Gold Matter In “a banquet of consequences” Deficits

Commodities / Gold and Silver 2013 Jul 17, 2013 - 10:12 AM GMT DEFICITS MATTER! Democrat Franklin Delano Roosevelt was the first to publicly declare that deficits did not matter since, he reasoned, we owe the money to ourselves. Dick Cheney, who should know better, made the same claim in behalf of Republican deficits. Deficit denial has never held water simply because holders of government paper – foreign or domestic — intend to be repaid and with interest. It’s that part about creditors demanding interest that blows a hole in the “deficits-do-not-matter” argument.

DEFICITS MATTER! Democrat Franklin Delano Roosevelt was the first to publicly declare that deficits did not matter since, he reasoned, we owe the money to ourselves. Dick Cheney, who should know better, made the same claim in behalf of Republican deficits. Deficit denial has never held water simply because holders of government paper – foreign or domestic — intend to be repaid and with interest. It’s that part about creditors demanding interest that blows a hole in the “deficits-do-not-matter” argument.

Some quick background:

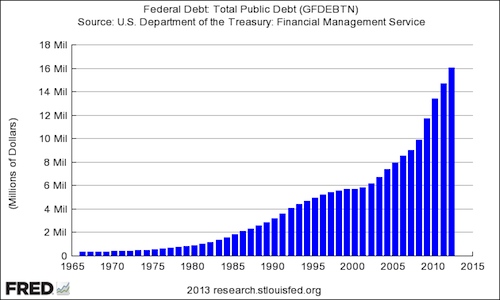

* * * In 2008 when the national debt stood at $10 trillion, the federal government paid $451 billion in interest at an average rate of 4.5%.

* * * In 2012, it paid $360 billion interest on a $16 trillion debt at an average interest rate of 2.3%. For a measuring stick, the ten-year treasury bill drew an average interest rate in 2012 of around 1.75%.

* * * If the ten-year treasury bill were to rise to its most recent high of 2.75% and stay there), the implied interest rate paid by the federal government would go to roughly 3.6%. The total interest paid would exceed $600 billion, the rough equivalent to what the United States spends on the national defense.

* * * If the average interest rate paid were to return to 4.5% — the blended rate in 2008 — the United States would pay $765 billion in interest, or nearly one-third of 2012 tax revenues ($2.45 trillion). At that point, markets might begin to question the solvency of the U.S. federal government.

A banquet of consequences

Wall Street trembles at the thought that the Fed may have lost control of interest rates. Now you know why.

Think too what might be behind chairman Bernanke’s impending retirement from his position at the Fed. As Neil Howe stated in an interview posted at this website a couple of weeks ago, the Fed has maneuvered itself into an inescapable policy trap he called a “cockroach hotel.” Of course, Howe believes there is a certain inevitability to the historical process and that the Fed’s current dilemma is part and parcel of the Fourth Turning he now states began in 2008. What happens when the only policy alternative is to continue monetizing the debt in order to keep the federal government reasonably solvent? Ultimately, the monetarist school would likely tell you, we might all wake up one day to the same sort of sudden and inexorable hyperinflationary explosion Germany experienced in the 1920s. As Robert Louis Stevenson put it, “Sooner or later everyone sits down to a banquet of consequences.” What the nation needs is another Paul Volcker. Under the circumstances, what it is likely to get is another Ben Bernanke.

Fitch downgrades French sovereign debt, gives U.S. debt a pass (??)

Meanwhile, things are not going well in Europe. On Friday Fitch, the rating agency, cut France’s credit rating suggesting in its report the French government needed to reform its finances. Fitch justified the downgrade by citing a projected sovereign debt to gross domestic product ratio of 96% in 2014. “The only ‘AAA’ country with a higher debt ratio is the US (AAA/Negative),” says Fitch somewhat sheepishly, “which has exceptional financing flexibility and debt tolerance afforded by the preeminent global reserve currency status of the US dollar.” (Fitch, it appears, deemed it advisable to explain why it was punishing France while giving the United States a pass.)

A good many would disagree with Fitch’s assessment of the dollar’s preeminence. The days of U.S. government’s exorbitant privilege, they say, are quickly waning. In fact, the U.S. is having trouble financing its debt. So much so that the Federal Reserve — not foreign governments, sovereign funds and central banks — has become the U.S. government’s primary lender. In 2012, the Federal Reserve purchased 45% of the government’s debt issue, and that does not include the massive back door monetization conducted via the Feds purchase of mortgage-backed securities from the commercial banks.

Gold’s market bestowed AAA rating

As you can see, DEFICITS DO MATTER! In fact, they matter a great deal and that’s why gold matters. Nation states will go about their business as they always have, and they will continue to receive their report cards, for better or worse, from the ratings agencies. The solid AAA rating for gold, on the other hand, persists without the blessing of any rating agency. It is a rating bestowed by a global financial marketplace that understands the difference between a paper promise and an asset that, as Alan Greenspan once put it, “does not require endorsement.”

I will end this postern to golden economics with a quote I have referenced here often. I return to it religiously because it states so well why nation states, insititutions and individuals alike inevitably revert, as they have over the past several years, to gold as a wealth repository in times like these. French president Charles DeGaulle presented this argument in behalf of gold in the 1960s at the height of another monetary crisis centered around the dollar. At the time, France was converting a large proportion of its dollar reserves to gold at the U.S. Treasury.

“Indeed,” he said, “there can be no other criterion, no other standard than gold. Oh, yes! Gold, which never changes its nature, which can be shaped into bars, ingots or coins, which has no nationality and which is eternally and universally accepted as the unalterable fiduciary value par excellence. Moreover, despite everything that could be imagined, written, done, as huge events happened, it is a fact there is still today no currency that can compare, either by a direct or indirect relationship, real or imagined, with gold.”

USAGOLD NEWS COMMENTARY & ANALYSIS

If you would like to broaden your view of gold market, we invite you to sign-up for our regular newsletter and receive quality commentary like what you are now reading. It’s free of charge and comes by e-mail. You can opt out at any time.

In addition, we invite you to bookmark our Breaking News page for up to the minute news and opinion of interest to the gold owner. By scrolling through our archive, we think you will see why this page has become an important part of the gold info package for a large number of gold owners.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael Kosares has over 30 years experience in the gold business, and is the author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold, and numerous magazine and internet articles and essays. He is frequently interviewed in the financial press and is well-known for his on-going commentary on the gold market and its economic, political and financial underpinnings.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.