Even Oil Executives Know Crude Oil Prices are Too High!

Commodities / Crude Oil Jul 16, 2013 - 10:37 AM GMTBy: EconMatters

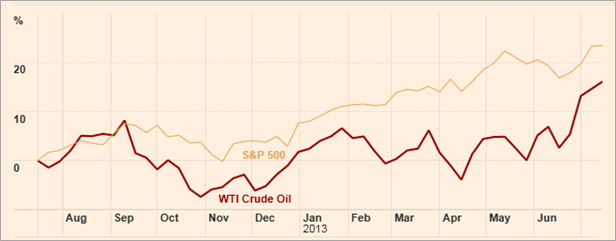

WTI is Tracking S&P 500 last Month

WTI is Tracking S&P 500 last Month

It is obvious that the oil market is out of touch with the fundamentals of a sluggish global macro-economic picture, and surging domestic and international oil production right now. The problem is that Oil, and especially WTI which is being tied to the S&P 500 bullishness, (i.e., stock market at all-time highs) is completely manipulated by hedge funds and investment banks and is harmful to the economy, businesses and consumers.

Chart Source: FT.com

Oil Industry Analysis

But this is just my analysis, let`s hear what Oil industry executives believe: Gulf Oil CEO Joe Petrowski stated that Oil prices should be about half of today's $105 a barrel price by the end of the year. He stated the reason for this price analysis is because of increasing supplies as there are record amounts of oil and natural gas that are being produced in the United States and in Canada and OPEC supplies are higher.

Joe Petrowski, CEO of Gulf Oil, explains why he sees oil headed much lower. (Video Source: CNBC, July 15, 2013))

What is wrong with this picture?

So we have an economy growing at 1.8% by the official GDP numbers, China just printed their lowest GDP number in five years, and Greece needs additional bailout money from the IMF. What is wrong with this picture?

The same thing that has been wrong with this picture for the last five years! It is about time government, regulators or the American people themselves say enough is enough and do something about this outright theft, i.e., stealing from businesses and consumers.

To artificially raise an everyday staple like oil and derivatively gasoline for citizens worldwide when there are ample supplies, more than ample, an over-abundance of supplies is more than criminal it is immoral in a civilized society. I am all for a fair price being set by the actual market forces but we don`t have that in the oil markets.

Speculators, Speculators, Speculators…

The oil market is a paper/electronic market which is manipulated by a few powerful elite investment banks and hedge funds that distort prices in the actual physical oil and gasoline markets.

For example, “Money managers boosted their bets on higher oil prices to the highest level in more than two years during the week ended Tuesday, according to government data”. As in, ‘Hedge funds and other speculators held a net long position of 281,918 contracts during the week ended Tuesday, the Commodity Futures Trading Commission said Friday. That is a rise of 6.9% over the prior week and the biggest net long position since March 22, 2011” as reported by the Wall Street Journal.

Further Reading: Oil in Tankers to Manipulate Prices?

Who Protects Consumers from these Predatory Practices?

This has happened probably 20 times during the last five years, where the speculators drive up prices not because of fundamentals, or real supply shortages, but because they can.

The government wouldn`t let them rob banks with this kind of impunity. The Fed is so concerned with banks ripping off consumers with aggressive credit card fees and banking fees, how is this any different? This is a prime example of investment banks and hedge funds taking advantage of consumers and businesses with predatory practices.

Political Representation has Over-riding Interests versus Consumers

It is impractical for consumers who have jobs to take time off and protest against this crap, voting doesn`t work because if you look at all the largest campaign donation lists you find the likes of J.P. Morgan, Citi, Morgan Stanley, Goldman Sachs. Talk about the fox guarding the hen house!

The Oil companies realize prices don`t match the fundamentals, even the Saudi`s on several occasions have called out the speculators, but they still benefit as a result of maintaining the status quo. The only time there is governmental intervention, is when President Obama worried about getting elected. So this seems like a “self-interest” problem.

How do the majority who use the product get the market price instead of the “Hedge-Fund & I-Bank” mandated price in the marketplace? Going through proper local representation in Congress seems fruitless as they are more concerned with getting further donations to win the next election from the very same investment bank that is artificially gaming the market.

Would a national gasoline boycott day get the media`s attention, and thus politician`s ear? Maybe but that requires an organized movement, impractical participation, a motivated leader and seems hard to pull off in a society the size of the United States.

It is a shame because isn`t this what our political representatives and market regulators are supposed to be doing all along anyway? Isn`t this the actual service they are supposed to be performing?

We should just have an election every year, and then the politicians would be more worried about getting elected versus taking donations from I-Banks and would threaten release of the SPRs a la Obama on an annual basis as opposed to every four years.

The Big-Pullback that Oil Companies & OPEC Fears

I think what inevitably will happen, and what insiders are preparing for in large Oil companies because they know that the fundamentals versus supplies don`t match, and they also know that they are producing far more oil than they should because of artificially high prices, that there will be a major pullback in prices whether I-Banks and Hedge Funds like it or not.

All the market Intel departments of the Oil majors have researched and forecast the pullback period for budgetary and business development purposes. They just cannot precisely say when it will happen, but they all expect it to come given the fundamentals in their industry. Ask anybody who works at one of the Oil majors if their research doesn`t forecast this scenario!

It seems Consumers & Businesses are Powerless in this scenario

It is a shame that consumers are so powerless, have no real representation on this issue, and excuse my French, but have to put up with this crap!

Markets have become ‘Characterizations’ of Free-Market Ideals

It must be some twisted irony that the country that promotes free and equal markets has bots stealing pennies from every transaction, legal front-running via co-location and subscription data access, and energy prices standard deviations above real market forced value. All the while I-Banks routinely never have a losing trading day in a quarter.

It is pretty bad when even oil execs start shaking their heads. The Party who buys the most futures positions has all the power, and can push prices wherever they want until somebody puts their foot down and stops this nonsense!

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2013 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.