Cyprus Resists International Pressure To Sell Gold Reserves

Commodities / Gold and Silver 2013 Jul 17, 2013 - 02:33 PM GMTBy: GoldCore

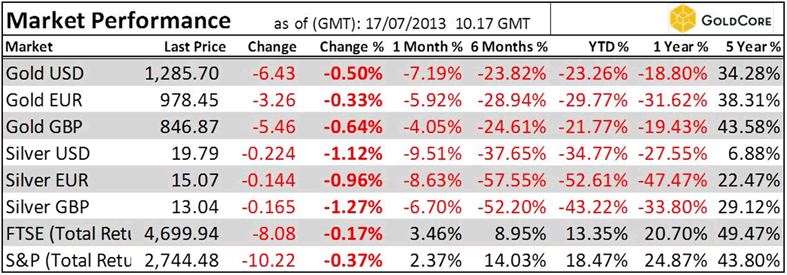

Today’s AM fix was USD 1,284.25, EUR 977.29 and GBP 845.68 per ounce.

Today’s AM fix was USD 1,284.25, EUR 977.29 and GBP 845.68 per ounce.

Yesterday’s AM fix was USD 1,286.00, EUR 983.03 and GBP 853.24 per ounce.

Gold rose $7.40 or 0.58% yesterday and closed at $1,292.40/oz. Silver gained $0.06 or 0.3% and closed at $20.02.

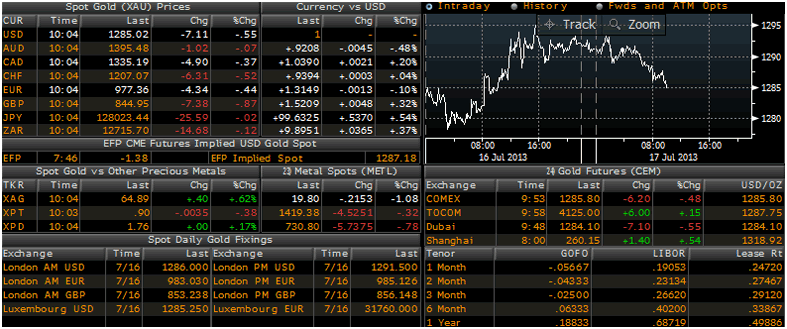

Gold Prices/Fixes/Rates/Vols - (Bloomberg)

Gold is lower in all major currencies today but remains well bid near the $1,300/oz level.

Physical demand, particularly from China, remains very robust and premiums high at over $30 per ounce overnight.

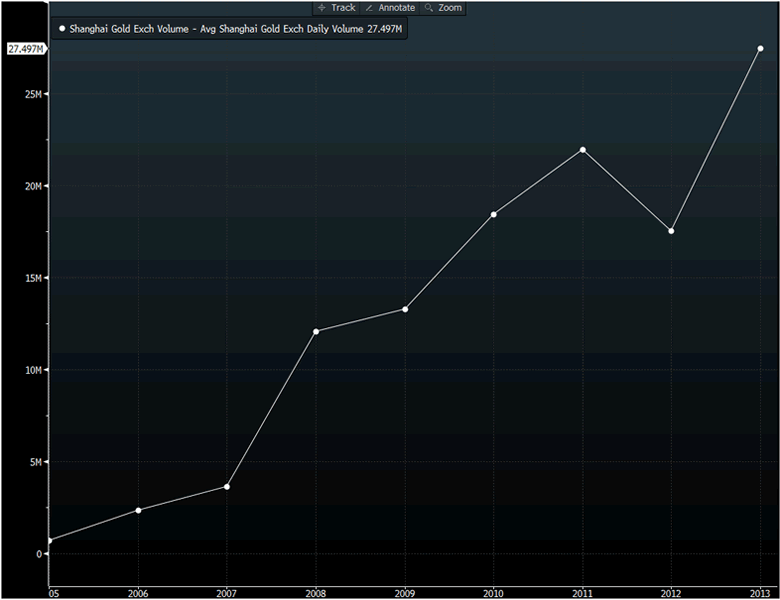

Physical gold delivered to buyers by China’s largest bullion bourse in the first half of this year almost matched the entire amount taken from its vaults in 2012 (see Shanghai Gold Exchange charts below), and was more than double the country’s annual production.

Breaths will be held prior to Bernanke’s testimony but as ever it will be prudent to ignore the noise and his often contradictory words and focus on actions and the reality of continuing ultra loose monetary policies.

Cyprus is resisting pressure from the European Commission (EC) and International Monetary Fund (IMF) to sell its gold reserves to finance its “bailout”.

Yesterday the Cypriot Finance Minister said that a sale of its gold reserves was not the only option under consideration to pay down its debt and that other alternatives were being considered.

Cyprus has 13.9 tonnes (c. 447,000 troy ounces) of gold reserves which are worth some 436 million euros at today’s market prices.

The international bailout imposed on Cyprus involved 10 billion euro ($13 billion) and therefore the Cypriot gold reserves are worth a mere 4.36% of the bailout.

"The possibility of selling gold is known, but only as an option," Finance Minister Harris Georgiades told reporters. He did not elaborate on what the alternatives were according to Reuters.

The government in Cyprus may realise that in the event of Cyprus leaving the euro and returning to the Cypriot pound, their gold reserves could provide support to the fragile newly launched national currency.

International lenders have imposed a 10 billion euro bailout on the country, which was forced to seize bank deposits in two major banks in radical new “bail-ins” to finance the sudden “bail out” in March.

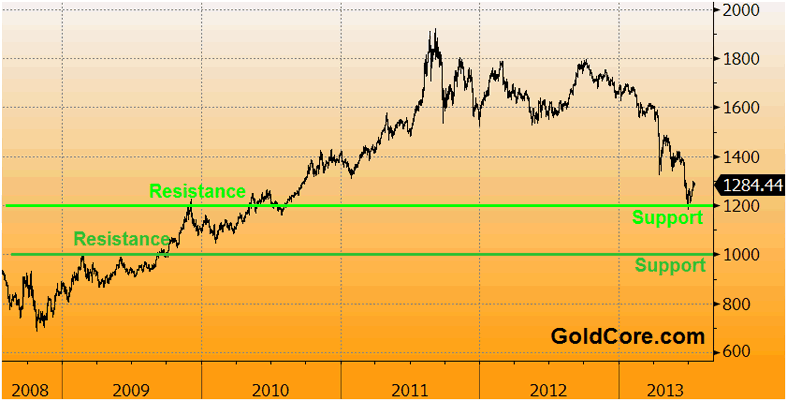

Support and Resistance Chart, 5 Year - (GoldCore)

Cyprus continues to see capital and currency controls today - meaning that a euro in Cyprus is no longer the same as a euro in France or Germany.

The International Monetary Fund and the European Commission stipulated that Cyprus should sell its gold reserves at the time of the bailout.

"It will be considered, when the time comes, with options, or rather, all other options," Georgiades told reporters. Asked if this meant there was a possibility of Cyprus not selling its gold, he answered: "When that time comes other options will be examined."

At the weekend, Cypriot President Nicos Anastasiades said he hoped there would never be a need for the sovereign nation to sell its gold reserves. Anastasiades said responsibility for the issue rested with the country's central bank.

"I want to believe there will never be such a need," Anastasiades told a news conference in Nicosia at the weekend. "The issue is not being discussed by the government, it is a responsibility of the central bank," he told reporters.

An assessment of Cypriot financing needs prepared by the European Commission in March said that Cyprus has to sell its gold reserves. Officials have attempted to play the issue down, saying the matter is not a priority for the government.

There was much unfounded speculation that news of the potential sale helped drive the biggest fall in gold prices ever last April. However Cypriot gold reserves are miniscule at just 13.9 tonnes.

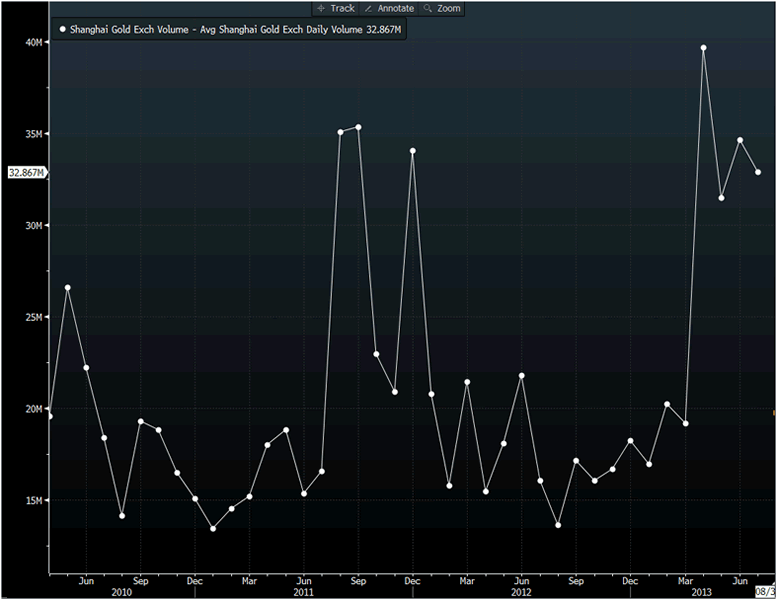

Shanghai Gold Exchange Volume 8 Year - (Bloomberg)

To put that number into perspective, it is about 7% of monthly gold deliveries on the Shanghai Gold Exchange (SGE). Demand leading to monthly gold deliveries on the Shanghai Gold Exchange are roughly 200 tonnes per month - 236 tons in April, 224 tons in May and 180 tons in June.

There was also speculation that a possible gold sale would be a precedent and could lead other Eurozone and other debtor nations to consider gold sales and a suggestion that this contributed to gold’s weakness.

Largely ignored in much of the analysis was the fact that under the Washington Agreement,extended in 2009, central banks are prohibited from gold sales outside of “a concerted programme of sales over a period of five years, starting on 27 September 2009”.

Shanghai Gold Exchange Volume 3 Year - (Bloomberg)

Nations may consider using gold reserves as collateral, as proposed by the World Gold Council, in order to maintain confidence in their debt and keep yields low but they will be reluctant to sell gold reserves completely. Even if indebted central banks such as Cyprus were forced to sell their gold reserves, it would likely be to another central bank or to the IMF or the ECB, and would not make its way onto the open market and create extra supply.

Should the Cypriot gold sale happen, it would be unlikely to set a precedent for other troubled Eurozone countries such as Italy as these nations now greatly value their gold reserves as important stores of value that will protect against currency devaluations.

There is also the likelihood that debtor nations will be very reluctant to sell their gold reserves to finance bailouts of their banks and financial sectors which have been lent to irresponsibly by international banks.

Cash strapped people and nations such as Cyprus are being forced by circumstance to sell their gold while creditors are continuing to accumulate gold.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.