Cash For Gold ‘Giveaway’ As 'Cash Strapped' Europeans Sell Jewellery Amid Asian ‘Gold Rush’

Commodities / Gold and Silver 2013 Jul 15, 2013 - 02:53 PM GMTBy: GoldCore

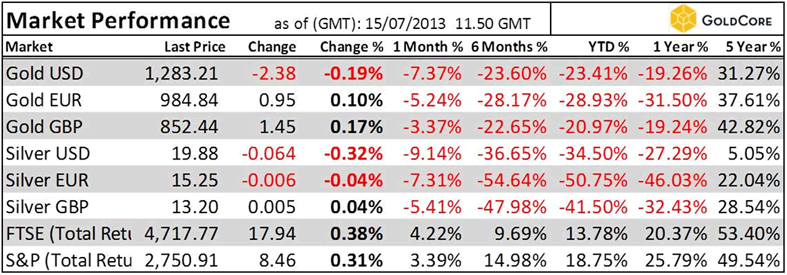

Today’s AM fix was USD 1,281.25, EUR 983.08 and GBP 850.65 per ounce.

Today’s AM fix was USD 1,281.25, EUR 983.08 and GBP 850.65 per ounce.

Friday’s AM fix was USD 1,275.00, EUR 976.79 and GBP 842.70 per ounce.

Gold fell $0.90 or 0.07% on Friday and closed at $1,284.40/oz. Silver fell $0.29 or 1.44% and closed at $19.89.

Gold and silver were both up on the week at 5.14% and 5.46% respectively.

Gold inched up Monday after last week saw its largest percentage increase in over two years. Ben Bernanke admitted last week that a highly accommodative monetary policy was needed for the foreseeable future, which boosted interest in gold as a hedge against inflation.

Cash-strapped consumers are losing almost 80% of the value of their gold jewellery when they sell it to cash for gold companies.

In a major survey of cash for gold firms, it has been found that consumers are losing approximately 15% of the value of their gold when they sell their gold to get euros.

Desperate citizens throughout the EU are getting very poor prices when they are forced to sell their gold jewellery and similar figures and worse were seen in the UK, Portugal, Italy, Spain, Cyprus and Greece.

When the mark-up of jewellery retailers is also factored in – which can range between 250-400% – this figure rises to approximately 80%, meaning that a ring originally bought for €1,000 will return only approximately €212.5 for a seller.

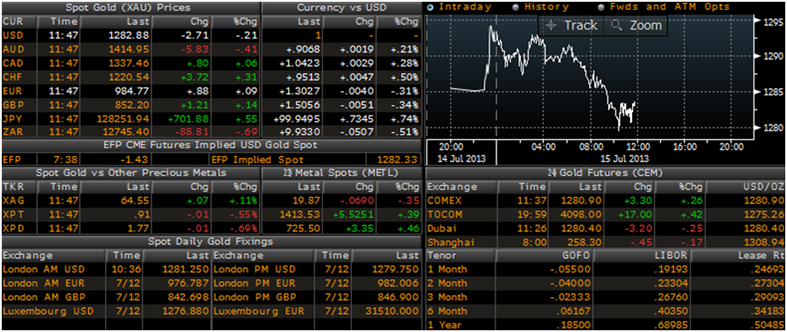

Gold Prices/Fixes/Vols - (Bloomberg)

The survey, which was carried out by Goldcore, the precious metal specialists and gold bullion brokers, found that on average cash for gold merchants are paying approximately €10 per gramme of 9-carat gold, which is 37.5% pure.

“Consumers need to be careful when selling their gold jewellery for euros,” says Mark O’Byrne, Research Director of Goldcore. “While it may seem an attractive proposition in the short-term due to the current economic environment, when you factor in the original purchase price, you can see that consumers are getting a very bad deal overall. There is also the fact that it is likely that gold prices will continue to rise in the long term.”

The current spot price for one troy ounce of 24-carat gold is €977 (as per July 12, 2013) and when readjusted at 37.5% for 9-carat gold, the price is €366.38 (the price for gold changes every day and to see current prices see www.gold.core.com ). One troy ounce equals 31.1035 grammes, therefore €10 X 31.1035 grams = €311.03 per 9-carat ounce (or €829.31 approx per 24-carat ounce). Cash for gold merchants are therefore paying approximately 15% less than the market price for an ounce of 9-carat gold (€311.03 is 15% less than €366.38).

Most retailers of jewellery will have a 250-400% mark-up on the intrinsic gold value. For the purposes of the survey, the average mark-up taken was 300%. Therefore, if a 9 carat (9/24 or 37.5% pure) gold ring is purchased for €1,000, the value of the actual gold content contained in the ring would be close to €250, based on gold’s market value. A cash for gold company will pay 15% less than its market value, giving the seller just €212.5 (a loss of approx 80% from €1,000).

“Our survey has shown that consumers are getting a raw deal from the cash for gold sector,” adds Mr O’Byrne.

“Selling gold jewellery in this manner is a classic case of buying high and selling very low – akin to ‘selling the family silver’ for very poor prices. The public is being misled that now is a good time to sell gold. At nearly $1,300 and €1,000 per ounce today, gold is well below its record high of $2,400 per ounce in 1980 in real terms when adjusted for inflation,” he continued.

Gold Support & Resistance Chart - (GoldCore)

People in the EU should try and hold onto their gold as it will protect them from bail-ins and currency crisis as physical gold has done throughout history.

Today the smart money in the world is buying gold including people in China, India and Asia who are buying gold jewellery, coins and bars in what is being termed a modern ‘gold rush’.

Meanwhile struggling working and middle class Europeans are selling their gold and getting a very raw deal in the process.

Gold is the last thing people should sell and should only be a very last resort as it is financial insurance which will protect from systemic and currency crises. In time, people will scratch their heads at “cash for gold” schemes and wonder why harder questions were not asked about this peculiar western phenomenon of recent years.

Figures for The Great Gold Giveaway graphic:

Loss for consumer overall:

* 80%

Market price per troy ounce:

* €977 per 24-carat oz

* €366 per 9-carat oz (37.5% purity)

Cash for gold merchant pays:

* €10 per gramme of 9-carat gold (37.5% pure)

One troy ounce = 31.1035 grammes,

* €10 X 31.1035 grams = €311.03 per 9-carat ounce (15% less than the market price).

Breakdown of ring purchased for €1,000

* 300% – jewellers mark-up.

* €250 – intrinsic value of the gold

* €212.5 – price cash for gold merchant will pay.

Prices valid as per July 12, 2013.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.