Single Largest Driver of the US Economy is About to Collapse

Economics / US Economy Jun 27, 2013 - 05:48 PM GMTBy: Graham_Summers

The markets continue their dead cat bounce while the economic data worsens.

The markets continue their dead cat bounce while the economic data worsens.

First quarter US GDP was revised down from an annual rate of 2.4% to 1.8%. The drop was due to lower personal consumption expenditures than initially forecast.

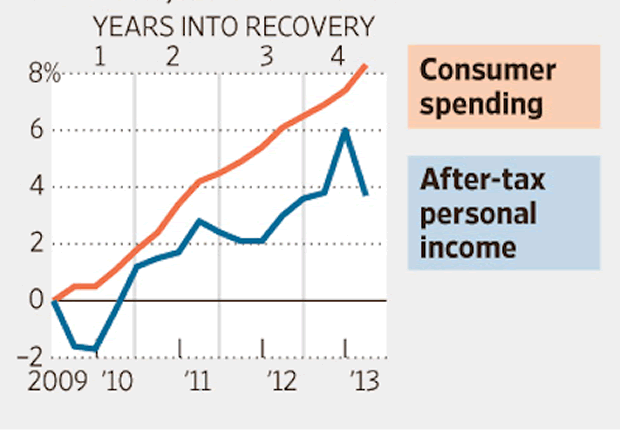

This is the crux of the US’s current economic woes: consumer-spending accounts for roughly 70% of our GDP. And QE does nothing to help incomes, which drive consumption.

The US Federal Government has subsidized a weak economic recovery via food stamps and other social program, but the private sector is lagging with most of its hiring coming in the form of temporary or part-time jobs.

The Wall Street Journal ran this graphic yesterday. Anyone who is banking on consumers to continue spending as they have is out of their mind. I’ve been warning Private Wealth Advisory subscribers of this for weeks.

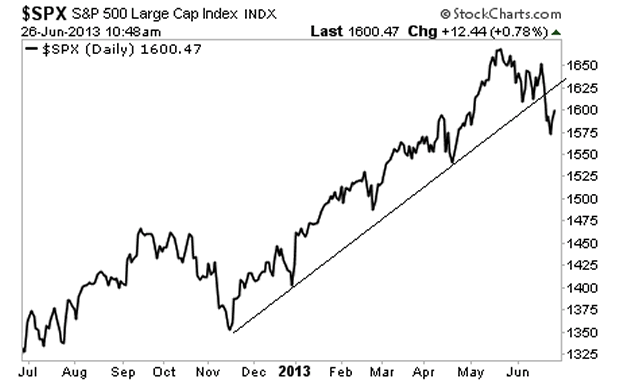

Regarding the stock market, it’s important to note that all market collapses follow a similar pattern of:

1) The initial drop breaking support

2) Bouncing to re-test support

3) The larger drop

The S&P 500 has completed #1 and is now in #2:

This move could take us as high as 1,625. However, if the market fails to reclaim its trendline we’re going down as far as 1,500 in short notice. And if we take out that level we’re in BIG TROUBLE.

This is just the start. I warned Private Wealth Advisory subscribers in our most recent issue that higher rates were coming noting a collapse in bonds in Europe and the emerging market space.

This could easily become truly catastrophic. The world is in a massive debt bubble and the Central banks are now officially losing control. The stage is now set for a collapse that could make 2008 look like a joke.

If you are not preparing in advance for this, the time to get started is NOW.

To join us

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.