Media Ignores China Stock Market's Precipitous 40% Drop!

Stock-Markets / Chinese Stock Market Mar 25, 2008 - 12:38 PM GMTBy: Marty_Chenard

I received an email from someone watching CNBC's Cramer last night. He said that Cramer was bullish about yesterday's market movement because the financials were leading yesterday's up move.

I received an email from someone watching CNBC's Cramer last night. He said that Cramer was bullish about yesterday's market movement because the financials were leading yesterday's up move.

I won't say that the banking sector is devoid of strength ... because yesterday, 69% of the sector's stocks had a Relative Strength reading of 50 or higher. 31% had a Relative Strength reading below 50.

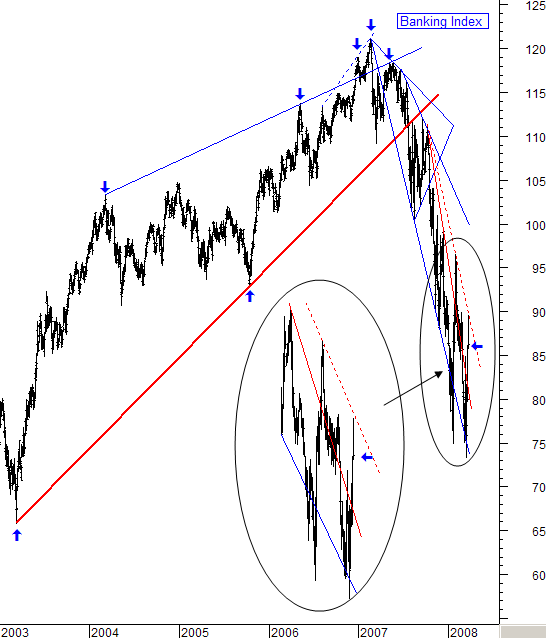

However ... on a trending basis, the Banking index is still in a technical down trend for two reasons.

(Remember the old adage ... "The trend is your friend"?)

First, the index closed below its (red dotted) resistance line again yesterday ... a formidable resistance going back to last October. It did move up to test the resistance during the day, but retreated and pulled back. (See today's chart below.)

Second, the down trend is still in play because the Banking Index has continued to make lower/highs and lower/lows. This has not changed yet. We are getting some consolidation, but that needs to work itself out and shift to an upside condition. The point is that there is still more work to be done on the financials before we can say that an up rally is in play ... and that it is one that is sustainable for awhile.

Choosing yesterday as the beginning of a longer term rally is premature and bottom fishing right now. Be patient, and let the markets "show you the proof" before trying to be a "good guesser" ahead of everyone else.

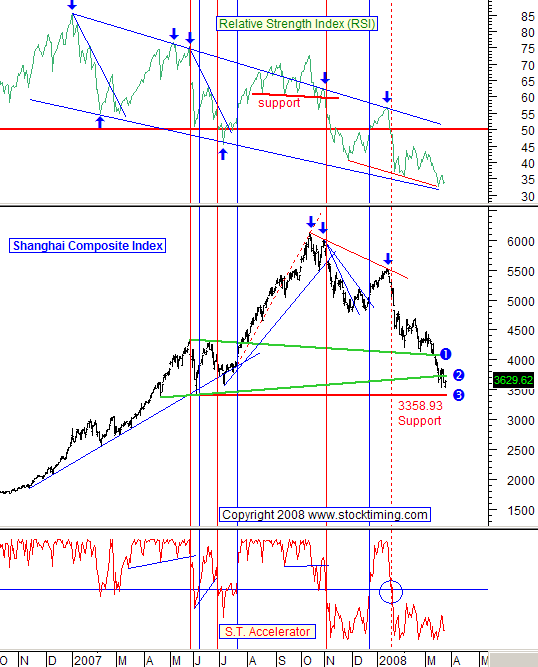

China's Shanghai Composite:

The Shanghai Composite was up 0.09% last night. The next Major support levels are in between 3358.93 and 3400.

Its amazing how the media has just plain ignored China's precipitous drop ... a drop of 40.7% since its high of only 5 months ago. Past Chinese drops have un-nerved global markets with sympathetic down moves. Are we so focused on what is happening to our markets that everyone is ignoring the precipitous drop in China? If it drops below 3358.93, the media will suddenly sit-up and take notice.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.