The Collection Agency Weekly Report- Yen Carry Trade

Currencies / US Dollar Mar 25, 2008 - 07:59 AM GMTBy: Mick_Phoenix

Welcome to the Weekly Report. Firstly a big thank you for the interest in this article . From the reaction I have seen, it looks like I put into print what many were thinking. Enough hindsight, let us see what opportunities and risks face us in the coming week, or longer. We take a look at the Financials, looking for weakness and strength, wonder what the Dow has to say and have a look at gold and a few other commodities. We finish with an example of current living standards in the US , thanks to an email sent to me a couple of weeks ago.

Welcome to the Weekly Report. Firstly a big thank you for the interest in this article . From the reaction I have seen, it looks like I put into print what many were thinking. Enough hindsight, let us see what opportunities and risks face us in the coming week, or longer. We take a look at the Financials, looking for weakness and strength, wonder what the Dow has to say and have a look at gold and a few other commodities. We finish with an example of current living standards in the US , thanks to an email sent to me a couple of weeks ago.

Regardless of whether we consider the Fed/US Gov't (Fannie and Freddie especially) intervention into “free” markets as right or wrong, we have to be realistic and face the fact that it is happening. One of the worst mistakes you can make as an investor or trader is to fight the Fed. Their pockets go much deeper than ours and as I have said previously intervention begets more intervention. Are we facing a dramatic drop in the stock markets, the big one? Or will the Fed/US Gov't instil enough confidence to let stocks rally?

It's the big question and it is one you do not want to ask. So rather than stand on the rail tracks hoping the train will switch rails, lets see if we can highlight some possible trends. Keep in mind the following, regardless of what the media and shills will tell you, the macro-economic fundamentals are under stress, meaning more shocks are likely. In the shorter term leverage is being unwound on some positions whilst new positions are being created elsewhere. Volatility abounds, it may give us new opportunities but it can also severely damage your wealth. Use protection to stop contamination.

First up an old favourite (that may not last….) Dollar/Yen/Euro/Dow. I use this chart to spot changes in Forex flows over the medium term. Some of my longer suffering readers know I use $/ Y to help identify carry trade flows in stocks and bonds. Whilst the carry trade continues this chart will be helpful.

In this version, Yen is shown as a baseline (hence 0%) and the dollar (pink), DJIA (red) and Euro (green) show their respective moves from Yen.

Click on the image or link to visit the excellent Stockcharts.com interactive chart. You can change the baseline instrument by clicking the tabs at the top. Whose the daddy? The Yen, no doubt about it. Since June 07 even the almighty Euro has lost ground to the Yen, the damage to the dollar and dollar denominated Yen priced stocks is extraordinary. If you were a Japanese investor who bought stocks on the “dip” in August 07 you made a big mistake. If you sold Yen to buy dollar based assets, looking for the carry trade, you are crushed. Think of the charts you see pricing the Dow in gold, this is presenting the same scenario.

It gets worse, much worse. This next chart holds a warning about why policies that allow dollar devaluation will continue to damage fundamentals, we may be seeing an acceleration of foreign funds abandoning support for dollar assets.

Again thanks to Stockcharts.com. The two new lines are gold (turquoise) and the 10yr Treasury bond yield (pink) using Yen as the baseline. The one profitable carry trade, gold, has taken a big hit. Japanese/Yen borrowing investors must be wondering where they can get any return on the carry trade.

We are at a critical junction here, either direct Central Bank intervention stops Yen appreciation (remember Yen is up against just about everything) and restores stability or we could see a capitulation. With a lack of credit liquidity and therefore further leverage unavailable for Hedge Funds, Banks and Institutional Brokers, no wonder the Fed has spread its largesse this past week. If the carry trades in Financial Sector cannot add capital (margin calls) or double up, hoping for a reversal then they are stuffed, roasted alive.

So what will be the outcome? Let us look at this realistically, not at what should happen but at what the interventionist policy prone Central Banks are likely to do. We do not want to get caught on the wrong side of this.

As much as I would hate to see it on a macro-fundamental long term view because of the damage it will cause, I think Central Banks will intervene, they know of no other reaction. The only question open now, in my opinion, is the timing. Do the Central Bankers wait for the beginning of a capitulation move or do they move earlier to try and prevent it?

Looking at the timing the Fed took over Bear, they were deeply concerned about the Far East reaction (Greenspan was asked what would be the biggest change to his routine after he left the Fed, he replied “not having to check the Tokyo markets first thing in the morning”) and ensured the plan was released before Far East markets sold off heavily (they bounced on the announcement). So we need to be prepared for an attempt to push the value of the Yen down, to re-invigorate the carry trade and stop Yen based losses. If such intervention does happen (I could be wrong, I have been before) the rally in stocks could be fast and large. As the Financials would benefit the most, I would expect them to rocket higher.

However, any such move may well be temporary. Remember, Banks, Institutions, Primary Dealers and through them Hedge Funds are surviving on the Feds willingness to lend. The Fed will want their money and assets back (with a profit, notice Fed lending is not free) and a rally could well be an opportune time to unwind positions, drawback leverage and withdraw credit facilities on repayment. Look for strong hands to sell into the weak hands who buy. Keep an eye on the financial media, if it starts telling investors that the good times are back, be wary.

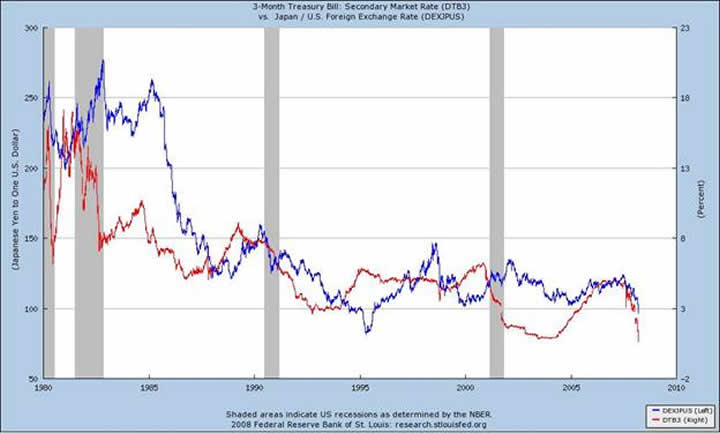

Finally on the subject of Yen carry trades, I did a bit of digging, looking at $/ Y and 3 month Treasury Bill yields. I went back to 1980 to encompass 4 recessions, mainly to see what effect recessions had on Fx rates and yields. I got more than I bargained for.

$/ Y is in blue, 3 month T-Bill rate in red. Some important points show up here. Falling yields weaken the dollar, rising yields strengthen it. Since the double dip recession in the early ‘80s there is a strong correlation to this link and showing that yield moves lead FX changes. We can see the effects of Japanese Central Bank interventionist policies from 2001-05 as the dollar was propped by the Bank of Japan which mitigated but did not break the correlation.

Now we shouldn't map the future according to the past, we avoid it wherever possible but Central Banks tend to rely on the past to give them lessons for the future. Let there be no doubt, either the Fed has to raise rates to stop $/ Y descending into the abyss or the Bank of Japan has to intervene and prop the dollar by selling Yen.

What are the chances of Ben “chopper” Bernanke raising rates in the next 6 months?

To read the rest of the Weekly Report click here

By Mick Phoenix

http://thoughtsfromthetrenches.blogspot.com

An Occasional Letter From The Collection Agency in association with Live Charts UK .

For some years now I have written an ongoing letter, using macro-economics, to try and peer into the economic future 6 to 18 months ahead. The letter contains no recommendations to buy or sell, indeed I leave that to all the other letters out there and to the readers own judgment. The letter is designed to make us all think about what may be coming, what macro trends are occurring and how that will filter down to everyday life and help spot weak or strong areas to focus on for trading or investing. Two years ago the owner of Livecharts.co.uk persuaded me to take the letter public, eventually starting my own blog. I hope to have a website up and running in the near future.

I am not an economist or ex-institutional trader. I do not have a Fund to sell and I will not write about any trading instrument I have an interest in. I have been actively trading and investing for myself since 1998. I write because I enjoy it.

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.