Gold Surges $50 As Brinks Sees 55% Decline In Gold Inventories

Commodities / Gold and Silver 2013 Jul 11, 2013 - 10:25 AM GMTBy: GoldCore

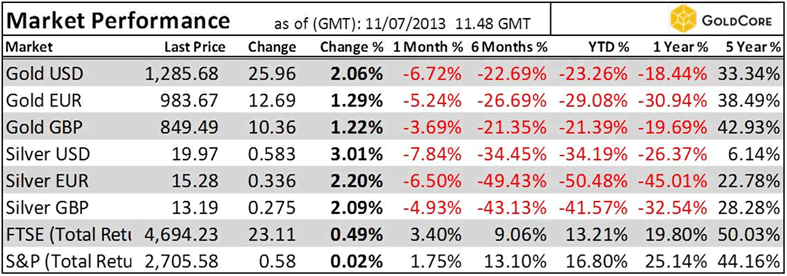

Today’s AM fix was USD 1,280.75, EUR 981.87 and GBP 848.91 per ounce.

Today’s AM fix was USD 1,280.75, EUR 981.87 and GBP 848.91 per ounce.

Yesterday’s AM fix was USD 1,252.25, EUR 977.02 and GBP 840.78 per ounce.

Gold climbed $2.70 or 0.22% yesterday and closed at $1,251.10/oz. Silver fell $0.07 or 0.36% and closed at $19.15 prior to some sparks that were seen in after hours and Asian trading.

Gold Prices/Fixes/Rates/Vols - (Bloomberg)

Gold surged 3.3% or nearly $50 from $1,248/oz to $1,298/oz after Federal Reserve Chairman Ben Bernanke admitted that the U.S. economy continues to need a highly accommodative monetary policy and will do for the “foreseeable future”.

Gold climbed for a fourth day to the highest level in more than two weeks due to safe haven buying after Bernanke also admitted, what many more realistic analysts have been saying for some time, that the 7.6% unemployment rate probably "overstates the health of the labor market."

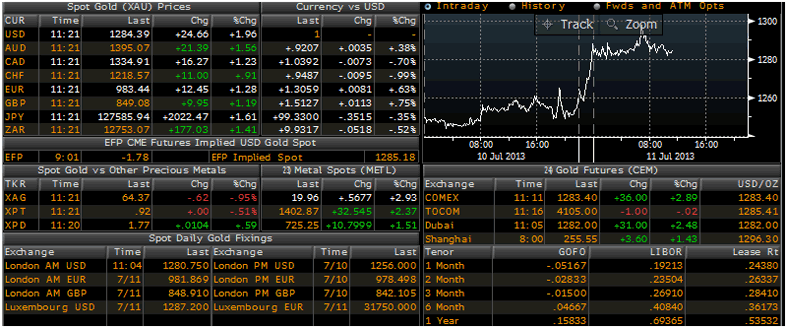

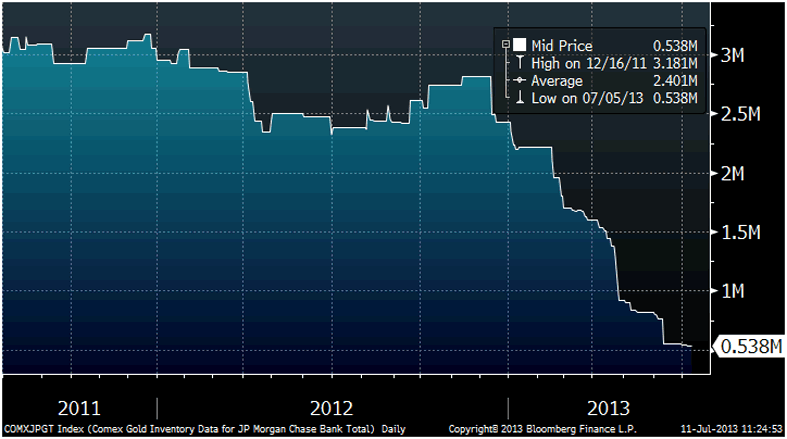

Comex Gold Inventories (Millions of Ounces)

Gold’s record 23% fall last quarter was attributed to Bernanke’s “jawboning” when he again claimed that the Fed would reduce its $85 billion of monthly asset purchases this year. Minutes of that meeting released yesterday showed many officials wanted to see more signs that employment is improving before backing a trim to bond buying.

This is gold bullish and suggests that gold’s recent fall is overdone.

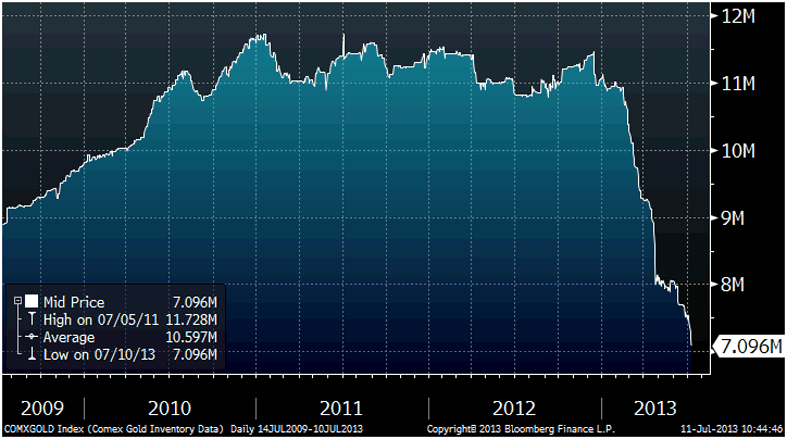

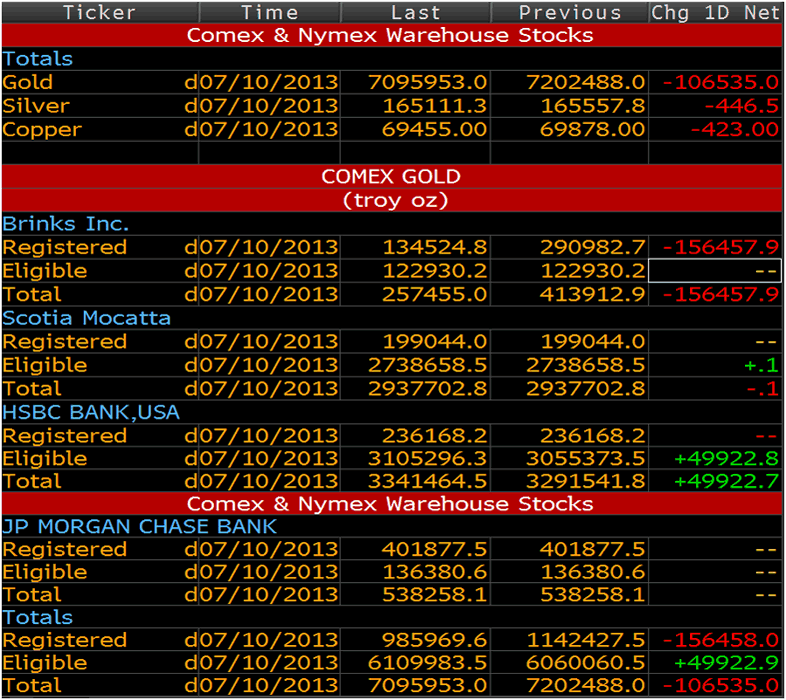

Comex Gold Inventory Data/Brinks Inc Total

The Fed, in conjunction with the BOJ, ECB and BoE is set to continue pursuing extremely accommodative monetary policies which should see fiat currencies continue to fall in value versus gold.

Comex Gold Inventory Data/JP Morgan Total

Record high gold borrowing costs due to significant physical demand, especially in China and much of Asia, continues.

Although Bernanke’s comments are the ostensible reason for gold’s price rise, a more fundamental reason, and less reported upon, is likely to be the continuing decline of COMEX gold inventories.

Bullion buyers internationally and particularly in Asia are taking delivery of physical gold which is draining inventories on the COMEX. COMEX inventories fell another 1.5% yesterday (see table).

Brinks has seen a massive decline in its gold inventories in recent days. The huge decline in Brinks inventories is being seen soon after a similar decline in JP Morgan’s gold inventories.

Brinks inventories have fallen from 570,000 ounces on July 3rd to 257,000 ounces today which is a drop of 313,000 ounces - a drop of 55% in just one week.

The entire inventories on the COMEX, of bullion banks and depositories is now just 7.096 million ounces and is worth just $9.1 billion at today’s prices. This is a very small amount vis á vis the amount of money in stocks, bonds, cash and other assets today throughout the world and in Asia where much of the gold seems to be flowing East.

This has all the hallmarks of a ‘run’ on the COMEX and needs to be monitored. A default on the COMEX would see the price of physical gold rise substantially and potentially in a very short period of time.

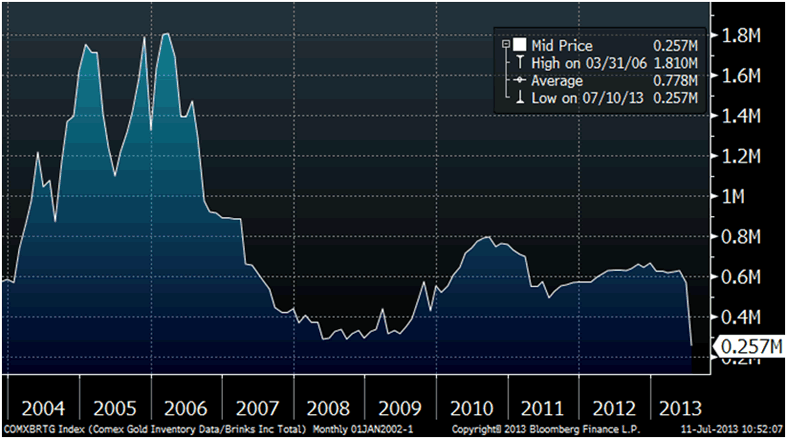

Cross Currency Table - (Bloomberg)

Has Gold's 'Bubble' Burst Or Is This A Golden Opportunity?

Our recent well attended webinar has been uploaded to YouTube.

Topics covered in the webinar included:

* Outlook For Gold And Silver This Year and Coming Years

* Learning From 1970s Bull Market & 1975/76 Price Collapse

* Safest Way To Own Gold And Silver

* Paper and Digital Gold

* Knowing When To Reduce Allocations Or Sell

* Safest Way To Own Gold And Silver

* Extremely Negative Sentiment Towards Gold

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.