Highly Rated High Quality Equity Dividend Income Stocks

Companies / Investing 2013 Jul 21, 2013 - 09:06 AM GMTBy: Richard_Shaw

As of 07/18/2013, there are only 6 stocks traded in the US that have these attributes:

As of 07/18/2013, there are only 6 stocks traded in the US that have these attributes:

- highly rated for fair value

- highly rated for year ahead expected performance

- highly rated for earnings and dividend quality

- yield greater than that of the S&P 500

- paid and increased dividend for at least 5 years

- technical condition is neutral to attractive

Suitability

This commentary is intended to be suitable for those portfolios that are required to seek consistent long-term growth of above average equity income, and for that income to be an important part of the overall total return due to approaching or current withdrawal requirements; and for which achievement of the income objective is more important than exceeding the total return of a broad equity index.

This commentary is not intended to be suitable for those portfolios for which maximizing price appreciation and exceeding broad index total returns is the primary objective. Neither is this commentary suitable for those portfolios engaged in short-term trading activities.

Each portfolio should be designed and operated to meet the real world needs and purposes for which it is intended.

SIMPLE STANDARD & POOR’S FILTER

32 stocks passed this filter:

• Fair Value rated 4 or 5 • Stars rated 4 or 5 • Earnings & Dividend Quality rated A+, A or A-

DIVIDEND CONSISTENCY & GROWTH FILTER

20 of the 32 stocks passed this filter:

• paid dividends for each of at least the past 5 years • increased dividend payments in each year

ABOVE AVERAGE YIELD FILTER

11 of the 20 stocks passed this filter:

• yield greater than the yield on the S&P 500

SHORT-TERM TECHNICAL FILTER

6 of the 11 stocks passed this filter:

• BarChart net rating >= 50% BUY

STOCKS SURVIVING FILTERS

The 6 surviving stocks are:

- (K) Kellog

- (UTX) United Technologies

- (AFL) Aflac

- (TGT) Target

- (BAX) Baxter International

- (SU) Suncor

YIELDS

Unfortunately for many (most?) dividend income seekers, none of these stocks have high yields — just above index yields. However, that’s the best you can do if you also want or need the stringent S&P filter terms. Highest quality stocks have been bid up so that high yield is not generally available among them at this time.

| Name | Symbol | Yield |

| KELLOGG CO | K | 2.66 |

| UNITED TECHNOLOGIES | UTX | 2.12 |

| AFLAC | AFL | 2.37 |

| TARGET | TGT | 2.37 |

| BAXTER INTERNATIONAL | BAX | 2.68 |

| SUNCOR ENERGY | SU | 2.46 |

STOCK CHARTS WITH WRIGHT RATINGS

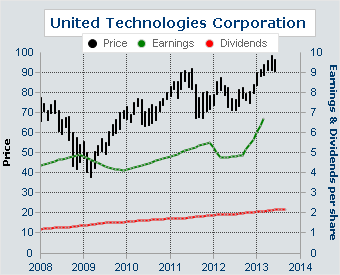

The charts below show the 5-year history of price, earnings and dividends for each stock.

Charts and ratings were obtained by subscription at the premium side of CorporateInformation (a description of Wright ratings is at our blog).

In brief, the three alpha Wright ratings are for liquidity, financial strength and profitability; and the numeric rating is for multi-factor growth on a 20 point scale.

K (rated ABA7)

UTX (rated ABA8)

AFL (rated AAA14)

TGT (rated ABA9)

BAX (rated ABA12)

SU (rated AAB7)

ANALYST RATINGS

This table shows the number of reporting analysts and the high and low and average year ahead price change projections.

| # Analysts | Symbol | % to Hi | % to Av | % to Lo |

| 21 | K | 12.0 | (1.0) | (17.0) |

| 24 | UTX | 14.0 | 3.2 | (17.0) |

| 23 | AFL | 27.0 | 5.9 | (6.8) |

| 23 | TGT | 14.0 | 1.2 | (15.0) |

| 19 | BAX | 12.0 | 3.9 | (34.0) |

| 21 | SU | 47.0 | 2.0 | (9.4) |

DIVIDEND GROWTH RATES

Here are the 5-year and 1-year dividend growth rates for the 6 stocks.

| Symbol | 5yr DGR | 1Yr DGR |

| K | 7.26 | 2.33 |

| UTX | 10.83 | 11.46 |

| AFL | 7.84 | 6.06 |

| TGT | 25.16 | 43.33 |

| BAX | 17.64 | 46.27 |

| SU | 31.95 | 53.85 |

REVENUE GROWTH RATES

Dividends can’t grow forever unless revenue grows too.

There is significant concern these days about weak revenue growth in general, with concerns about the ability of companies to maintain margins (and ultimately dividends) without good growth.

Here are the 5-year, 3-year and 1-year revenue growth rates for the 6 stocks.

| Symbol | 5yr RGR | 3Yr RGR | 1Yr RGR |

| K | 3.81 | 4.13 | 11.14 |

| UTX | 1.19 | 2.99 | 7.56 |

| AFL | 10.50 | 11.62 | 8.75 |

| TGT | 2.96 | 3.90 | 3.31 |

| BAX | 4.73 | 4.15 | 1.81 |

| SU | 18.00 | 19.60 | (0.50) |

These stocks may not be right for you, but having passed a rigorous set of filters, they may provide a rational set of leads for further research for the Do-It-Yourself equity income investor.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2013 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.