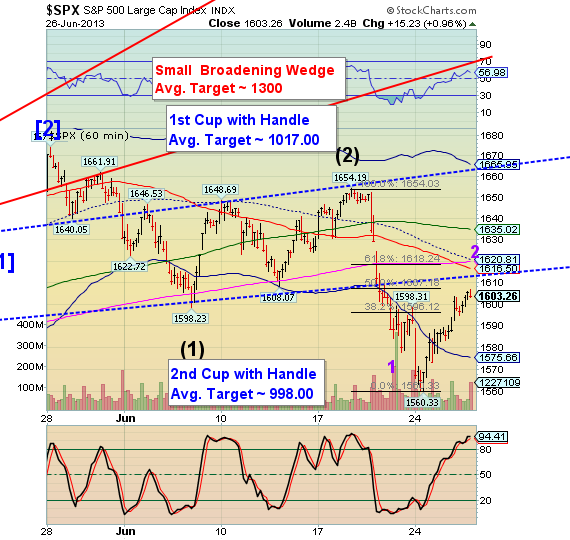

Stock Market Pop-n-Drop?

Stock-Markets / Stock Markets 2013 Jun 27, 2013 - 04:15 PM GMTSometimes analyzing very short-term charts can be misleading. For example, an a-b-c formation often subdivides so that Wave a also is an a-b-c. That is what appears to have happened at yesterday’s close.

The hourly charts often show the most granularity, since they also show support and resistance, while smaller degree charts only show wave structure.

There are several resistance points that may offer a stopping place for this retracement. The first is the Lip of the Cup with Handle at 1613.00, followed by short-term resistance at 1616.50. The next set of resistances are the 50-day and mid-Cycle resistance, both currently at 1620.61.

Considering that the Pre-Market is up nearly 11 points, it appears that the upper resistance is the prime candidate for a reversal. The Cycles Model allows up to 24 hours on either side of the Pivot date, since in this case 4.3 X 14 = 120.4. So we may see a final spike up and a probable reversal sometime this morning.

There is a storm front moving through the area this morning, leaving us an unreliable power supply. I am still in northern Michigan for the rest of the day, but will be packing soon for the drive back home.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.