Bernanke Plays Call my Bluff With Markets

Interest-Rates / US Federal Reserve Bank Jun 25, 2013 - 06:37 PM GMTBy: John_Mauldin

(Wikipedia): Call My Bluff was a long-running British game show between two teams of three celebrity contestants. The point of the game is for the teams to take it in turn to provide three definitions of an obscure word, only one of which is correct. The other team then has to guess which is the correct definition, the other two being "bluffs".

(Wikipedia): Call My Bluff was a long-running British game show between two teams of three celebrity contestants. The point of the game is for the teams to take it in turn to provide three definitions of an obscure word, only one of which is correct. The other team then has to guess which is the correct definition, the other two being "bluffs".

Grant Williams writes: Among the first things we learn in school are the rules of grammar — the building blocks of proper communication which underpin the English language.

Among the first things we forget when we leave school are the rules of grammar — the infuriating and extremely irritating rules rendered completely unnecessary in a world in which texting seems to be the most popular form of communication and where most sentiments can be adequately conveyed by acronyms, abbreviations, and the ubiquitous emoticon.

It's amusing therefore to watch as "the market" (a collective expression of the grammatical competence of billions around the world) tries to dissect every utterance made by the likes of the Federal Open Market Committee, which itself spends an inordinate amount of time structuring its prose so as to convey, via the most intricate inflection imaginable, exactly what it intends to do.

Bizarrely, the reason it spends so much time on its statements is entirely because of the scrutiny afforded it by the market, and the reason the market scrutinizes the statements so assiduously is because it is looking for the tiniest nuance that might be a guide to the future actions of the FOMC.

Wouldn't it all be so much simpler if the FOMC told the world, in plain English, exactly what it was thinking and the signs it was looking for that would cause it to change course?

But no. That would be far too easy. Why lay out what's going on in plain language when you can hide behind nuance?

What we SHOULD get from the FOMC is a statement that looks something like this:

The committee feels that the economy is moribund and growth is faltering despite our best efforts at reviving it. We have kept rates at zero for the last several years and will be forced to do so for the foreseeable future — likely several years if the bond markets allow us to.

We fully realize that at some point we will have to work out how to wean the world off freshly printed money, but that day is a long way off; and so, for now, there is absolutely no need to worry about that eventuality.

We have said that we will begin to wind back QE once unemployment falls at least to 6.5%, but we very carefully said "at least" so that we had some wiggle room, because the chances are that, should we reach that target, things won't actually be in a state where we can withdraw stimulus, and then we will need to change our language.

The Committee has decided to confiscate your savings through ZIRP and inflation so you will be forced to invest your money in risky assets, which policy we hope — oh how we hope — will stimulate some growth. We understand that you may think you have the right to live off the interest on the nest egg you have so carefully saved over your working life, but right now the needs of the many outweigh your own.

We will try to let you know when we are serious about pulling back on the monetary throttle; but in the meantime, get out there and spend, spend, spend.

Please.

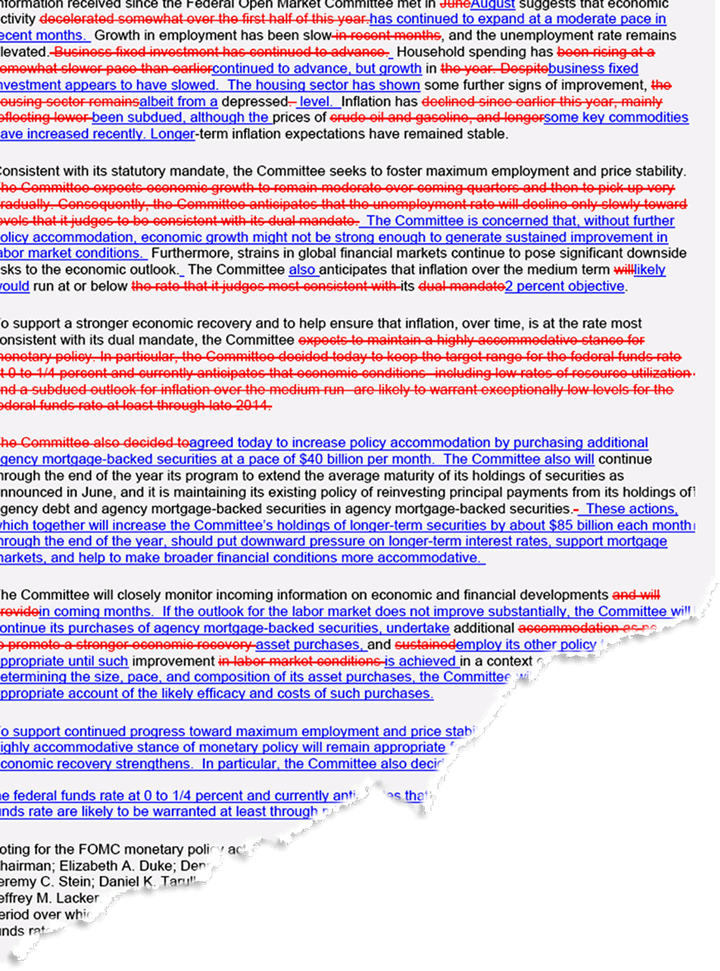

The second a new communique from Ben Bernanke and the Hole in the Wall Gang is released, the race starts to be the first to publish the customary "comparison" (see example below, which I found in my trash can) and pick apart any tiny change in language or tone that might be instructive in trying to determine what the esteemed members of the committee are thinking.

Markets react according to the consensus assessment of the communique, and then the FOMC is forced to react to the market reaction if the market reaction isn't in keeping with the reaction expected by the FOMC when they carefully craft the words that are disseminated to the expectant markets.

It's all so tiresome.

Why the mystery? Why the intrigue? Why not just have a full and frank dialogue with the world so we all know where we stand?

Why? I'll tell you why. Because then they would have no room to change course when it was proven that they had no idea what they were doing.

Actually, since this edition of Things That Make You Go Hmmm... starts off talking about the importance of the rules of grammar, I should perhaps amend that last sentence to include an independent clause in order to justify beginning it with the word because.

Try this:

Because the Fed has no idea what it is doing, it is much more sensible for it to be as vague as possible in its choice of language so as to leave itself room to change course when the magic pixie dust it is sprinkling on the world turns out to be largely ineffective.

To continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore – please click here.

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2013 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.