Stock Market SPX Kiss of Death

Stock-Markets / Financial Markets 2013 Jun 29, 2013 - 01:27 AM GMT SPX made an irregular Wave [b] below support this morning with a retest of support-turned-resistance. A turn-down here is literally the “kiss of death” for the rally. In this case, we would not want to see SPX retesting the 50-day moving average, since it is still rising. However, the Short-term resistance and Lip of the Cup with Handle formation serve as a proxy.

SPX made an irregular Wave [b] below support this morning with a retest of support-turned-resistance. A turn-down here is literally the “kiss of death” for the rally. In this case, we would not want to see SPX retesting the 50-day moving average, since it is still rising. However, the Short-term resistance and Lip of the Cup with Handle formation serve as a proxy.

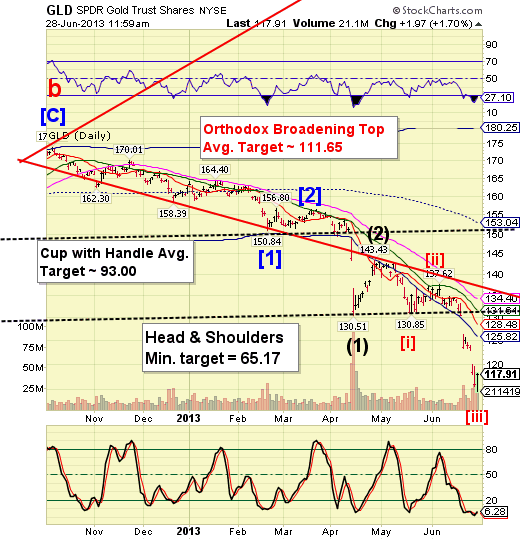

GLD may have completed its minute Wave [iii] at 114.65 this morning, although a corrective Wave (b) could still go to the Orthodox Broadening Top target. At the moment, I am satisfied that GLD has made its target, while gold came very near its target of 1155.00 this morning as well. The Cycles Model calls for a turn over the weekend, so this is a day early.

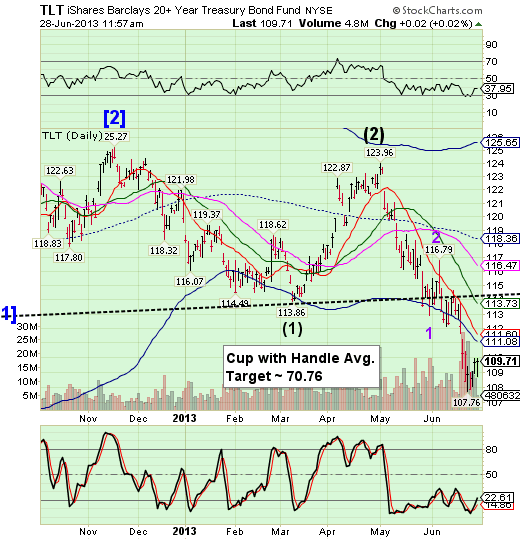

TLT has yet another decline left in its Wave structure that may allow it to go to 100.00 by the end of next week. This may indeed be the catalyst for an abrupt and severe decline in stocks at the same time. 30-year yields may approach 4.00%, which haven’t been seen since July 2011. Seeing a 20% drop in bond values in two months may give investors pause that the Fed is no langer in control.

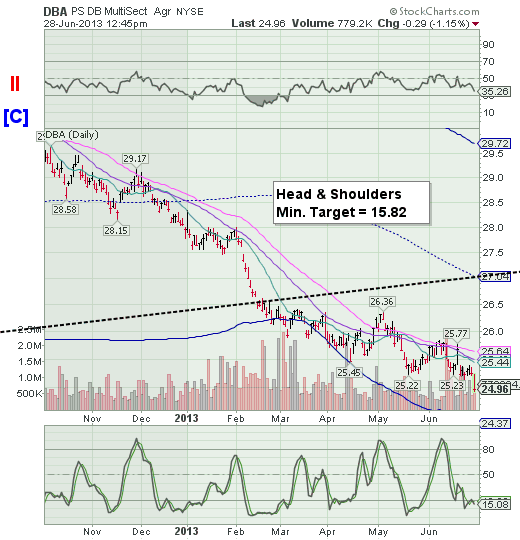

Agricultural commodities are starting the next major impulse down. This is yet another indication of deflation taking hold of our economic assets.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.