Federal Reserve has Begun Buying Mortgage Securities

Interest-Rates / Credit Crisis 2008 Mar 28, 2008 - 10:46 AM GMTBy: Ty_Andros

The lighting strike in the markets that I looked for in last week's edition did indeed occur across many sectors. It was a belly button moment for many as Commodities, Currencies, Stocks and Interest Rates were rocked midweek and I was forced look around to make sure that “nothing had changed”. The mainstream financial press was quick to say about the ordeal, for those who place their faith and portfolios in Wall Street's hands, that things were on the mend, the commodities BUBBLE was popped and that the implosion of “paper” investments was on its way to being resolved. New bull markets in paper assets. I have two words for their suppositions: NO WAY and KEEP DREAMING. A new phase of the unfolding BAILOUT of the G7 financial and banking systems began in the last 10 days.

The lighting strike in the markets that I looked for in last week's edition did indeed occur across many sectors. It was a belly button moment for many as Commodities, Currencies, Stocks and Interest Rates were rocked midweek and I was forced look around to make sure that “nothing had changed”. The mainstream financial press was quick to say about the ordeal, for those who place their faith and portfolios in Wall Street's hands, that things were on the mend, the commodities BUBBLE was popped and that the implosion of “paper” investments was on its way to being resolved. New bull markets in paper assets. I have two words for their suppositions: NO WAY and KEEP DREAMING. A new phase of the unfolding BAILOUT of the G7 financial and banking systems began in the last 10 days.

For greater insight into our publication, have a look at the Overview of Tedbits . It helps current and potential subscribers understand our mission in serving you. It also gives a broad description of what's unfolding globally and what you can expect from Tedbits as a regular reader.

Instead, the next phase of the “Crack up Boom”, as outlined by Mises, commenced. For those of you who think the commodities BULL market is OVER, I ask you to please show me where the growing surpluses are? Do we see huge amounts of oversupply which marked the housing, NASDAQ and credit bubbles? NO. Do you think the emerging world's growth stopped last week? NO. All we witnessed last week was a vicious correction which restored a lot of HEALTH to those markets as late arrivals to the commodities bull were taken out and spanked as they always are. People who are chasing markets in expectations that the trend never corrects itself, and who think that markets are one-way trains learned a lesson. It was a classic transfer of holdings from WEAK and unprepared hands to STRONG ones. Nothing more!

The opportunities which have been emerging with the VOLATILITY are now ready to begin again from a healthier starting point. Volatility is opportunity and it is abundant!

You should be having a field day with your portfolios. Gold was offered to you at a discount to earlier prices, did you take advantage of it or did it shake you out? Crude Oil did a perfect 50% Fibonacci retrace of its previous move as did grains. If you blinked you MISSED the buying opportunity as is the HALLMARK of all great bull markets.

The Road to Perdition

The G7 financial, central bank and banking regulators are in full battle mode trying to prevent the bankruptcy of the financial system. Since last Monday, almost 1 trillion Dollars of financial band aids have been applied. Investment banks have been included as participants at the discount window. And the investment banks, such as GOLDMAN SACHS, Merrill lynch and Morgan Stanley, quickly took advantage of the liquidity by shoving over $50 billion Dollars in CRAPPY paper into the window. The Term Auction Facility is now regularly OVERSUBSCRIBED and the Term Securities Auction Facility opens today. Fannie and Freddie were allowed to expand their balance sheets by over $200 billion Dollars. The ECB is shoving funds out the door. The bank of England did so and is preparing to accelerate doing so to rescue the mortgage market in the UK . The federal home loan banks were given expanded lending authority.

Under rhetorical disguise the Federal Reserve has begun to BUY mortgage securities. Even though the Treasury and Federal Reserve claim the Bear Stearns bailout and buyout by JP Morgan Chase, which included a $30 billion cash injection, was just a loan for impaired liquidity of the mortgage securities; the fine print of the deal signals something MORE. Little noticed was the FACT that BLACK ROCK was hired to manage the portfolio of securities which was pledged as collateral. What did you say? If it's just collateral, which will be returned upon repayment, then the fed would just hold them; instead they have hired a portfolio manager implying that they are now the OWNER of the CRAPPY paper and are managing the portfolio -- just as a bank would handle foreclosure property it had acquired in order to maximize return. This action of hiring a portfolio manager denotes who actually OWNS the securities, regardless of who the financial authorities say owns them. The government has now begun to buy the bad paper! It is only the beginning…

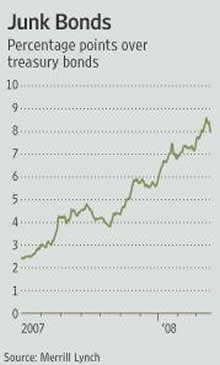

The credit market spreads are continuing at elevated levels and hoarding of funds by and between banks and investors continues. LIBOR (London Interbank Rate) remains near their highest levels over their benchmarks since the credit crisis began. All this is indicating no confidence in counterparties. Take a look at two charts from the Wall Street Journal:

As you can see, the Federal Reserve's innovative liquidity provisions of last week helped, but the trend towards higher spreads between treasuries and ALL levels of credit (AAA to Junk) remain wide and trending higher. The Fed has lowered rates 300 basis points and mortgages have only declined 50 basis points highlighting the ineffectiveness of the easing. Credit card issuers and the banks are relentlessly increasing lending rates for current customers, pounding nails into their customer's finances. Savers are punished by low rates which are necessary for bank balance sheet repair, further discouraging saving and robbing retirees of their incomes. For corporations below investment grade, borrowing is only for those that can afford punitive rates. Another $50 billion Dollars of cash moved into US money market accounts bringing the total to approximately $3.5 TRILLION dollars, signaling increasing risk and adverse behavior.

Who can blame them? When I speak to investors, many believe you can make good rates of return without taking risk! Of course, risk over the last 4 years has seemed low as volatility receded in response to the unbelievable amount of FIAT money and credit creation that has transpired during the terms of Alan Greenscam, er Greenspan and Helicopter Ben Bernanke. Things went up nominally and, since most people don't have a clue what that means, they BOUGHT the illusions. In real terms versus gold, commodities or natural resources they were suffering blistering losses in purchasing power of their holdings while they APPEARED to be rising in value. Now they are confronted with reality of losing nominally as well and they can't take it. These people are not returning to the fixed income marketplace for a while, a long, long while. They are sitting in cash and treasuries being robbed at night by the blistering money and credit creation we outlined last week.

The actions taken last week were only the beginning of the bailouts; we now know that the Monolines, Money Center , Investment and Super Regional Banks will not be allowed to fail as they are as entwined in the financial system, as was Bear Stearns if not more . The Federal Reserve is involved in a fierce debate with the Bush administration about mounting a rescue and recapitalization of the banking and financial system. The chairman of Wells Fargo has publicly expressed the desire to take over a failed institution like Bear Stearns guaranteed by the Fed. SICK…

The Bush administration prefers to dribble out the medicine and always arrive to the problem late; Bush is working hard at becoming the second coming of HERBERT HOOVER. They have no choice, it's either an inflationary recession or a deflationary depression, and which would you choose? For me it's the latter and that is the only course you can choose. Whether you like it or not, the G7 is a credit-based economy and if you have no availability of credit you have an increasingly impaired economy. George “Pinocchio” Bush needs to think about these issues.

This administration and congress have expanded government by one third, doubled the regulatory burden, contrary to the press reports raised taxes on the wealthy. They have increased debt from $5 trillion to almost $10 trillion and increased unfunded entitlements from $20 trillion to over $50 trillion -- funded by runaway fiat currency and credit creation. Congress and the administration have unleashed WORLDWIDE food inflation by mandating CORN based ethanol, while simultaneously destroying the water tables in the areas of ethanol plants. It has destroyed our futures in accelerated fashion. The candidates running for president are running on the canard of CHANGE when in actuality they are planning on doubling up on these policies . The insanity and incompetence of this administration and congress will be written about for decades, if not centuries.

Consumer sentiment is at 15-year lows, as it should be; they are yoked up to the financial system in a kind of indentured servitude where they can never repay their debts, only borrow more as their incomes are insufficient to overcome the usurious nature of the current lending industry. Business investment plans and durable goods orders have turned lower so job creation is set to plummet and unemployment is set to skyrocket.

Municipal revenues are in freefall as property values decline along with incomes. So, higher taxes are set to diminish future income. Public servants NEVER restrain spending, sacrifice or restrain their lavish pay, benefit and retirement packages. Cost benefit analysis of regulatory and law making is never considered. The “wealth generating” private sectors are under relentless attack and succumbing to regulatory assassination. They are demonized daily by public servants and their cheerleaders in the press, preying on the desperation and economic illiteracy of the continually declining middle classes.

Meanwhile, the European Central Bank has resumed using the word “vigilance”, its code word for coming interest rate hikes. Business and consumer sentiment is firm or rising in the Eurozone and they have one thing the US and UK do not: SAVINGS. Trichet of the ECB and Mervyn King of the BOE are right to leave interest rates high while providing liquidity to the financial system as it forces borrowers to live closer to reality and reduces the mal-investments being created.

The UK is in the US boat, its citizens are more indebted than Americans and their real estate markets are even more OVERPRICED; so you can expect continuing pressure on the British Pound and US Dollar as taxes rise, deficits explode and money printing accelerates.

This has been a very depressing Tedbit, but it is one you must know in order not to go down with the ship that is the US economy. There is only one solution to these problems and that is to PRINT the money, recapitalize the banking system to allow PRUDENT lending to get going again (at least $500 billion to $1 Trillion Dollars will be required) and restore confidence to investors everywhere. Lending standards must be restored to prudent levels and past excesses written off. It must be done. Fannie Mae and Freddie Mac have to formally be acknowledged as government-sponsored enterprises to lower borrowing costs and entice investors to purchase their securities, or be recapitalized in some form. There is no other course of action which has any chance of success.

Perfect Description

I want you all to know that no matter how much I report on the current macro-economic and geo-political events that I LOVE THE UNITED STATES. It was god's gift to man and its founders were wise men that provided future generations the greatest free country in history. The United States government was organized to prevent elites and bankers from doing what they have always done in history: Enslaving those around them. Unfortunately, immoral and insatiable greed has done to the United States what it has done for millennium: Enslaved the broad public through ignorance and deception. Our forefathers knew these lessons well and provided the blueprints for preventing this from happening in our constitution. However, the constitution has been eviscerated by corrupt public servants, central and private bankers, weasel words, attorneys and George Orwell redefinitions of our language, and those lessons have once again been forgotten. History is repeating as it always does, over and over.

I am including a link to an essay for your review from Dr. Daryl Schoon who has penned an accurate description of where we have descended to: The Die is Cast The Cast Will Die . Read it and weep as I did after reading it. I was lucky enough to be among one of the last generations to have been taught economics, history and what the constitution really means. Those lessons are now verboten and never to be allowed into citizens' minds anymore. The public school monopolies see to it.

I love my readers and all of you who I have met through this newsletter. That is why I must continue to inform you, as much as possible, of unfolding events. To do so allows you to organize yourselves to be victimized as little as possible by the current state of affairs here and throughout the developed world of the G7. Pray for us all.

Crack-Up Boom

I was interviewed by David McAlvany about the Crack-Up Boom, which is now moving into a higher gear as we face the tsunami of unpayable obligations past, present and future. I have included a link to the interview ( www.mcalvany.com/podcast /) and I hope you enjoy it!

In conclusion , the socialization of the risks and the bailout in the banking and financial system has just begun. They need to move faster and many in the government support this. They support it not because it's the right thing to do or they have knowledge of history/economics but because it is an election year and nothing will be allowed to get between them and their thirst for more power over others. All this creates OPPORTUNITIES for prepared investors and you must prepare yourself to capture them and not be victim of them. Capitalism is a memory in the United States and the G7 and is growing rapidly in the emerging world.

The bankers and elites mentioned in Dr. Schoon's essay are firmly in control in the G7 and we will progress to the ultimate result he outlines: A hyperinflationary boom which will evolve over the next decade. It is a “Crack-up Boom” in its infancy and worldwide in scope. Recognize it and organize yourself to prosper. Volatility is opportunity and it is going to increase infinitely as the unfolding “Crack-up Boom” turns every main stream investment and saving assumption on its head. It is creating huge moves as investors run like ping pong balls until they understand that a lifetime of their investing assumptions are now INCORRECT!!! Lenders, borrowers and fiat currency holders are being put into a LOSE, LOSE, LOSE situation as outlined by this newsletter over the last 4 years and Dr. Schoon. It is an unbelievable, rarely seen opportunity in history for those who can recognize it, and who can organize themselves to capitalize on it.

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Doreen

02 Jun 09, 03:25 |

market oracle

This is a very interesting website, I have added it in my favourites. Keep up the good work. Thanks :). Sloan. |