Gold Prices Search for That Illusive Ignition

Commodities / Gold and Silver 2013 Jul 14, 2013 - 12:00 PM GMTBy: Bob_Kirtley

Let me start by stating that I am a gold and silver bull and that the precious metals sector has been very good to me. However, any stock or commodity doesn’t not go up or down in a straight uninterrupted line. There are bear phases in a bull market just as there are bullish rallies in a bear market. Gold prices are in a long term bull market despite being in a bear phase at the moment. With that being our starting point then being short rather than long in the near term, makes sense to me.

Let me start by stating that I am a gold and silver bull and that the precious metals sector has been very good to me. However, any stock or commodity doesn’t not go up or down in a straight uninterrupted line. There are bear phases in a bull market just as there are bullish rallies in a bear market. Gold prices are in a long term bull market despite being in a bear phase at the moment. With that being our starting point then being short rather than long in the near term, makes sense to me.

As retail investors we should be able change and implement a new strategy all in one day. This is not so easy to do for the bigger players who hold sizeable stakes in some mining companies, but this should not be a stumbling block for retail investors. We have the advantage of being small enough and therefore nimble enough to recognize change and position ourselves accordingly.

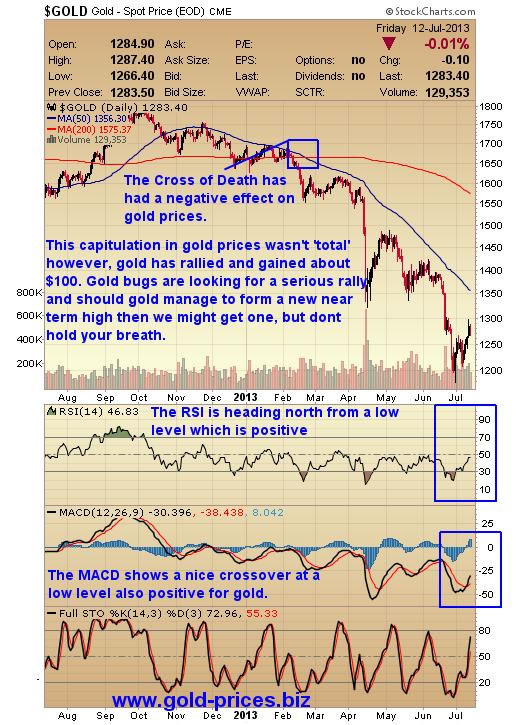

The Gold Chart

This capitulation in gold prices isn’t 'total' in that it feels more like death by a thousand cuts than a total wash out of the weak hands. Gold has rallied and gained about $100/oz recently and should gold manage to form a new near term high; get above $1400/oz then we might get a decent rally, but don’t count on it.

The Illusive Ignition

Last week’s fire side chat by Ben Bernanke changed nothing other than to calm the market participants who feared that the punch bowl was about to be drained. The dollar dropped and gold rallied bringing forth a chorus of ‘that’s the bottom in’ from the Perma-Bulls. The point here is that the employment figures are viewed as good enough to justify no further increase in QE and that deprives gold of the oxygen that it needs to rally.

The demand for physical gold continues unabated; however it is not strong enough to overcome the paper market as defined by the COMEX, at least not just yet. The bears have a tight grip of the paper market and until the selling is truly exhausted any rally in the precious metals sector will be capped.

The argument that gold can’t go any lower because this is what it costs to produce it is a strange one; if it were true then we wouldn’t have any bankruptcies as the price wouldn’t go any lower. When the pendulum swings it doesn’t stop at equilibrium, it tends to overshoot the mark and gold is well capable of doing just that. Mining companies will consider their options such as staff layoffs, a wage freeze, shelve expansion programs, spend some of their cash and reduce dividends, etc., in order to keep mining. The bigger operations would need to be moth balled which is an expense in itself. Gold may not go any lower, but it won’t be due to this sort of reasoning as it is flawed.

A resurgence of bank bail-ins in the southern EU countries could cause a few investors to seek refuge in the precious metals sector as the fear grows that their hard earned cash could be confiscated. However, there are many alternatives to cash which an investor can utilize and as gold does not pose a rosy picture at the moment alternatives will be sort.

There is the possibility of social unrest given the high levels of youth unemployment across the Eurozone but they have tolerated the current situation up to now. Although we have had riots from Istanbul to Stockholm, gold prices didn’t head higher, they drifted lower.

A Black Swan Event could boost prices; however, by definition this is an unexpected event and can hardly be depended upon as a reason for gold prices to boom.

Conclusion

We are still in a bear phase of this bull market and so we can profit from it if we trade on what we know and not on what we imagine. If you think this bear phase is set to continue then you could consider deploying some of your ‘opportunity cash’ to your change of view. A well thought out strategy involving put options or a few straight out ‘short’ positions could be well worth your consideration.

In 2013 this strategy has served us well and helped us to build cash pile in readiness for the resumption of this bull market or indeed opportunities out with this market sector. This consolidation period may have further to run so we’ll need a fair amount of patience to get through it. However, as investors we can make money whether gold goes up, down or sideways, all we have to do is take the blinkers off and recognize the current situation for it is and not for what we would like it to be.

Take care.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.