Egypt Muslim Brotherhood’s Legacy: Controls, Shortages and Inflation

Politics / Middle East Jul 09, 2013 - 10:07 AM GMTBy: Steve_H_Hanke

The Muslim Brotherhood and President Morsi never had a credible plan for the Egyptian economy. Indeed, I doubt that the Brotherhood’s leaders know the meaning of the word “plan”. Over the past year, economic conditions in Egypt have gone from bad to worse. And, it seems Morsi’s brief tenure as president will likely be remembered largely for its shameful economic record – one marred by a decline in GDP growth, a reduction in foreign reserves, and a sharp increase in unemployment.

The Muslim Brotherhood and President Morsi never had a credible plan for the Egyptian economy. Indeed, I doubt that the Brotherhood’s leaders know the meaning of the word “plan”. Over the past year, economic conditions in Egypt have gone from bad to worse. And, it seems Morsi’s brief tenure as president will likely be remembered largely for its shameful economic record – one marred by a decline in GDP growth, a reduction in foreign reserves, and a sharp increase in unemployment.

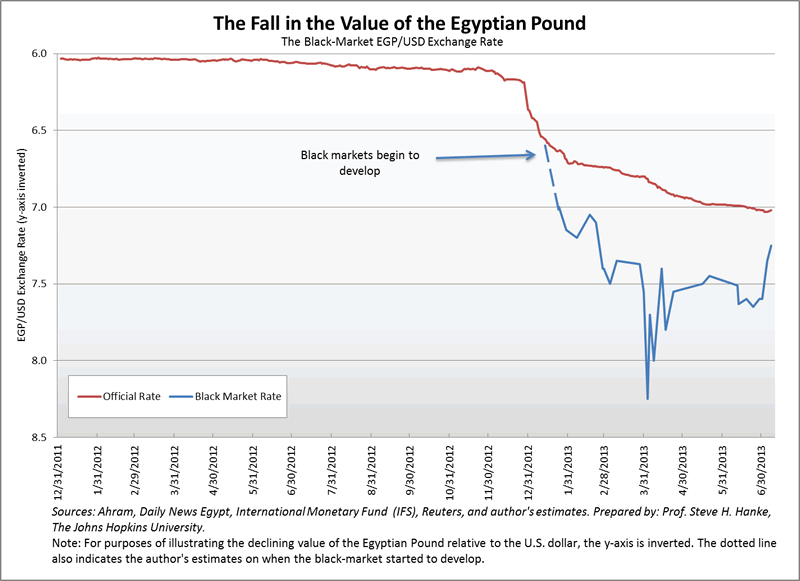

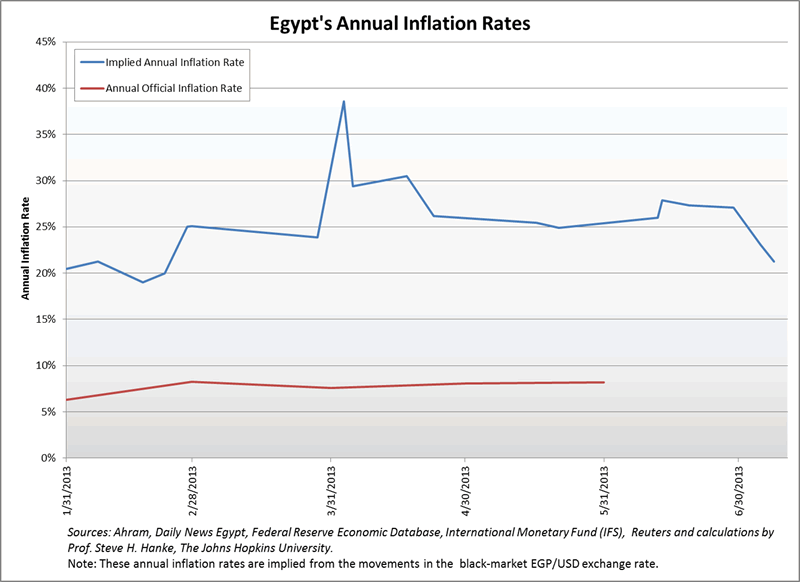

Black markets have also been a hallmark of the Muslim Brotherhood’s economic legacy. Price and capital controls have caused shortages and a substantial slide in the value of the Egyptian pound. In consequence, Egyptians have watched inflation destroy their standard of living. Additionally, controls have delivered shortages of foreign exchange and many goods, like gasoline. In the face of the Brotherhood’s wrongheaded economic policies, official inflation and price statistics took leave of reality, and the black market quickly became a source of material support that the Muslim Brotherhood’s government could not provide.

Yes, as the accompanying charts illustrate, the story of a failing Egyptian economy is the story of a troubled Egyptian pound – and of the inflation troubles (21.2% annually) that accompanied it.

These trends have proven fatal for Morsi and the Brotherhood. While Morsi’s final hours were filled by lectures on “constitutional legitimacy”, Egyptians weren’t listening – they were preoccupied with a plunging pound and an inflation rate that is roughly two and a half times higher than the official rate. Morsi and the Muslim Brotherhood’s policies, of course, contributed mightily to the implosion of the Egyptian economy. In the final analysis, the Egyptian people have taught Morsi and the Muslim Brotherhood a harsh lesson: bread is more important than ideas.

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2013 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.