Global Stock Markets P/E Ratio and Prospective Growth Analysis for 2008

Stock-Markets / Global Stock Markets Mar 26, 2008 - 02:29 PM GMTBy: Nadeem_Walayat

The sharp drops in global stock markets has led to a fall in the current price earnings ratio's, however this fall needs to be tempered against lower GDP and earnings growth forecasts as the sharp US economic slowdown will impact most economies to varying degrees, shaving between 1.5% to 3% off the growth rates of many emerging markets.

The sharp drops in global stock markets has led to a fall in the current price earnings ratio's, however this fall needs to be tempered against lower GDP and earnings growth forecasts as the sharp US economic slowdown will impact most economies to varying degrees, shaving between 1.5% to 3% off the growth rates of many emerging markets.

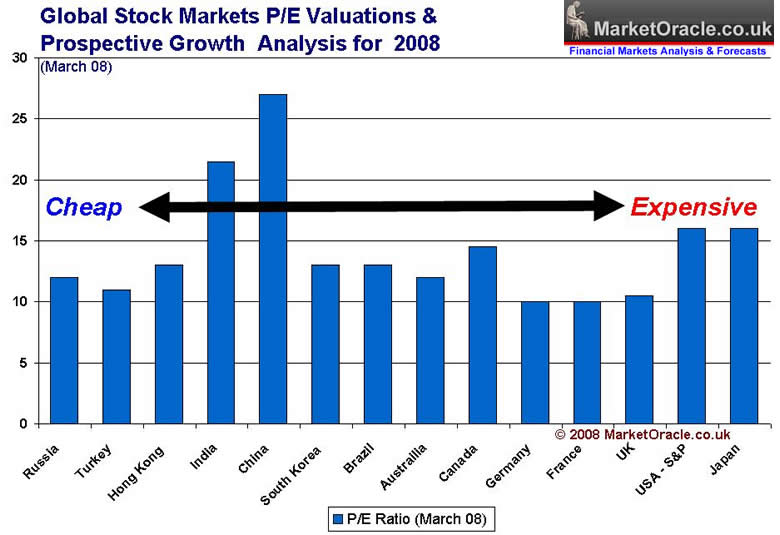

Therefore the following chart is updated to illustrate which stock markets represent value over others in terms of relative strength and growth into the end of 2008.

The main change since the last update in November 2007, is in that the falls of 40% in China and Hong Kong have now made these markets more appealing though the recent global stock market analysis pointed to more downside before the markets make a low and resume a more sustainable uptrend. The clear market to stand out from this analysis is Russia, this was backed up by technical analysis as the Russian stock market has weathered the global equity downturn quite well.

At the weak end of the spectrum, both the US and Japan come in towards the end and present the most risk to investors. Though much of Western Europe is not far behind therefore suggesting investors should be underweight in these markets.

Look out for further technical analysis of the global stock markets in coming days in addition to the 7 markets covered in the lengthy Global Stock Market Forecasts and Outlook for 2008 article.

Also for the latest on the Credit Crisis and outlook for the global stock markets subscribe to our FREE weekly newsletter.

By Nadeem Walayat

Copyright © 2005-08 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 120 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.