Central Banksters Make the Best Economic Terrorists

Economics / US Economy Jul 19, 2013 - 09:27 PM GMTBy: Richard_Mills

From the minutes of theFederal Reserve meeting April 30th - May 1st 2013.

From the minutes of theFederal Reserve meeting April 30th - May 1st 2013.

"Many participants indicated that continued (job market) progress, more confidence in the outlook, or diminished downside risks would be required before slowing the pace of purchases."

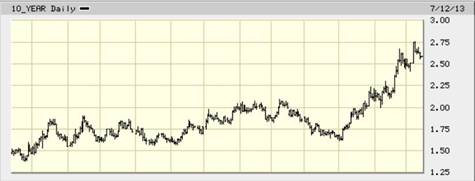

On May 22nd Federal Reserve Chairman Ben Bernanke told Congress that a decision could be made, at any of the next few Fed meetings, to scale back the $85 billion in bonds the Fed is buying each month if the economy looked set to maintain momentum. The S&P 500 closed 0.8% lower, the dollar hit a three year high and the bond market sold off with yields on the 10 year Treasury notes jumping above 2%.

Speaking at a Boston economic conference Bernanke backtracked saying the Fed would continue to pour stimulus into the US economy, so long as inflation stays low, below 2.5% and until unemployment improves to below 6.5%.

Bernanke made it very clear that those thresholds were merely for considering a rate hike from the Fed’s current .25%, they weren’t necessarily a trigger for tightening…

“Given that the unemployment rate understates the weakness of the labour market and given where inflation is, I would suspect that it may be well after we hit 6.5% before rates reach any significant level.”

“Given that the unemployment rate understates the weakness of the labour market and given where inflation is, I would suspect that it may be well after we hit 6.5% before rates reach any significant level.”

In Bernanke’s July 17th testimony to Congress he said the economy is weak, inflation is low and that if the Fed reduces its accommodation the economy would tank. This was a complete contradiction of remarks made only a few minutes before, when he said stock markets were strong because they reflected the strength of the underlying economy.

“I was gratified to be able to answer promptly, and I did. I said I didn't know. ” Mark Twain

The economy, unemployment and inflation

U.S. retail sales rose by just 0.4% in June (the majority of the rise was in higher gasoline prices). Sales were down in several key segments – down 2.2% at home-improvement stores, by 1.2% at bars and restaurants and by 1% at department stores.

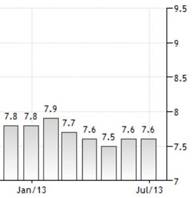

We all need to understand that to have a real, and sustainable recovery for an economy that relies on consumer spending for 70 percent of its activity we need to have a jobs recovery. At 7.6% unemployment the number of jobs being created each month is barely at the level needed for new entrants into the workforce let alone replacing the jobs lost since the Great Recession in 2008 and manufacturing continues to bleed jobs.

Okun’s Law holds that an economy, it’s GDP, must grow above its potential to reduce the unemployment rate. Year-on-year economic growth of two percent above the trend (considered to be 2–3 percent) is needed to lower unemployment by one point.

A third downgrade of U.S. economic growth for the first quarter 2013 showed the country’s GDP grew at just a 1.8 percent annualized pace.

Bloomberg and IHS Global Insight estimate the U.S. economy will grow by 1.6 percent this year. Barclays just cut its second quarter GDP forecast to 1.0% from 1.6% and J.P. Morgan Chase cut its second quarter forecast to 1% from 2%.

From marketwatch.com comes the following; “Following the releases Monday (July 15th) of tepid reports on retail sales and inventory accumulation, forecasters marked down their GDP expectations from 1.4% to 1.1%. It’s probable that U.S. GDP rose less than 2% for the third quarter in a row, and it’s possible that growth was less than 1% for the second quarter in the last three.”

Bureau of Labor Statistics, Alternative measures of labor underutilization

U-4: Total unemployed plus discouraged workers – up from 8.0 percent to 8.2 percent.

U-5: Total unemployed, plus discouraged workers, plus all other persons marginally attached to the labor force – up from 8.8 percent to 9.1 percent.

U-6: Total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons - up from 13.8 percent to 14.3 percent.

Long term unemployment - those unemployed over 26 weeks - in the U.S. stands at 4.357 million workers (up from 4.353 in April). Long term unemployed workers remain one of the key problems for the U.S.

The U.S. economy lost 240,000 full-time workers in June while gaining 360,000 part-time workers.

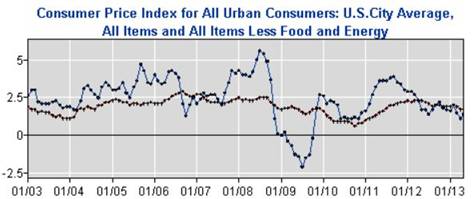

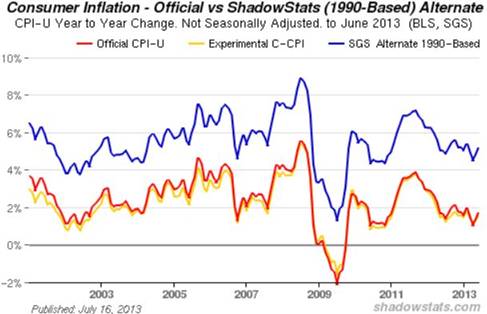

The Federal Reserve uses the Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) as there guide. As you can see, this inflation indicator inflation is well within the Fed’s guidelines.

Please don’t release the (tapering) Kraken

If the Federal Reserve hadn’t backtracked on Bernanke’s May 22nd suggestion that the Fed expects to start scaling back its massive bond buying program the fallout would have been economic terror.

Inflation and jobs weren’t THE real reason Bernanke backtracked. His talk of tapering literally started a global bond market rout. The Federal Reserve has over $3.5 trillion worth of securities on its balance sheet - of which $1.9 trillion are U.S. Treasuries. If the Fed had started down the path of interest rate normalization by slowing its purchases and eventually unwinding its balance sheet interest rates would climb back to at least the 4% they were before the Great Recession in 2008 and maybe as high as the 40 year average of 7%.

10 year treasury yields

This from Charles Hugh Smith over at oftwominds.com…

“The wheels fall off the entire financialized debtocracy wagon once yields rise. There's nothing mysterious about this:

1. As interest rates/yields rise, all the existing bonds paying next to nothing plummet in market value

2. As mortgage rates rise, there's nobody left who can afford Housing Bubble 2.0 prices, so home prices fall off a cliff

3. Once you can get 5+% yield on cash again, few people are willing to risk capital in the equities markets in the hopes that they can earn more than 5% yield before the next crash wipes out 40% of their equity

4. As asset classes decline, lenders are wary of loaning money against these assets; if the collateral for the loan (real estate, bonds, stocks, etc.) are in a waterfall decline, no sane lender will risk capital on a bet that the collateral will be sufficient to cover losses should the borrower default.

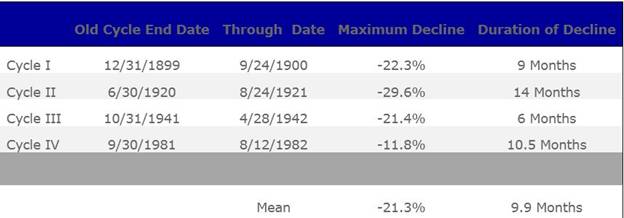

The consequences of interest rate normalization for stocks will prove very painful. According to the hmcapitalmanagement.coms chart below the average correction is 20% and happens in an incredibly short span of time – 10 months. Devastating to the top few percent of Americans who own 80% of the wealth in the stock market.

Global currency printing

Japan, the world’s third largest economy, is currently an economic ray of sunshine - the Japanese economy grew at an annualized 4.1 percent in the first quarter and their stock market is soaring. Abenomics goal is to end a long miserable decade and a half of deflation by kick starting the economy, this will happen because of massive yen creation. The fiat balloon will induce consumers to spend and corporations to reinvest profits, convinced by a rising stock market and surging exports that all is well.

The flood of fiat has depreciated the yen, over the first six months of 2013 the yen weakened the most against the U.S. dollar since 1982. The yen also dropped 12 percent against the euro and seven percent against the sterling, threatening European trade.

The weaker yen is also drawing investment away from emerging markets and toward Japanese equities - the Nikkei 225 has been soaring.

China will, in response to Japans deliberate and massive yen depreciation, force its currency the yuan to depreciate. Other Asian countries (and the EU and UK) will have to do the same to keep their exports competitive with China’s and Japan’s.

Real Interest Rates

We know U.S. employment has not recovered and that the inflation rate is well within the Fed’s targeted range. We can also see a fragile U.S. and global economy does not need, and cannot handle, an interest rate shock.

From Frank Holmes at usfunds.com comes the following:

“Higher yields may not be sustained in the short-term, as current economic data is not very inspiring…With real growth in the U.S. and global economy failing to materialize to date, the Fed may not want to risk taking away the stimulus until economic growth is more certain.”

The demand for gold moves inversely to interest rates - the higher the rate of interest the lower the demand for gold, the lower the rate of interest the higher the demand for gold.

The reason for this is simple, when real interest rates are low, cash and bonds fall out of favor because the real return is lower than inflation - if your earning 1.6 percent on your money but inflation is running 2.7 percent the real rate you are earning is negative 1.1 percent - an investor is actually losing purchasing power.

Dumping 400 tons of gold on the market, as recently happened, cannot dampen the demand for gold at low/negative real interest rates. As long as interest rates are low to negative the demand for gold will grow and soon strips supply from the world’s vaults.

Consider:

During the first half of this year, compared to the first six months in 2012, sales of American Eagle gold bullion coins almost doubled and that the mid-year total ranks fifth highest in the Gold Eagle’s 26 year history.

Through the first half of 2013 American Eagle Silver Bullion Coin Sales hit 25,043,500. The annual sales record for the silver coins happened in 2011 at 39,868,500.

John Paulson understands that gold is the most proven investment to offer a return greater than inflation (by its rising price) or at least not a loss of purchasing power. “I would say that the rationale for owning gold has not gone away. The consequence of printing money over time will be inflation, it's just difficult to predict when." Legendary hedge fund manager John Paulson, Delivering Alpha conference, CNBC

The benchmark US 10-year note currently yields 2.50 percent, yields on 30 year bonds are 3.59 percent.

The inflation rate for the first six months of 2013 - from the Consumer Price Index (CPI-U) which is compiled by the Bureau of Labor Statistics (BLS) is 1.8 percent unadjusted.

“Have you ever wondered why the CPI, GDP and employment numbers run counter to your personal and business experiences? The problem lies in biased and often-manipulated government reporting.” John Williams

Williams shadowstats.com uses pre-1990 methodology for computing the CPI-U…

Conclusion

“At this point, the Fed has been accommodating Credit and market Bubbles for so long that the only way to ensure ongoing loose financial conditions is to perpetuate Bubble excess. I would argue – and I believe recent market behavior supports this view – that various Bubbles have inflated to the point of acute vulnerability. This implies fragility to waning liquidity and episodes of risk aversion, hence – and as the speculator community assumes - unrelenting Fed QE activism.” Doug Noland, Bernanke's Comment, prudentbear.com

The Fed, and all the other central banks, are damned if they do and damned if they don’t. Quit easing and we have soaring interest rates, a bond bloodbath and all that entails. Keep easing and well, let’s just say that the piper always has to be paid, and he will be eventually - taking out another loan to cover your existing debt payments only postpones the day of reckoning.

Seems to me that buying some gold and silver bullion, and an investment into carefully chosen, extraordinary resource juniors (here’s one of my favorites), are the best insurance against the coming days of economic reckoning. Are the coming days of financial terror, and how to deal with the consequences, on your radar screen?

If consequences and solutions aren’t on your screen they should be - central banksters make the best terrorists.

If not, maybe one should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.