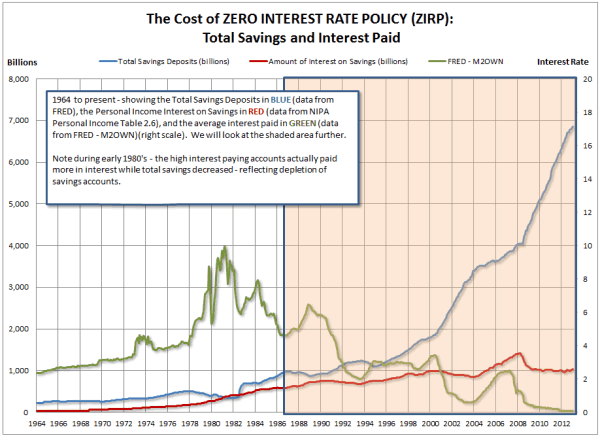

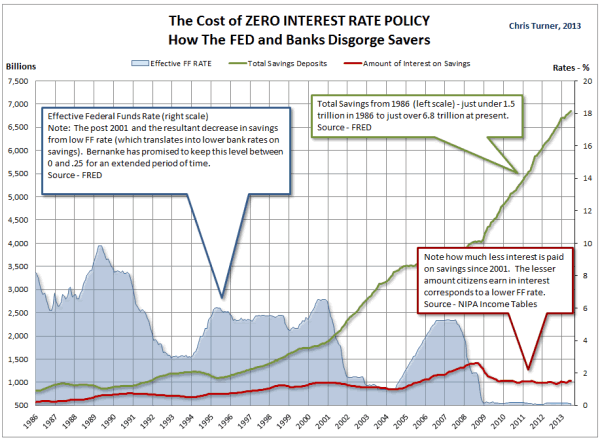

The good news behind the bottom 85% of close-to-retiree status Baby Boomers that participate in the “markets” via sub $50,000 retirement money is that at some point, the voters might actually get smart and get mad at how much money has been siphoned from them. Consult the chart below to see a historical relationship between total savings and amount of interest income earned on the savings.

Note that prior to 2001, as savings increased (blue line), interest income received increased (red line) proportionally. However, after 2001, the interest earned stopped increasing. The green line shows the effective interest paid on interest bearing accounts.

Scaling into the shaded area representing 1986 to present, the following chart depicts the actual Fed Funds rate determined by FOMC.

As savings increased when Fed Funds rate remained around 5%, interest income continued to rise. However, post 2001, the interest income received stopped growing at the same rate. With the exception of 2005 to 2008 when rates went back to “normal” in the 5% range – the interest income earned has remained stable at just under 1 trillion (Ben Bernanke is so smart).

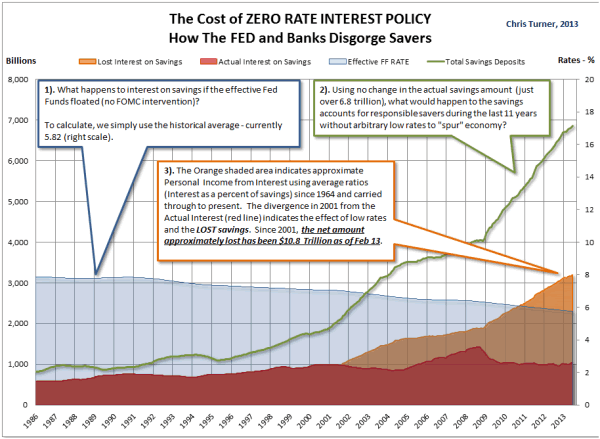

Let’s apply some thought experiments and make a couple calculations – what would happen if the FOMC were removed and the Fed Funds rate “floated?” Using average historical rates from the 1920’s for the 10 year note– the mean rate would sit around 5.82%. With a floating Fed Funds rate, banks would be competing for money and providing responsible savers with some interest income. Voila, a calculation is borne:

The final chart above makes a loud and clear statement toward the beneficiaries of the low interest rate environment.

"Very focused on Main Street" indeed. It's where (through QE) newly found and fangled bank profits come from. As per the very first - Change in Debt - graph, household debt has gone down (though that's largely due to falling real estate prices, in other words, a double edged coin), but so have savings. And not a little bit either. Americans lost $10.8 trillion. And counting.

So how does the Oracle 2.0 explain it all? From Bloomberg, July 10:

Bernanke Supports Continuing Stimulus Amid Debate Over QE

"Highly accommodative monetary policy for the foreseeable future is what's needed in the U.S. economy," Bernanke said yesterday in response to a question after a speech in Cambridge, Massachusetts.

The numbers don't add up to that. If it's what's needed for the economy, that economy is in very bad shape, and has been for a long time despite the same highly accommodative monetary policy. If the economy is the goal, it makes no sense to keep going or even double down. What Bernanke's saying he's aiming for is not what's needed for the economy, but for the financial system.

........ the minutes showed many Fed officials wanted to see more signs employment is improving before backing a trim to bond purchases known as quantitative easing.

The fear of course is that the very moment they ease bond purchases, stock markets plummet and, with a short lag, unemployment will start rising again. Any positive effect of QE on employment is not backed up by numbers, other than people believing the illusion that it makes the economy better. But that's a fleeting illusion which depends on both their belief and continuing QE. Take either of the two away and you're holding an empty bag.

Bernanke said the central bank is trying to communicate its plans for two different policy tools. With bond purchases, the Fed is "trying to achieve a substantial improvement in the outlook for the labor market in the context of price stability. We’ve made progress on that but we still have further to go," he said.

The Fed wields another policy tool with its benchmark interest rate, which it reduced to close to zero in December 2008. Officials have said they won’t consider raising the main interest rate until the unemployment rate falls to 6.5 percent, as long as long-term inflation expectations don’t exceed 2.5 percent.

We're approaching nonsense territory here. We've already seen that years of low interest rates and bond purchases have not raised the velocity of money in the US economy. For the US economy and labor market, QE has been a total and unmitigated disaster, and a hugely expensive one to boot. For the financial system, though, it's been an unbelievable behemoth of a windfall.

Sure, unemployment has fallen a little, because most people still believe that a higher stock market is positive for the economy. But if it rises only if and when promises are issued for more and continuing free giveaways for the banking sector, that can then remain in accounts with the Fed and not get into the real economy, then a higher stock market is perhaps a symptom of an increasingly sick economy, not a healing one. It's like banks announcing great profits, that directly reflect nothing but those same giveaways. A profit would seem to indicate something has been sold for more than was paid for it, because of added value. That is obviously not the case here. Without free credit, there would be no "profits" in the banking sector.

"It may well be sometime after we hit 6.5 percent before rates reach any significant level," Bernanke said. "So again, the overall message is accommodation."

Well, no. If and when only, at best, one in every 7 dollars in QE has any influence on the real economy at all (the estimate is 86% is in banks' reserve accounts with the Fed), then QE is a failed policy. From the perspective of the economy, at least. For the banking sector, it's an entirely different story. People keep on thinking that what is good for the banking sector is good for the economy as a whole, but the recent graphs prove that this is not true. That should be end of story for QE, but Bernanke's oracle talk apparently still is too convincing; the general optimism bias trumps reality. Bernanke claims he's accommodating the economy, but he's not, he accommodates Wall Street.

The 59-year-old Fed chief said the FOMC may opt to hold interest rates near zero even after unemployment reaches 6.5 percent due to the possibility of low inflation.

And, apparently, he'll keep on accomodating Wall Street, even if enough waitressing, greeting and flipping jobs that don't pay enough to feed yourself let alone your family, but still count towards official jobs numbers, can be created to lower the unemployment rate to 6.5%. Why? Deflation. Or as he euphemistically calls it: low inflation. Bernanke paves the way for endless QE (breaking his own former promises, but he's leaving anyway). Why endless QE? Because without it, the US banking sector AND economy would collapse in a heartbeat. That's what it means when markets rise as fast as they do just because Bearded Ben announced what he did. It means there are no other prospects for profits. Or that the banks don't have to go looking for other prospects as long as the free stuff keeps flowing in.

Now, whatever powers one may think they do have, it should be clear that Bernanke and the Fed have no control over : 1) Treasury yields and 2) Velocity of money. As for the first, Ambrose Evans-Pritchard has some numbers:

Can the world cope with a trigger-happy Fed?

After weeks of utter confusion, the result of Fed taper talk is clear enough. Long-term borrowing rates are much higher across the world regardless whether the underlying economies are in any fit condition to absorb this shock. The rise in 10-year sovereign yields by basis points has been: Japan (25), Germany (35), France (62), UK (63), Norway (63), Australia (66), Korea (66), Spain (70), US (70), Italy (74), Poland (120), Mexico (122), Turkey (131), Brazil (135), and Indonesia (170).

As you can see, the emerging market bloc has suffered the worst hit, especially those countries caught when the tide went out with big current account deficits – the CADs as they are called in the trade. Basically, the whole world has just suffered a credit shock, even as the global economy weakens and the IMF downgrades its forecasts. What a mess.

A rate rise of 70 basis points or more is nothing short of catastrophic for Italy, Spain, Portugal, all in the grip of nominal GDP contraction, and all at risk of surging debt ratios as the denominator effect does its worst. The ECB must take action immediately to offset this "passive" tightening.

Can the US deal with higher yields on 10-year Treasuries? Well, better than Spain and Italy, obviously, but when yields are higher than real GDP (nominal+inflation, perhaps some 2.5% combined today), debt continues to rise. Yields are there already. Add a little deflation and what will the Fed do? QE on steroids probably, a.k.a. more debt. As Ambrose put it:

What struck me about Bernanke's testimony was his comment that the Fed would have to monitor the risk of "outright deflation" closely. "If needed, the Committee would be prepared to employ all of its tools, including an increase the pace of purchases for a time", he said.

The US will be the least worst horse in the glue factory, but only by the grace of Europe, Japan and China doing even worse. That will not save it from a combination of rising yields and falling inflation and GDP growth, however. And that is a lethal combination.

No risk of deflation, you think? Ben Bernanke does:

Bernanke Says Fed Bond Purchases Not on 'Preset Course'

Some sources of declining inflation "are likely to be transitory" and expectations for future price increases "have generally remained stable," he said in his prepared remarks. At the same time, "very low inflation poses risks to economic performance - for example, by raising the real cost of capital investment - and increases the risk of outright deflation." [..]

[..] Bernanke said in his testimony the Fed could keep buying bonds for longer if "financial conditions - which have tightened recently - were judged to be insufficiently accommodative to allow us to attain our mandated objectives." Responding to a question, he said the policy makers have succeeded in reducing market volatility that has greeted the Fed’s discussion of tapering. "Markets are beginning to understand our message, and the volatility has obviously moderated," he said.

Well, no. Volatility fell because of the promise of more free money. And that's all she wrote.

Policy makers have tried to assure investors that the Fed will hold down the benchmark interest rate after ending bond buying.

Well, no again. Chances are very real that when the Fed ends its bond buying, yields will rise so fast the Fed will lose control of the benchmark rate.

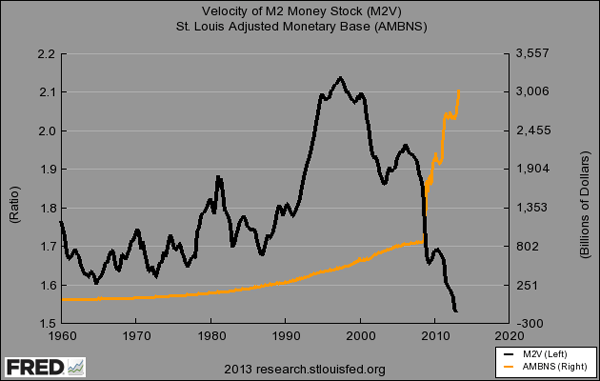

As for No. 2 above, the Velocity of Money, here's once again my favorite graph so far this year. It's so important in understanding the American economy today, one can't repeat it often enough:

Money isn't going anywhere in America. The banks sit pretty on their QE excess reserves, and the little that consumers do spend is what they can borrow. The velocity of money is a crucial element in any true understanding of what inflation really is, and this graph screams deflation. To which Bernanke (or his successor) will react with QE on steroids, but as we can see, that won't help Main Street one bit. It’ll help Wall Street, though .....

Everyone in America who doesn't work on Wall Street should be very worried when stock markets go up as soon as Ben Bernanke suggests more free credit is available for the world's biggest banks, because everyone who doesn't work on Wall Street will end up paying for it. Instead, everybody's celebrating it. Still, all it is, is a clear and simple sign that the markets are not well. At all.

Americans should demand that Bernanke discuss how he intends to speed up the velocity of money. This should be his no. 1 priority, because without it there will be no recovery, but he doesn't even mention it.

Wall Street banks post huge profits again, and pay huge bonuses. Does that mean they're healthy? No, it doesn't. It only means that they can use excess reserves provided by Bernanke's QE to increase high-risk wagers. Take away QE and then you'll see how healthy they are. And it goes, of course, one step further: Banks can (and will if there's a profit in it) take the advantages provided by the QE excess reserves and use them to bet against exactly what Bernanke purports to aspire to for the real economy. And he'll play innocent, like he never could have seen that coming.

I'm not saying that Bernanke wouldn't like to help out Main Street as well, I'm just saying that it's not his priority, and that he'll gladly help out Wall Street at the cost of Main Street. And will gladly lie about it too.

Ben Bernanke has spent 6 years and change dragging America deeper into the debt swamp, and just about everyone thinks he's brilliant. He must be quite the magician indeed. But as Chris Turner says above: The good news [..] is that at some point, the voters might actually get smart and get mad at how much money has been siphoned from them.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2013 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.