Stock Market Technical's and Fundamentals Remain Weak

Stock-Markets / Stock Market Valuations Mar 26, 2008 - 12:33 PM GMTBy: Chris_Ciovacco

While there is no question stocks are trying to form what market technicians call a double bottom, not much has really changed in recent weeks in terms of market leadership. It is helpful to take a step back and see what is actually happening from both a technical and fundamental perspective when times are uncertain and people are continually asking, "Has the market found a bottom?"

While there is no question stocks are trying to form what market technicians call a double bottom, not much has really changed in recent weeks in terms of market leadership. It is helpful to take a step back and see what is actually happening from both a technical and fundamental perspective when times are uncertain and people are continually asking, "Has the market found a bottom?"

Technically Not Much Has Changed – Stocks Remain in a Primary Downtrend

The press is full of stories of how the financial stocks may have found a bottom, which in turn may mean the general stock market has also bottomed. It is also easy to find stories calling for an end to the bull market in commodities. When you clear away all the noise, investing is about owning things that are in long-term uptrends and avoiding or underweighting things which are in long-term downtrends. You do not need to be a Certified Market Technician to see that financial stocks remain firmly in a downtrend (see chart below).

Graph 1: U.S. Financial Stocks - Little Evidence of a Bottom

Similarly, the recent pullback in commodities has done nothing yet to even remotely place the current primary uptrend in jeopardy. The fundamentals in many commodity markets remain favorable from a long-term perspective. It is prudent to acknowledge economic weakness could cause sharp corrections in some commodities. As of Tuesday's close, nothing is sounding alarms in the chart below, which shows a diversified basket of crude oil, heating oil, corn, wheat, gold, and aluminum.

Graph 2: Physical Commodities - Little Evidence of a Top

Fundamentals: Are Stocks Cheap and Are The Worst of the Write-Offs Behind Us?

From yesterday's Wall Street Journal (3/25/08): "The stock market's comeback lately erodes the argument that equities are cheap. As of Monday's close, the Standard & Poor's 500-stock index was priced at about 16 times the past four quarters' earnings, nearly matching the market's long-term price-to-earnings ratio. The S&P looks better relative to expected earnings for 2008, with a forward price-to-earnings ratio of about 14, below the long-term average. The trouble is that forward earnings are based on optimistic assumptions about earnings growth. They presume earnings will grow 17% in 2008, more than reversing a 6% 2007 decline and more than doubling their average growth since 1989 -- despite the fact that analysts agree earnings are likely shrinking in the first quarter. If earnings merely return their average growth rate of 8% -- unlikely, if the economy really is in recession -- the forward P/E rises to 15. If earnings fall 17.5% -- as they have, on average, during the past three years that included recessions, according to S&P data -- then the forward P/E ratio rises to 20, undermining the idea that stocks are cheap. Some market bulls suggest the recent rallies in financials and other interest-rate-sensitive sectors are a sign the market has begun to act as it typically does at the start of new economic cycles. But maybe these "early cycle" bulls are getting ahead of themselves. The market doesn't even seem to have priced in much of an earnings slowdown yet."

From Tuesday's Bloomberg Reports (3/25/08): “March 25 (Bloomberg) -- Wall Street banks, brokerages and hedge funds may report $460 billion in credit losses from the collapse of the subprime mortgage market, or almost four times the amount already disclosed, according to Goldman Sachs Group Inc. Profits will continue to wane, other analysts said.”

Current Trends Remain Unfavorable for Global Stocks

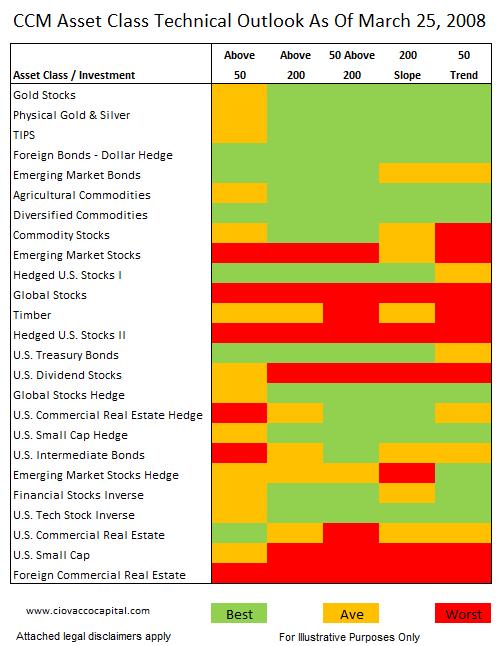

The table below focuses on what is happening now from a technical perspective, which is better than reading a thousand forecasts or predictions of where the markets may be headed.

Table 1: Long-Term Trends

From S&P: "New York, March 25, 2008 – Record Declines in Home Prices Continued in 2008 According to the S&P/Case-Shiller Home Price Indices - Data through January 2008, released today by Standard & Poor's for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show declines in the prices of existing single family homes across the United States continued into the new year, with 16 of the 20 reporting MSAs posting record low annual declines, of which 10 are in double-digits."

When the Fundamentals and Technicals Align

The best time to invest is when you have both positive fundamentals and positive market action (or technicals/charts). It is very difficult to say the charts look good (yet), and nearly impossible to say the fundamentals look good.

The Positives – Keeping an Open Mind

- Market is trying to form a double bottom

- Sentiment is in bottoming territory

- The FED is pulling out all the stops to put a floor under asset markets

- It is good to buy when there is blood in the streets

- The market climbs a wall of worry

What do you do?

You remain skeptical, but open minded, about bullish outcomes for stocks. If this double bottom is indeed “the bottom”, then the charts will reflect that in due time. There is not enough evidence in either the fundamentals or the technicals to put significant amounts of capital at risk in stocks. Nor is there enough technical evidence (as long as the January market lows hold) to blindly pitch your tent in the bearish camp for stocks. However, there is enough evidence to have picked out a place to possibly pitch your tent in the bearish camp. If the January S&P 500 lows are taken out, it would add to the weight of the unfavorable evidence.

If we stay focused on what is happening now while respecting there are numerous paths for the Fed and markets to take from here, we'll be fine. There remains a significant amount of what I call “press conference risk” where one press release from the Fed or announcement from the financial or housing sector can change the market's dynamics on a dime.

Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2008 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.