Russia’s Gokhran May Resume Gold, Silver Purchases Next Year

Commodities / Gold and Silver 2013 Jul 09, 2013 - 12:35 PM GMTBy: GoldCore

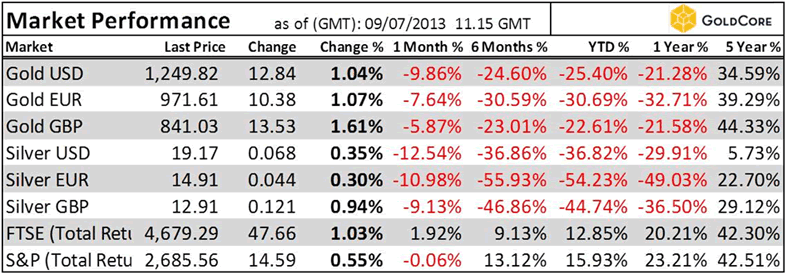

Today’s AM fix was USD 1,252.00, EUR 972.58 and GBP 840.95 per ounce.

Today’s AM fix was USD 1,252.00, EUR 972.58 and GBP 840.95 per ounce.

Yesterday’s AM fix was USD 1,225.50, EUR 954.22 and GBP 822.70 per ounce.

Gold rose $14.80 or 1.21% yesterday and closed at $1,236.50/oz. Silver climbed 1.06% and closed at $19.06.

Support and Resistance Chart - (GoldCore)

Gold is over 1% higher in all currencies today. The gains are being attributed to data which showed that China’s inflation accelerated more than estimated in June, boosting demand for the precious metal as a hedge against inflation, in what will become the world’s largest buyer of gold this year.

The Russian State Precious Metals and Gems Repository Gokhran may resume gold purchases in 2014, Bloomberg and Reuters reported citing Russian state news services.

Gokhran, the State Precious Metals and Gems Repository, is a state institution under the Russian Ministry of Finance, responsible for the State Fund of Precious Metals and Precious Stones of the Russian Federation, is set to start buying gold again on the domestic market in 2014 after a two-year break.

Annual purchases by state repository Gokhran may also include palladium and silver.

State-run news service reported, citing an unidentified official with knowledge of the matter, that Gokhran may buy 7 to 10 tonnes (225,050-321,500 troy ounces) of gold in addition to purchases of the Bank of Russia, the Russian central bank.

RIA, The Russian State News Agency, reported that the resumption of purchases depends on approval of amendments by lawmakers during the Duma fall session.

Gokhran's holdings are not part of Russia's more than $500 billion in gold and foreign exchange reserves held by the central bank, which include 32.0 million troy ounces of gold, according central bank data as of May 1.

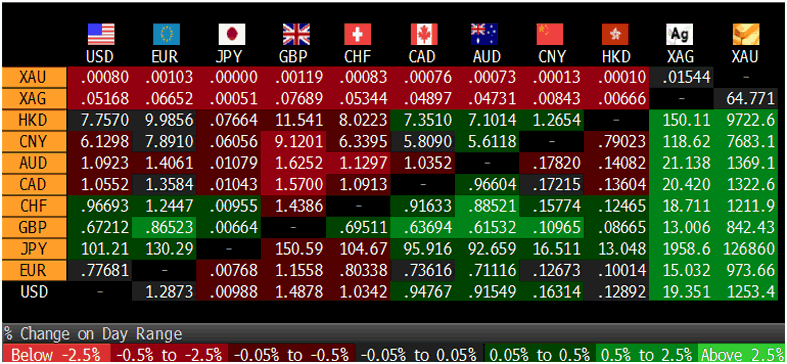

Cross Currency Table - (Bloomberg)

In 2009, Gokhran sold 30 tonnes of gold to the central bank, in a deal valued at $1 billion that covered part of a budget deficit resulting from the 2008 global financial crash and subsequent recession.

The repository used to buy 3-5 tonnes of gold by advance payment to domestic producers.

Gokhran could face challenges returning to the gold market as it would have to compete with commercial banks which are buying gold on the domestic market and to offer miners better terms, said Sergei Kashuba, the head of the Russian Gold Industrialists' Union.

Russia's 2013 gold production is likely to rise by 3.5%, year-on-year, to 233.8 tonnes.

While the source did not specify how much palladium Gokhran may buy from the market, its sales of the metal from stocks have helped keep the global palladium market in surplus for eight of the last 10 years. These stocks are almost depleted now, according to platinum refiner Johnson Matthey.

Has Gold's 'Bubble' Burst Or Is This A Golden Opportunity?

Our recent well attended webinar has been uploaded to YouTube.

Topics covered in the webinar included:

* Outlook For Gold And Silver This Year and Coming Years

* Learning From 1970s Bull Market & 1975/76 Price Collapse

* Safest Way To Own Gold And Silver

* Paper and Digital Gold

* Knowing When To Reduce Allocations Or Sell

* Safest Way To Own Gold And Silver

* Extremely Negative Sentiment Towards Gold

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.