Draghi's Guidance Light is Non-farm Payrolls Train at End of Tunnel

Economics / Euro-Zone Jul 06, 2013 - 10:11 AM GMTBy: Ashraf_Laidi

US June non-farm payrolls rose by 195K, surpassing forerecasts of 165K, with the unemployment rate remaining unchanged at 7.6%. You'd have to go back to 1999-2000 to find 12 consecutive monthly readings of +100K NFP. Not only non-farm payrolls have shown 3 consecutive monthly net additions of greater than 190K, but 12 consecutive monthly readings above 100K, the last time this was seen was in May 1999-May 2000.

US June non-farm payrolls rose by 195K, surpassing forerecasts of 165K, with the unemployment rate remaining unchanged at 7.6%. You'd have to go back to 1999-2000 to find 12 consecutive monthly readings of +100K NFP. Not only non-farm payrolls have shown 3 consecutive monthly net additions of greater than 190K, but 12 consecutive monthly readings above 100K, the last time this was seen was in May 1999-May 2000.

The strong US jobs report means the Fed's timing for autumn tapering remains on track, implying additional yield divergence between the US and Eurozone/UK to the detriment of prolonged losses in EUR and GBP vs USD.

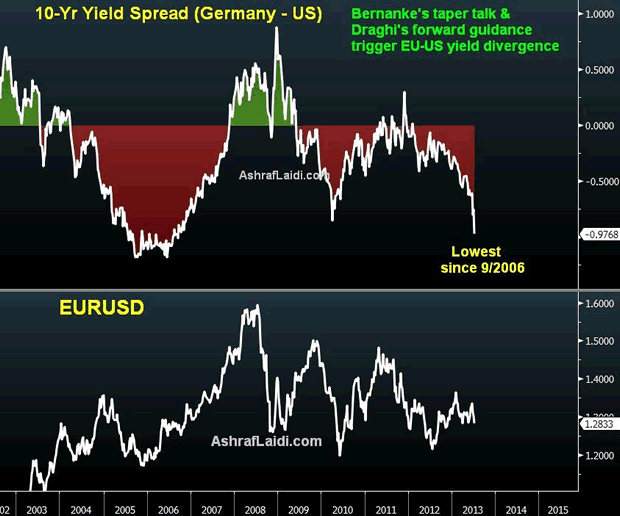

US-German Yield Spread at 7-Year Highs (German-US at 7-yr lows)

On Thursday, ECB's Draghi made the step of moving towards forward guidance, borrowed the phrase long used by the Fed in stating: "monetary policy stance will remain accommodative for as long as necessary. The Governing Council expects the key ECB interest rates to remain at present or lower levels for an extended period of time." The decision to finally resort to forward guidance in ensuring rates remain low is the verbal equivalent of announcing Outright Monetary Transactions, whose goal was to rein in soaring Spanish and Italian bond yields.Draghi had little choice to contain advancing yields stemming from Bernanke's tapering comments and Portugal's political instability. Portugal's 10-year yields hit the 8.0% level for the first time since 7 months, posting 7 straight weekly advances-the longest in 3 years. As German yields fell and and US yields hit 2-year highs at 2.71%, the US-German 10-year differential soared to 7-year highs (shown inversely in the chart below to mirror the correlation with EURUSD).

The 2nd half of the year started with a bang from the ECB & BoE (talking down rates), in response to the thump in the final weeks of the first half of the year from the Fed (timing of tapering).

Looking into next week (and rest of the quarter), markets will closely watch the extent of the divergence between hawkish rhetoric at the Fed (partly in function of data) and dovish stance from Draghi & Carney. If the Fed finds no reason (from the data) to remove tapering plans from autumn, then markets will witness a sharp divergence in rates between US yields and UK and Eurozone yields, leading to a the next leg down in EURUSD and GBPUSD.

We continue to prefer EUR over GBP as EURGBP breaks above the 4-year channel (as per yesterday's piece) and the weak GBP becomes part and parcel of the Cameron-Osborne-Carney trio, whereas Draghi's priority remains that of lower yields. Eyeing 0.89 remains our medium term view for EURGBP.

The main events to watch next week are: Wednesday's release of the FOMC minutes (will reveal comments from more hawkish members than Bernanke ) and the Thursday's BoJ meeting and subsequent conference from Kuroda, which will likely grease the wheels of further yen weakness ahead of the Upper House elections - source of Abe's power consolidation from both houses.

For tradable ideas on FX, gold, silver, oil & equity indices get your free 1-week trial to our Premium Intermarket Insights here

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2013 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.