Bernanke Boosts Stock Markets, Bashes U.S. Dollar

Stock-Markets / Stock Markets 2013 Jul 11, 2013 - 02:38 PM GMTBy: PhilStockWorld

Hallelujah!!!

Hallelujah!!!

And He shall print for ever and ever. That's right kids, Uncle Ben came to the rescue last night with his most doveish speech of the year (and the competition was fierce!). We went over the Fed Minutes (well, half of them, they were long!) in yesterday's chat (tweeted here) but all that analysis was thrown out the window when Bernanke said: "Both sides of our mandate are saying we need to be MORE accommodative."

MORE??? (and, yes, that's what it sounds like inside my head) And oh yes, MORE was the message and, just in case you were somewhat thick of head, the Fed Chairman said this (in less than 25 minutes):

"You can only conclude that highly accommodative monetary policy for the foreseeable future is what's needed in the U.S. economy"

(Fed Governors) "were concerned that stating an intention to slow the pace of asset purchases…might be misinterpreted as signaling an end to the addition of policy accommodation or even be seen as the initial step toward exit from the (Fed's) highly accommodative policy stance."

"The Fed is heading toward a possible, and gradual, change in the mix of instruments it is using to help the economy, but that shouldn't be confused with the overall thrust of policy which is highly accommodative."

"The overall message is accommodation."

Holy cow! Being that accommodative can get you arrested – except in certain parts of Nevada…

Holy cow! Being that accommodative can get you arrested – except in certain parts of Nevada…

Now, as sexy as all that accommodation may sound to the bulls (and we intended to go bullish today if Bernanke came through), I have a bit of a problem with it - and it's not just the fear of catching some monetary disease that makes my wallet drip:

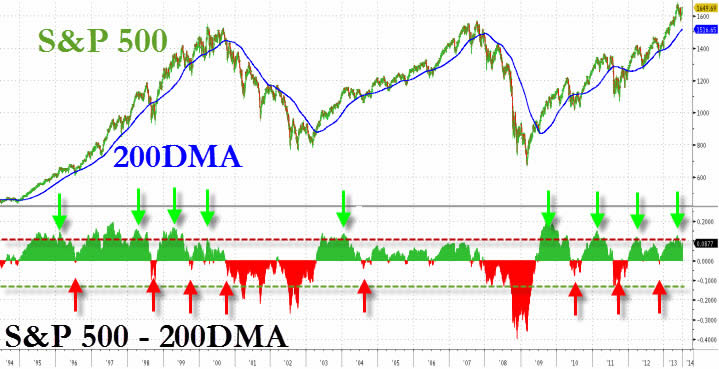

It's the LACK of reaction to his statement. Sure the Futures are up about 1% pre-market (8am) but the Dollar is down 1.3% and the Nikkei once again topped out at our 14,600 shorting target (/NKD) and oil topped at $107 where we shorted that again in early morning Member Chat (and a LOT of ground was covered this morning) and TLT (20-year notes) has barely budged, indicating Bond Traders aren't buying what Bernanke is selling.

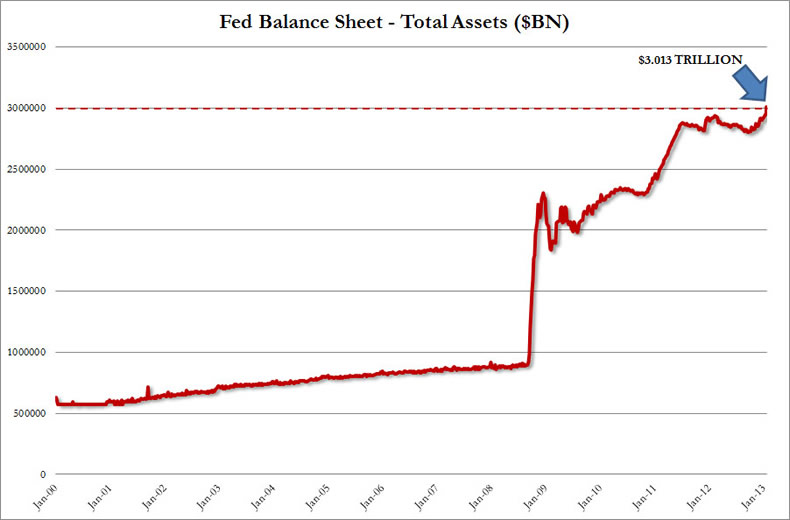

That will be tested later today when we get our 30-year auction at 1pm. Rates have been shooting up on long bonds ever since "tapering" became a buzzword and our last few long auctions have had very poor participation (but the Fed is always there to buy up the excess). We'll also get a look at the Fed's burgeoning balance sheet after the close today but, as you can see from the chart on the left – that ship has sailed long ago and now, like our National Debt – it's just some crazy big number that can't really be conceived so we pretty much just ignore it (the SEP Effect).

What we can't ignore is the upcoming earnings or the weak data but let's back-peddle a bit to WHY the Chairman of the Federal Reserve felt it necessary to say "accomodative" 5 times in 25 minutes. There's a hint of desperation in the air as Bernanke pulls a Draghi and talks the best of all possible gains but offers nothing concrete as far as details and nothing at all that is actually new.

Are we turning into Europe? Surely the data recently has sucked. Garner just reported that Global PC shipments fell 10.9% from last year's awful levels and Samsung just confirmed this with HORRIBLE earnings and Cannaccord cut their SmartPhone forecasts by 2%, with sales leaning toward less expensive models. YUM brands saw a 20% drop in China sales (but there was a bird flu issue) but US sales were only up 1% (not even the supposed drop in unemployment) and margins fell 270 basis points as food chains have to push discounts to drive traffic.

NBR (oil services) put up poor numbers with lowered guidance and refinery stocks are tanking as the crack spread is falling because – you can fake the price of oil all you want (not even going to get into that this week) but you can't fake the price of gasoline because, ultimately, you need the consumers to buy it from you. After hanging out around $2.70 at the end of June, gasoline (/RB) is crossing $3 this morning – up more than 10% in the first 10 days of the month. At this pace, gasoline will be $5 by January! (just kidding – hopefully).

Gas last poped $3 (wholesale) back in February and ran up to $3.34 (another 10%) but oil was only $98 at the time (10% lower) and quickly fell back to $89 (another 10% lower) by March so we can assume the economy can't really take much more than $3.30 on gasoline but $106 oil means other non-discretionary items like food and electricity and heating oil are 10% more expensive and the leaves 10% less money for gas. So, if you are now going to ask consumers (who are making 0.6% more than they did in February) to pay 10% more for oil AND gas – I think discretionary spending may begin to suffer.

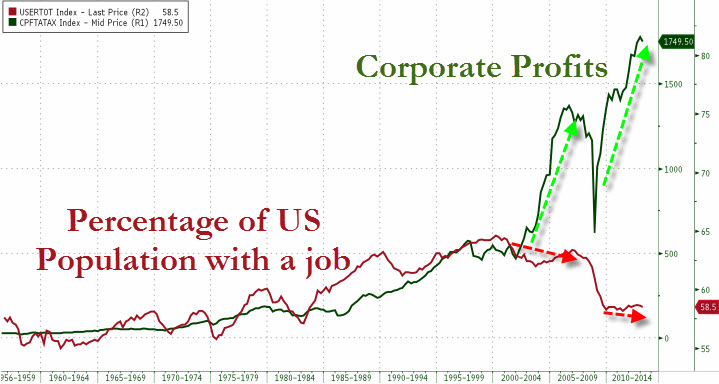

In short – something's gotta give and, from the few earnings reports we're seeing so far – it looks like it might be Corporate Profits. Never before in our nation's history have Corporations made so much and paid so little. So little to their workers and so little to the Government, who collected less than 1/3 of the taxes from Corporations in 2012 than they did in 2007 and it was less than half of what they collected in 1977, when the economy was 50% smaller!

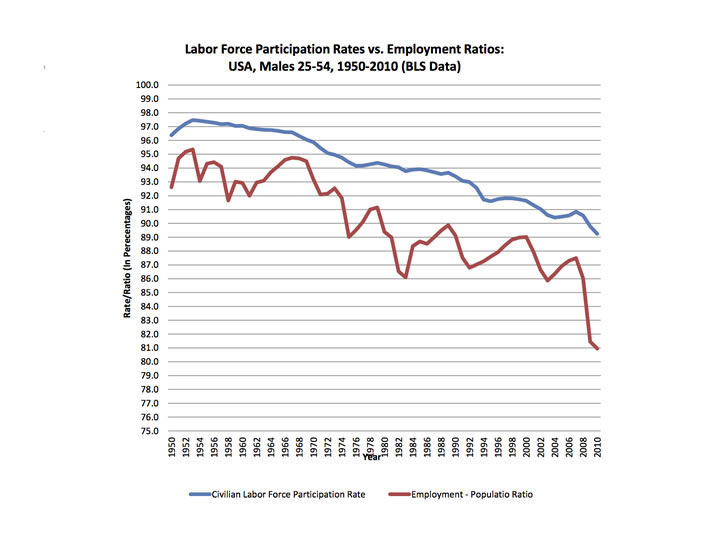

You can see the consumer suffering in what Real Clear Markets refers to as "The Astonishing Collapse of Work in America" and this is the kind of stuff the Fed SHOULD be worried about as our employment to population ratio is COLLAPSING – from 87 to 81 (7%) in just 5 years and down from 95% back in the 50s (down 15%).

With 300M people, that's 45M jobs that have been lost in 5 decades and 21M of those jobs lost in the past 5 years with no end in sight. In fact, even today, Jobless Claims jumped up to 360,000 vs 340,000 expected (same a prior) and continuing claims went up antother 24,000 to 2.98M.

As our Republican friends are quick to point out – more lazy mouths to feed. Why don't they go start their own businesses and raise capital to do a few LBOs and pay back the loan by laying off 100,000 more people like the rest of us? Some people are just born lazy I guess…

Ah Capitalism, you f'ing *****!

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.