You Can Still Make Big Money in This Stock Market

Stock-Markets / Stock Markets 2013 Jun 28, 2013 - 04:57 AM GMTBy: Investment_U

Marc Lichtenfeld writes: This weekend my family and I were checking out a local bookstore when I came across a magazine called The Intelligent Optimist. I would have bought it but I doubt it’s any good. (That’s a joke. Think about it.)

Marc Lichtenfeld writes: This weekend my family and I were checking out a local bookstore when I came across a magazine called The Intelligent Optimist. I would have bought it but I doubt it’s any good. (That’s a joke. Think about it.)

But a long-term investor is an intelligent optimist – and in this market, that’s not any easy thing to be.

There are always good, logical reasons to be a pessimist.

•The government stinks.

•The economy is tepid.

•Our education system is broken.

•Taxes are up.

•Privacy is down.

There are also always reasons to be a bear.

•The market is overvalued (it’s not at the moment, but that doesn’t stop bears from saying so).

•The market is rigged.

•The bull market has already gained 153%.

Years ago, while working for a permabear, I learned there is always a rational argument for being bearish. It’s easy to convince folks the sky is falling.

On the other hand, when you’re bullish, people think you’re crazy.

When the Oxford Club’s Investment Director Alexander Green advised loading up on stocks in early 2009, you should have seen the emails he received. Several people urged his family to have him committed to an insane asylum. Fortunately, Alex remains straitjacket free.

You don’t have to be a Pollyanna to be an optimist, especially when it comes to the stock market. You just have to know history.

Four Reasons to Be Optimistic

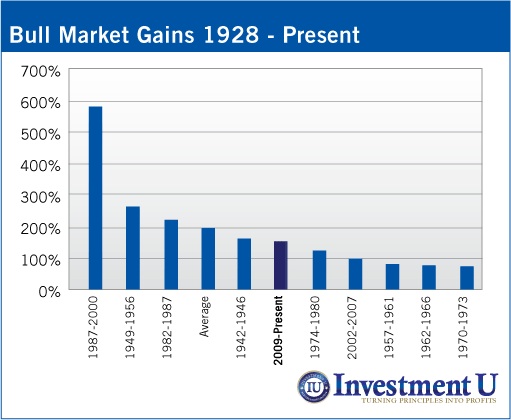

1) This bull market is hardly exceptional. Going back to 1928, there have been 10 bull markets. The current run ranks fifth in terms of gains. And it’s still 44 percentage points below the average gain.

2) The market goes up over time. This is a vital concept to understand. One of my favorite pieces of market data is the fact that since 1937, the market has only been down seven times over any given 10-year period, for a win rate of 91%. And the seven losing periods all encompassed the Great Depression and Great Recession.

In other words, you needed historic economic collapse to not make money in the stock market over 10 years. And keep in mind that not all 10-year periods that involved the years of the Depression and Recession were negative. For example, 1933- 1942 was positive, as was 2001-2010.

3) The market is not expensive. Despite the 153% run-up since the lows of 2009, the stock market is not pricey when you look at earnings.

Over the past 12 months, the stocks that comprise the S&P 500 earned $101.92 per share, for a price-earnings ratio of 17.

In 2013, the S&P 500 is projected to earn $110.42, giving the index a P/E of 14.3

In 2014, earnings are expected to rise to $122.99, for a forward P/E of 12.8.

Historically, the average P/E of the S&P 500 is about 16.5. That means the current market isn’t cheap, but it’s hardly expensive, especially considering the average over the past 15 years is nearly 20.

4) Interest rates remain low. Sure, they’ve risen over the past six weeks, but the rates you earn from Treasurys or from cash remain miniscule. And you can still obtain a 30-year fixed mortgage for 4%. Just a few years ago, most homeowners would have given up their firstborn for that kind of rate. Housing should remain strong, which will boost the economy and corporate profits.

If you’re in it for the long term and don’t freak out every time the market sinks a few hundred points, your portfolio will be just fine. That attitude isn’t being an optimist, it’s being a realist.

Good investing,

Marc

Editor’s Note: Rising interest rates and falling bond prices have many investors fleeing for the exits. But there’s always money to be made somewhere and the coming crash in bonds is no different…

Marc’s research has uncovered a unique type of income investment he calls “Spread Trusts” that are currently dishing out yields of up to 19.6%, and could offer one-time windfall gains of 164% when the bond market finally reaches its tipping point…

To see his full presentation outlining what will happen and how to prepare yourself, click here.

Source: http://www.investmentu.com/2013/June/make-big-money-in-this-market.html

Copyright © 1999 - 2013 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.