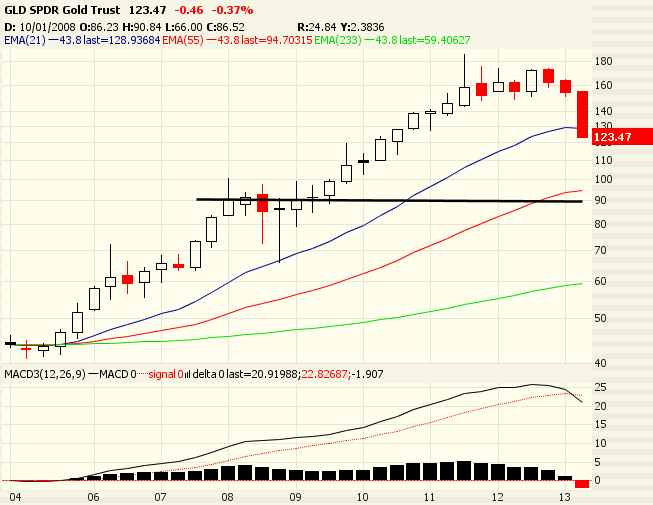

Time for Gold to Climb the Wall of Worry?

Commodities / Gold and Silver 2013 Jun 27, 2013 - 03:56 AM GMTBy: PhilStockWorld

Zeroxzero said it best last night: Reading the apocalyptic tone in many of the comments today — the imminent demise of Japan, the imminent demise of France, the inevitable implosion of China, the Demolition Derby of Euro, Yen, Dollar and Swissie, and the collapse of gold — all viewed against the fiery background of a Middle East abandoned to war because we don't need its oil anymore, a Brazil, Australia, Latam & Africa whose commodities are now worthless, and an Asia and India whose cheap labor has become superfluous — I have been given the sense that we are now riding the Fifth Wave up the Limpopo with Yellow Jack.

Yellow Jack is another word for Yellow Fever, a horrible mosquito-delivered disease that had been known to wipe out entire crews of ships traveling along the Limpopo river in Africa. It's great imagery for the doomsday scenarios that are suddenly being painted by the MSM to panic the sheeple into making as many poor investing decisions as possible while the market undergoes a minor correction.

Indeed gold collapsed overnight – all the way to $1,222.90 and this morning we took our first long on the gold futures in ages (/YG) at the $1,230 line as this is just beyond ridiculous at this point and we already caught a nice $5 pop for a $166 per contract gain and that lets us take a quick profit and reload for the next test of $1,230 – we can play this game all day if they want!

As I noted to our Members, GS, DB, SC, SocGen and UBS have all come out with notes lowering their gold forecasts this week – which seems a bit much for coincidence but this is the kind of collusion that is routinely ignored by regulators so, rather than complain about it – we just bet along with the crooks and load up on gold while the sheeple are stampeding out of it.

Well, not so much gold as that may still fall to $1,100 or even $1,000 in a proper panic but gold MINERS are getting very cheap, like ABX (which we have in our Income Portfolio), which has fallen to $15.50, which is the lowest it's been since 2002 – when gold was $450 an ounce! ABX's market cap is now under $16Bn, which is interesting as they…

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.