Why Great Stocks Drop Hard and Reverse

Companies / Company Chart Analysis Jul 15, 2013 - 06:27 PM GMTBy: David_Banister

One thing that will always over rule charts and technical analysis is fundamentals in the long run. To be sure, I love technical analysis but I always combine my work there with fundamental research. I rarely if ever buy a stock just because the chart looks nice, that is almost always a recipe for disaster.

One thing that will always over rule charts and technical analysis is fundamentals in the long run. To be sure, I love technical analysis but I always combine my work there with fundamental research. I rarely if ever buy a stock just because the chart looks nice, that is almost always a recipe for disaster.

With that said, how many times have you seen a good company with strong fundamentals and a seemingly great looking chart break down over 1-2 weeks and take everyone out of the trade? Then for sure, the stock reverses right back up all the way back to where the decline began? To make matters worse, this happens without any real news or any bad news as it were. What is it that causes these crazy down the mountain and up the mountain moves anyways?

Insitutional Sell Programs— sometimes referred to as “Bots” or “Algo” program trading

How does it work?

In an apparently strong fundamental growth stock with no apparent issues, an institution will have a pre-defined price at which point instructions are triggered to liquidate the entire position almost at any price once that price point is hit. They protect themselves ahead of time with Puts, which give them profits if the targeted stock drops hard while they are selling out of the position, thereby locking in their targeted sell price.

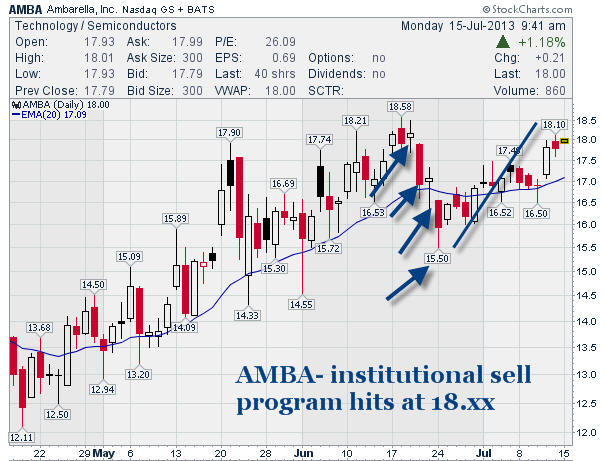

Lets take several examples below with 3 month charts to show you exactly how they look on paper. If you can learn to spot these moves you will be more likely to add to positions on big declines rather than selling out at a loss as all the stops trigger along with the margin calls:

The stocks we will chart out here are AMBA, DATA, DECK, and GILD. All strong companies with good growth profiles:

So what have we learned? In a Bull cycle buy the dips on the stronger fundamental stories when the Algo and Institutional programs start kicking in. Don’t panic out of your position at a loss, study the fundamentals and trust your instinct.

Join us at ActiveTradingPartners.com as we take advantage of exactly these types of swings all the time. Learn more at www.activetradingpartners.com

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (MarketOracle.co.uk, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2013 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.