Stocks Bear Market Notes

Stock-Markets / Stocks Bear Market Mar 27, 2008 - 10:43 AM GMTBy: Brian_Bloom

There is an argument which might be put forward that, as the bad news is now known and, given that the market looks forward, the worst may be over and we have seen the lows in the industrial equity markets.

There is an argument which might be put forward that, as the bad news is now known and, given that the market looks forward, the worst may be over and we have seen the lows in the industrial equity markets.

This view may well be right, but it is predicated on the assumption that all the bad news is known.

If one takes the trouble to check on the rate at which the US National Debt has been rising, one will be shocked.

As at March 25th 2008, the amount was:

$9,400,595,502,368.94

As of September 26th (6 months ago) it was

$8,994,357,848,983.46

Source: http://www.treasurydirect.gov /NP/NPGateway

That's a movement of $ 406,237,653,385.48 ($406 billion) in six months and the run rate appears to be accelerating.

This is one consequence of the US Federal Reserve standing behind failing companies/sectors in order to bail them out. The debt levels – already mountainous – are ballooning.

One might argue that a natural consequence of this will be inflation and, by definition, this argument will be correct. But the question is whether currency inflation will translate in lockstep into price inflation and whether volumes of transactions will hold up. Will people buy the same volumes of goods at higher prices, or will they buy less?

If they buy less, then the real income at corporate level within the USA will fall. If they buy less, this will be defined as a “reduction in the velocity of money” and, typically, this leads to recession.

It follows that the price movements on the stock market should be viewed in relative terms. Are there better places to put your money than in US based industrial shares?

The answer to that question does not require much brain strain – and so those who are arguing that the market might be giving off bullish signals may wish to re-examine their underlying assumptions.

Technically, we have not yet had a Dow Theory sell signal. That is a fact. It therefore does indeed follow that the industrial markets “might” rise from here.

Notwithstanding this, it is this analyst's view that the reason for this non-confirmation is attributable to the inelasticity of demand in the transport sector. Over 66% of all oil used by the USA is for transportation purposes, and over 90% of all transport within the USA is dependent on oil. If people are going to get to work, and if goods are going to get to market, transport will need to continue – regardless of the price of oil.

This analyst has demonstrated in earlier articles that the reduction in volume of oil processed by companies like Exxon and Shell has been masked by the higher price of oil.

I recently read a particularly interesting article which argued that the world is nowhere near peak oil because the oil sands, and the oil under Alaska and other parts of the world have not been counted into the inventory of available resources. That's all very interesting, and it may be true, but it begs two questions:

- If the oil companies believe that this oil is accessible, why have they not been adding refinery capacity in the developed world?

- Why has the volume of throughput of Exxon and Shell shown a decrease?

The fact is, when you cut through all the smoke and political obfuscation, oil drives the world economy and the proposed alternatives all have drawbacks:

- Solar needs (battery) storage capacity to facilitate the lessening of its dependence on sunny days, and the battery technology is not yet up to speed.

- Wind is confined to geographic locations where the wind blows

- Nuclear is dependent on vulnerable overhead grids, and gives off a pollutant which makes CO2 look positively desirable – which, up to a point, it is given that without it the plants which produce oxygen will die.

So, in the absence of a visible alternative to oil, and in the face of reducing volume throughputs of oil, and given that oil drives the world economy, on what fundamental basis could we possibly be expecting a booming economy in the foreseeable future? Arguably, it has been the waning of the virility of this economic “driver” that caused the Fed to begin artificially stimulating in the first place. In the early years (after 1982) the economy boomed; but now we are saddled with the debt. And the oil driver is even less virile. And the debt is ballooning.

But all is not doom and gloom. There are alternatives in the form of electromagnetic energy technologies which might be rolled out to plug the gap. One problem, however, is that this may be a few years away and the stock markets typically don't look that far down the track.

What will happen to the world economy in the interim – given that the Fed is apparently attempting to print its way out of trouble?

Well, let's be practical, we can only do what we can do. It's a matter of academic interest only that Senator Obama no longer goes to his old church, and Mrs Clinton, like Al Gore before her, has an overactive imagination regarding the importance of her role in history. Al didn't invent the internet, and Hillary didn't resolve Ireland's problems and, presumably, God will find Barack wherever he chooses to kneel.

The re ality is that if we are going to dig our way out of this mess that the Fed has created, we need a new way of looking at things.

The re ality is that the technical picture in the Standard & Poor Chart below (courtesy decisionpoint.com ) is not particularly encouraging:

It shows a clear double top (typically) bearish; a breakdown from a rising trendline (certainly not bullish) and a sell signal on the oscillator (bearish). This is the market saying “hey guys, pay attention here”.

Could it bounce up from here? Of course it could! It probably will. But on what basis can it be argued (technically or fundamentally) that the market is going to rise to new heights?

From where I am sitting, we are in the early stages of a Primary Bear Market, and there is no upside in trying to be cute about it. The question is, if this is true, then what the hell do we do about it? With respect, the “Old Guard” of political leaders no longer has even fumes of credibility in their Trust-me tank and it is wholly inappropriate that we should be going through a chest beating election exercise costing hundreds of millions of dollars when there are far more important issues to address. For example, promising to spend $x gazillion on Health Care is an insult to the intelligence of people who are lying awake worrying about their future.

The economy has to be stimulated at grass roots level – not by pumping money into it, but by building new industry infrastructure to address future needs in the long term (multi-generational view).

The first step in this process will be to ensure a robust energy infrastructure, and the first step in assuring this outcome is to stop the political posturing. Biofuels, for example, is a real dumb idea in a world where the planet's agricultural industry cannot produce sufficient to feed the planet's inhabitants. Yes, the wheat price has been falling, but it is still 100% higher than it was less than a year ago and the US Dollar hasn't halved in that time. (Chart source: http://tfc-charts.w2d.com /chart/CW/W )

The fact is that we are now living in a world where everything and everyone is dependent on everything and everyone else. It's not an outcome of some heinous “conspiracy”. It's the outcome of a population explosion and a profligate attitude towards resources. We have to change ourselves from inside out. We have to start taking individual responsibility.

For the record, I am reasonably optimistic that the world is soon about to come to its senses. If I had to take a punt, I would punt that May 16 th 2008 will be the day when that realisation will begin to dawn. That is the day that the Mayan Calendar forecasts will be the harbinger of an energy shift.

Am I going to put my trust in a calendar that was developed around 600 years BCE? Well, let's put it this way, I'm not planning on it, and I'm not fighting it either. All I'm doing is putting it out there that there may be reason for optimism – and I would sooner trust that calendar than any politician who is promising to spend billions of non existent dollars for the sole purpose of getting him/herself elected.

There are real problems out there, and we need to start taking them far more seriously than we have up to now. 90% of the challenge has been to identify and define the “core” problem. So let me have a go at it:

The core problem is that our energy paradigms have not evolved according to our needs, and trying to solve all our other problems seems like trying to weigh an elephant on a bathroom scale because of that. From a society perspective, we need to focus on that issue above all others.

From a personal perspective, if you are looking to protect yourself, then buy gold. In whatever shape or form, gold is likely to represent part of the solution in the years ahead. I happen to think that that solution will have nothing to do with “money”, but it doesn't really matter what I think. The chart below (courtesy gold-eagle.com ) tells the story. Gold is now in new territory in today's dollars. (But I wouldn't go crazy. 10% - 25% of the portfolio seems sensible)

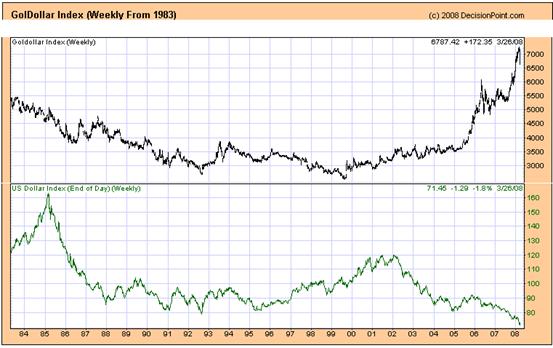

From the chart below (courtesy Decisionpoint.com ), it can be seen that Gold Multiplied by the US Dollar is also very bullish – ie Gold is not positioning to take over from the US Dollar as a currency. This is not me saying that. This is the market saying that.

However, a word of caution, from a trading perspective, the chart above and the chart below are overbought and the gold price could pull back significantly within the confines of a Primary Bull market. Taking a long term view, one should buy gold on the next down-move.

From a conservative perspective, there is a gap in the monthly chart above which needs to be covered. The problem is that I can't forecast what will happen on May 16 th – only that there will be a shift in consciousness. Theoretically, that shift in consciousness might be a collective sigh of relief – in which case the gap above will be covered, and the gold price might pull back to between $750 and $850.

If you think this is mumbo jumbo (this reference to a collective unconscious that Karl Jung told us existed all those years ago) then this won't help you at all. It follows, that if you think this May 16 th date is mumbo jumbo, you should follow your instincts now. And, with a wave of bearishness in place ( Tibet being the latest in a long line), those instincts will probably be telling you to buy gold now. Unfortunately, I don't have a crystal ball. But, if it was me, I would park my money in short dated treasuries and wait to see which way the wind is likely to blow. From my perspective it's academic. I have owned gold shares for years, and I have sufficient.

At the rate the Fed is printing money, though, the last thing I would do is put my money into long dated treasuries.

But the bottom line is this: We would be well advised to start thinking about how (collectively across the planet) we are going to address the structural problems to which we have been paying lip service.

I'm pleased to report that, if everything goes according to plan, my novel (which was written to explain the issues and opportunities to ordinary people in a light-hearted way) will have been edited by Sunday night, March 30 th , and should be available on the market within 3-4 weeks thereafter. If you're interested to acquire a copy, please register that interest at www.beyondneanderthal.com

By Brian Bloom

Since 1987, when Brian Bloom became involved in the Venture Capital Industry, he has been constantly on the lookout for alternative energy technologies to replace fossil fuels. He has recently completed the manuscript of a novel entitled Beyond Neanderthal which is targeted to go to the printers within 4-6 weeks.

Interested parties will be emailed with a personal invitation to place their order/s for Beyond Neanderthal – which will be processed and delivered by Austr ali a 's largest independent book distribution group. To avoid disappointment, please register your interest to acquire a copy of the novel at www.beyondneanderthal.com

Copyright © 2008 Brian Bloom - All Rights Reserved

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.