Mortgage Backed Securities Clobbered and U.S. Treasury Yields Soar Following Job Numbers

Interest-Rates / US Interest Rates Jul 07, 2013 - 10:10 AM GMTBy: Mike_Shedlock

Curve Watchers Anonymous notes that treasury yields surged higher and mortgage backed securities (MBS) had a steep selloff following purportedly good job numbers.

Curve Watchers Anonymous notes that treasury yields surged higher and mortgage backed securities (MBS) had a steep selloff following purportedly good job numbers.

Beneath the surface, the economy actually shed 326,000 full-time jobs.

In the short-term what matters is the reaction, so let's take a look at how treasury yields reacted to the news.

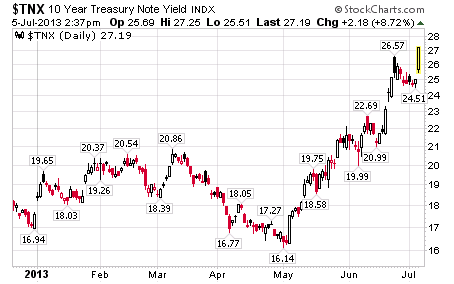

$TNX: 10-Year Treasury Yield

Yield on the 10-year treasury note is up 21.8 basis points to 2.719%. The yield is up 110 basis points (1.1 percentage points) since the May low of 1.614%.

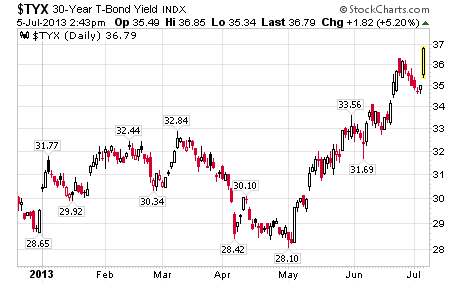

$TYX: 30-Year Treasury Yield

Yield on the 30-year long bond is up 18.2 basis points on the day to 3.679%. The yield is up 86.9 basis points since the May low of 2.81%.

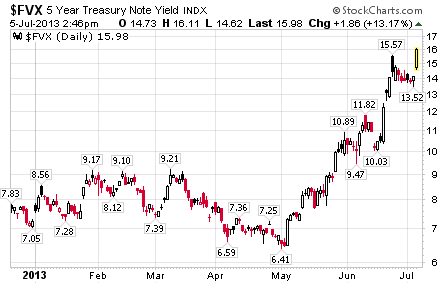

$FVX: 5-Year Treasury Yield

Yield on the 5-year treasury note is up 18.6 basis points on the day to 1.86%. The yield is up 95.7 basis points since the May low of .641%.

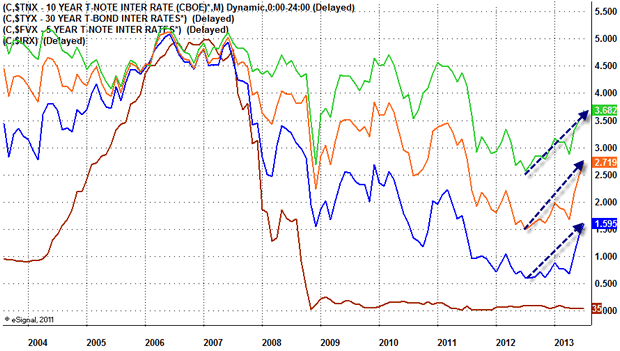

Historical Perspective

Charts were captured at slightly different times (minutes apart) so yields on two sets of charts do not match precisely.

Legend

- $TYX - Green: 30-Year

- $TNX - Orange: 10-Year

- $FVX - Blue: 5-Year

- $IRX - Brown: 3-Month

Yields have generally been rising since mid-2012 and have blasted higher since May-2013.

A 1.1 percentage point rise on treasures will have a significant impact on housing.

Mortgage Backed Securities Clobbered

Michael Becker at WCS Funding Group says today is one of the worst selloffs in mortgage backed securities (MBS) that he has ever seen.

For example a 30-year FHA loan that Becker placed on Tuesday at 4 1/8% would be 4 3/4% today.

The Fed is probably having a conniption-fit over these reactions. Expect the Fed to come out in full-force again, with repeated attempts to talk rates down.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.